გამარჯობა,

Victoria from Techpoint here,

Here’s what I’ve got for you today:

- ₦7.7B telco hack lands 6 suspects in police net

- Atsur wants African art to outlive its first buyer

- Moniepoint’s ₦1 trillion bet on small businesses

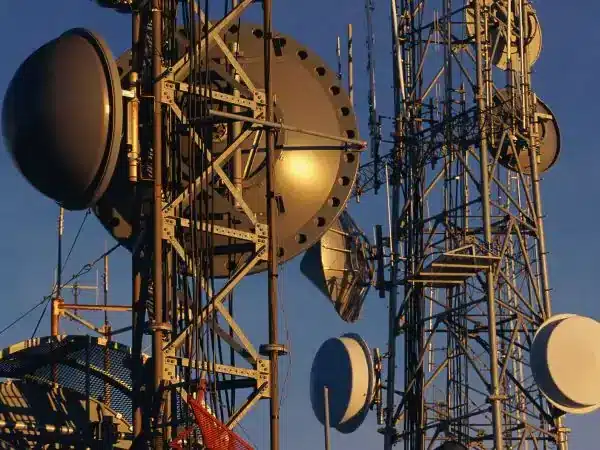

₦7.7B telco hack lands 6 suspects in police net

Hacking Nigerian telcos isn’t just a side hustle anymore; it’s a multi-billion-naira crime. That reality hit home this week after police revealed that more than ₦7.7 billion worth of airtime and mobile data was siphoned from a Nigerian telecoms company through an internal systems breach.

The Nigeria Police Force says it has arrested six suspects linked to the attack, following a petition from the unnamed telco. Per a police spokesperson Benjamin Hundeyin, the suspects gained access by compromising internal staff login credentials, giving them unlawful entry into the company’s billing and payment systems. The operation was carried out with the National Cybercrime Centre (NCCC).

Arrests were made across Kano, Katsina, and the Federal Capital Territory after coordinated operations that began in October 2025. Police say they recovered two residential houses, two mini-plazas, several GSM and laptop retail outlets, over 400 laptops, 1,000 mobile phones, and a Toyota RAV4. Substantial sums of money traced to the suspects’ bank accounts were also seized, with all six expected to be charged in court once investigations wrap up.

For everyday Nigerians, this case matters because hacks like this don’t just hurt telecom companies, they can affect service quality, pricing, and trust in the systems people rely on daily for communication, payments, and business. It also highlights how insider access and weak internal controls can expose critical digital infrastructure to massive losses.

The arrests fit into a wider crackdown on organised cybercrime in Nigeria. In October, the NPF-NCCC secured convictions against 59 foreign nationals involved in a major international fraud syndicate, bringing total convictions in that case to 85. Since its launch in July 2024, the National Cybercrime Centre has become central to the police’s push to secure Nigeria’s digital economy, signalling that large-scale cyber fraud is no longer flying under the radar.

Atsur wants African art to outlive its first buyer

African fine art has a visibility problem. Once a piece is sold, it often disappears into a private collection, taking its ownership history, proof of authenticity, and resale potential with it. Unlike Western art that keeps circulating, appreciating, and changing hands for decades, many African artworks quietly drop off the radar after their first sale.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

That’s the gap Atsur wants to fix. Founded in 2024 by Adaobi Orajiaku and Emediong Umoh, the startup is building the digital infrastructure African art has long lacked, one that tracks artworks over time, verifies authenticity, and keeps ownership records intact so art can function as both culture and a long-term asset.

At its core, Atsur verifies artworks and documents their entire lifecycle. Each piece comes with a certificate of authenticity and a clear provenance trail showing the artist, first sale, and every ownership transfer after that. For collectors and institutions, Atsur also audits existing collections, reconnects fragmented records, assesses value, and prepares documentation needed for insurance, resale, or legacy planning.

The platform’s reach goes beyond private collectors. In 2024, Atsur partnered with Nigeria’s National Gallery of Art to digitise and rebuild records for artworks in the national collection, a significant step in preserving institutional art history that had largely lived offline or in incomplete archives.

Orajiaku’s path to building Atsur didn’t start in galleries but in software and Web3. While leading a blockchain community during the NFT boom, she became sceptical of speculative digital art and more convinced that blockchain’s real value lay in real-world assets. Conversations with artists and collectors kept pointing to the same issue: Africa lacked credible systems for provenance, visibility, and trust.

Since pivoting away from a marketplace model in mid-2025 to focus purely on infrastructure, Atsur has verified over 6,000 artworks worth more than $300,000 and built a research database containing millions of provenance data points. It’s a quiet but foundational play, one aimed at ensuring African art doesn’t just get sold, but remembered, valued, and traded over time. Find out how Atsur works for artists, collectors, and institutions in Delight’s latest.

Moniepoint’s ₦1 trillion bet on small businesses

Moniepoint moved serious money in 2025. According to its year-in-review report, the fintech disbursed over ₦1 trillion in loans to about 70,000 businesses, most of them everyday, informal operators that keep Nigeria’s economy running.

Provision stores took the biggest slice of the loans, followed by supermarkets, building materials sellers, raw food traders, and drink and water wholesalers. On average, that works out to roughly ₦14.3 million per business, suggesting Moniepoint isn’t just handing out tiny microloans but providing capital that can actually move the needle.

The impact shows up in the numbers. Businesses that accessed credit recorded an average 36% growth in transaction value after taking loans. In a country where access to credit remains one of the biggest obstacles for small businesses, that growth underscores just how central financing is to daily operations.

Traditional banks have largely failed this segment, weighed down by collateral requirements, paperwork, and formal records many informal businesses don’t have. As recently as 2017, fewer than 6% of Nigerian MSMEs had access to financing, according to SMEDAN. Fintechs like Moniepoint, and, increasingly Paystack, are stepping into that gap using transaction data instead of land titles.

Credit is only one side of Moniepoint’s scale. The company says it processed 8 out of every 10 in-person transactions in Nigeria in 2025, handling ₦412 trillion across more than 14 billion transactions. It now serves over 6 million businesses and banks, more than 16 million individuals, cementing its position as the country’s largest merchant acquirer.

With a newly acquired national microfinance bank licence, new products like Moniebook, a growing diaspora remittance play in the UK, and over $200 million raised in Series C funding in 2025, Moniepoint is building more than a payments company. Its ₦1 trillion lending milestone shows how fintechs are increasingly becoming the primary source of credit for Nigeria’s informal economy, and how much influence they already wield.

In case you missed it

- Six in ten African creators earn less than $100 monthly

What I’m watching

- What Happens If You Eat Only Once a Day — Inside Your Body

- This is what causes fibroids!

Opportunities

- Credpal is hiring for several roles. Apply here.

- Want to learn how to secure your first $50,000 cheque? Attend the Nestuge event happening on January 30, 2026. Apply here.

- Lagos Business School is recruiting a Programme Officer (Delivery and Coordination). Submit a cover letter and your CV here.

- Kuda Technologies is looking for a Head of Product (Credit). Apply here.

- MTN Nigeria is hiring a Specialist – International Remittance (Product Manager). Apply here.

- Moniepoint is hiring for several roles. Apply here.

- Bamboo is hiring a quality assurance manager. Apply here.

- Paystack MFB is hiring for a few roles. Apply here.

- Attend your first tech event in January! Tech Revolution Conference, a two-day event to discuss everything tech, takes place at Landmark Event Centre, Lagos on January 30 and 31, 2026. Get your tickets here.

- Don’t miss the Cavista Technologies Hackathon happening between February 21 and 22. Register your team and go home with cash prizes here.

- Kuda is recruiting a Head of Product (Credit). Apply here.

- Jumia is looking for a Senior Key Account Manager. Apply here.

- MTN is hiring a Specialist, International Remittance (Product Manager). Apply here.

- Don’t Miss the Africa Business Convention (ABC) 2026. It’s Africa’s #1 Business Conference & Investment Expo. It’s between February 3 and 4. Book your seat today here.

- Moniepoint is hiring for over 100 roles. Apply here.

- We’re hosting a debate on AI in daily life. Join us to share your insights and perspectives.

- Techpoint Africa is creating a video series where people discuss and debate policies and current events. If you enjoy thoughtful conversations, fill out this form. Apply here.

- Are you building a startup can feel isolating, but with Equity Merchants CommunityConnect? You can network with fellow founders, experts, and investors, gaining valuable insights and exclusive resources to help you grow your business. Click here to join.

- Help us make Techpoint better for you! Your feedback shapes what comes next (your responses may potentially save my job. A bit dramatic, but still). It will only take 30 seconds to tell us what works and what doesn’t. Fill it here.

- To pitch your startup or product to a live audience, check out this link.

- Have any fresh products you’d like us to start selling? Check out this link here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a fun weekend!

Victoria Fakiya for Techpoint Africa