As Nigeria’s banking sector approaches the Central Bank of Nigeria’s (CBN) recapitalisation deadline, consolidation through mergers and acquisitions is fast becoming inevitable for many institutions. While capital adequacy will determine which banks survive the regulatory test, a quieter but far more decisive factor will determine which ones thrive afterwards: how well they manage communication and cultural integration.

Industry analysts already anticipate a number of mergers as smaller banks struggle to meet the new capital thresholds. But history shows that financial logic alone does not guarantee post-merger success. In fact, some of the most high-profile merger failures globally were not caused by weak balance sheets, but by mismanaged people, misaligned cultures, and poorly handled communication.

In merger environments, uncertainty becomes the default condition. Employees worry about job security. Customers question service continuity. Investors and regulators look for signals of stability. When these concerns are not addressed early and consistently, speculation fills the gap, and speculation is rarely kind to institutional reputation.

This is why communication must be treated as a deal-critical capability, not a post-transaction add-on. Strategic communication plays three essential roles in merger situations: stabilising trust by providing clarity in moments of change, protecting reputation in a sector where perception drives confidence, and aligning stakeholders behind a shared narrative of the future.

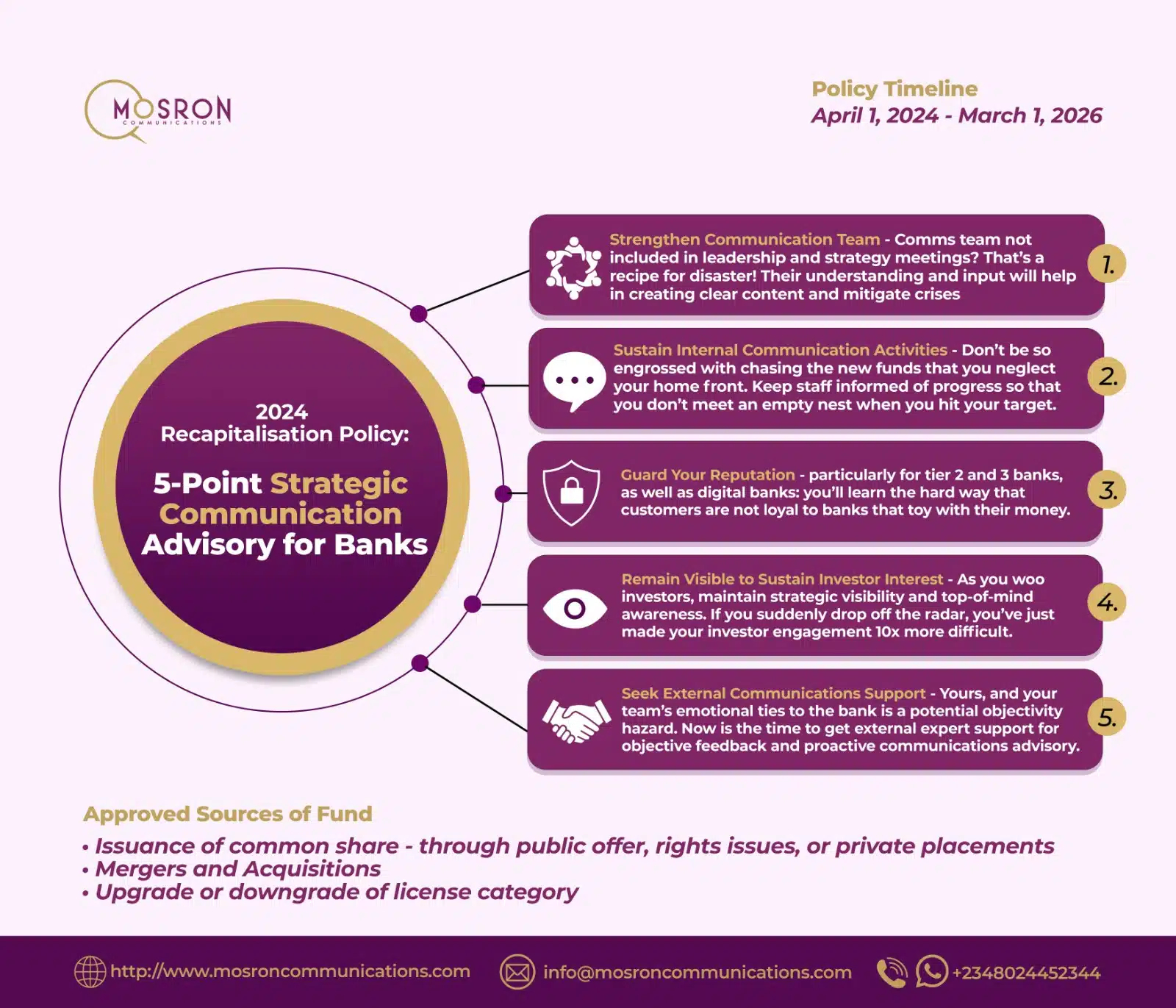

Mosron Communications’ strategic advisory on the CBN’s recapitalisation policy clearly highlights this shift, urging banks to strengthen their communication functions, embed communicators in strategic decision-making, and remain visibly engaged with stakeholders throughout restructuring and capital-raising processes. These recommendations become even more urgent in a merger context, where every silence can be misinterpreted, and every mixed message can deepen uncertainty. Among its recommendations:

- Strengthen communication teams by involving them early in high-level strategic decisions to ensure alignment between business moves and messaging.

- Sustain internal communication to maintain morale and retain talent even as leadership negotiates complex restructuring.

- Guard the bank’s reputation through proactive public engagement and clear, consistent narratives.

- Remain visible to investors and customers to sustain trust during uncertain transitions.

Seek external communication support where needed to provide objective perspective and strategic foresight.

For banks approaching consolidation, structured communication frameworks are not optional. Leadership messaging playbooks, internal engagement strategies, crisis-readiness protocols, and stakeholder mapping must become standard tools of integration, not afterthoughts.

Many mergers that appear successful on paper struggle in practice because cultural integration is underestimated. Differences in leadership style, decision-making speed, risk tolerance, employee relations, and customer engagement models can quietly undermine synergy long after legal agreements are signed.

In Nigeria’s banking environment, where institutional identity is often deeply shaped by founding values and leadership personalities, cultural misalignment can be especially disruptive. When employees remain loyal to “legacy cultures” instead of the new organisation, divisions harden. Talent exits accelerate. Service quality becomes inconsistent. And the very efficiencies mergers are meant to achieve begin to erode. This is why communication and cultural fit must be treated with the same seriousness as financial due diligence. It is not enough to merge systems and processes; banks must merge mindsets.

Culture does not change through policy documents alone. It changes through stories, symbols, leadership behaviour, and daily conversations, all of which are driven by communication.

Effective post-merger communication acts as the bridge between strategy and reality. It helps employees understand not just what is changing, but why it matters. It frames the merger as a shared future rather than a hostile takeover. It replaces “us versus them” with a new collective identity. Purposeful integration communication: town halls, leadership roadshows, internal campaigns, values alignment programmes, becomes the engine of cultural alignment. Without these, even well-intentioned leaders struggle to translate strategic vision into organisational cohesion.

As recapitalisation accelerates consolidation, banks will increasingly need support that goes beyond transactional communication. They will require specialist advisors like Mosron Communications in merger communication and cultural integration, a space where strategic communications firms can deliver measurable value.

This creates a strong business case for structured services such as:

- Pre-merger stakeholder perception and reputation audits

- Cultural fit assessments and narrative alignment frameworks

- Leadership communication strategy for transition periods

- Internal engagement programmes for post-merger stability

- Trust-building and reputation management during consolidation

For institutions navigating high-stakes mergers, communication becomes more than messaging; it becomes risk management, culture design, and reputation insurance rolled into one. The CBN’s recapitalisation policy is reshaping Nigeria’s banking landscape. Capital will determine who gets to the table, but communication and culture will determine who leads after the deal.

Banks that approach mergers with intentional strategies for stakeholder engagement and cultural alignment will emerge stronger, more cohesive, and more trusted. Those who treat these issues as secondary may meet regulatory targets yet struggle to achieve long-term integration success.

About Mosron Communications

Mosron Communications is a bespoke global public relations consultancy providing cross-border communications services to business-to-business and impact organisations across sub-Saharan Africa.