Kamusta,

Here’s what I’ve got for you today:

- Watchdog looks into Airtel Africa and ATC

- uLesson reduces subscription fees by 50%

- FairMoney plans to acquire Umba

- Kenya clamps down on crypto trading

Watchdog looks into Airtel Africa and ATC

Trouble is brewing for American Tower Corporation (ATC) and Airtel Africa.

What happened? The Common Market for Eastern and Southern Africa (COMESA) competition commission is investigating the two companies’ partnership agreement signed in 2022.

Why? They may have stepped on some toes with potential anti-competitive behaviour.

How? According to COMESA, ATC and Airtel Africa might have violated Article 16 of their regulations, which is strictly prohibited. This article says you can’t have agreements that mess with trade between member states or mess with fair competition.

Someone threw a complaint at COMESA, claiming that there’s some shady stuff going on between ATC and Airtel Africa. The allegation is that Airtel is grabbing a bunch of ATC sites every year, and in return, ATC is sliding some cash rebates Airtel’s way.

Now, COMESA is putting on its detective hat to determine if this deal is messing with the market. Airtel Africa and ATC have until March 14th to respond to the commission’s questions.

In 2022, these two companies signed a multi-year agreement where Airtel would use ATC’s sites in Kenya, Niger, Nigeria, and Uganda to beef up its network. A closer investigation of that deal is now underway.

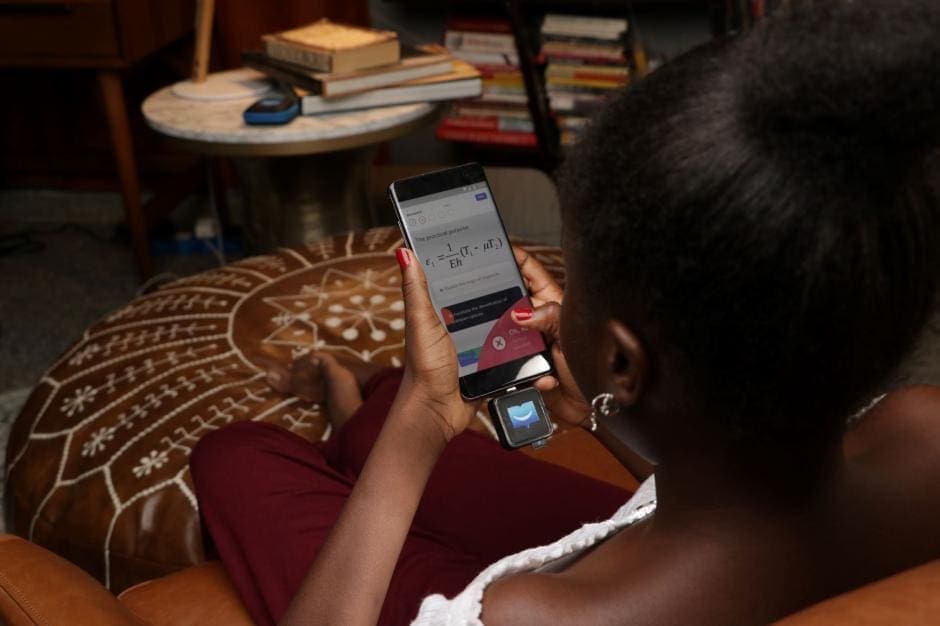

uLesson reduces subscription fees by 50%

uLesson, a Nigerian edtech startup, is slashing its subscription fees by 50% “indefinitely”!

The CEO, Ayooluwa Nihinlola, said the company wants to reduce the financial burden on families in light of the current economic situation.

Speaking of the economy, did you hear about Nigeria’s inflation rate hitting 29.9% in January 2024? That’s up from just under 28.92% the month before, showing how the pressure keeps piling on.

Inflation isn’t just a boring stat; it’s hitting families hard, especially with food prices shooting up. It’s making it more difficult for people to afford the basics.

Moreover, depending on who’s asking, uLesson’s subscription fees were no joke. The 3-month plan was going for ₦20,000, the 6-month plan for ₦50,000, and the lifetime plan for ₦150,000. But now, the edtech startup is reducing those fees by half!

Sim Shagaya founded the company in 2019 to bridge educational gaps for K-7 to K-12 students across Africa with top-notch yet affordable education, all powered by tech.

It covers several subjects, from math to English to business studies, and even prep for exams like the West African Senior School Certificate Examination (WASSCE) and Joint Admissions and Matriculation Board (JAMB) examination.

Meanwhile, uLesson is stepping up while several businesses are cutting back. Remember Jumia’s story last week? It’s an excellent time to visit it here: Orders on Jumia dropped by 22% in 2023 as inflation erodes customer purchasing power

Back to uLesson: With $25.6 million in total funding, it appears it’s committed to making education more affordable, regardless of the economic climate. But who knows? Maybe it’s got some exciting new projects up its sleeve. I guess only time will tell! What do you think?

FairMoney plans to acquire Umba

Word on the street has it that FairMoney, a Nigerian fintech, is considering the acquisition of Umba, another digital bank.

These two neobanks are reportedly in talks for a $20 million all-stock deal, but nothing is set in stone yet.

Umba, founded by Tiernan Kennedy and Barry O’Mahony back in 2018 in San Francisco, offers banking services like loans and savings accounts in Nigeria and Kenya.

FairMoney, on the other hand, is known for its lending services in Nigeria and has been looking to spread its wings, even venturing into India at one point.

It has been expanding its product line and making strategic moves, such as acquiring PayForce, a Nigerian merchant payment service. Now, it seems to have its eyes on Umba, possibly because of Umba’s microfinance licence, which could make it easier for FairMoney to enter the Kenyan market.

Even though Umba might not be actively seeking to sell, FairMoney’s offer might be compelling due to Umba’s financial circumstances.

Umba’s earnings have not kept up with its expenses. The company has been searching for additional funding after a Series A funding round, but things haven’t gone as planned.

If FairMoney ends up acquiring Umba, it’ll be its second big deal in two years. In 2023, the neobank acquired PayForce, a subsidiary of Y Combinator-backed Nigerian merchant fintech CrowdForce, in a cash-and-stock deal.

Sidebar: Last week, Carbon, another Nigerian neobank, acquired Vella Finance.

Kenya clamps down on crypto trading

Kenya plans to tighten the reins on cryptocurrency trading. The government is concerned about money laundering and funding for terrorism due to increased crypto adoption in the country.

Kenya does not want to be on the Financial Action Task Force’s (FATF) “grey list,” as the global watchdog on money laundering and terrorist financing is watching the country.

The FATF gave Kenya a 12-month deadline to address deficiencies in its anti-money laundering and counter-terrorism financing systems, which ended in October 2023.

Kenya might wind up on the grey list after the FATF evaluates its progress at its next meeting and finds any gaps.

Consequently, Saitoti Maika, the Director General of the Financial Reporting Centre (FRC), knows they can’t ignore the issue. He’s talking about setting up a new regulator just for virtual assets.

In October 2023, Kenya’s parliament tasked the Blockchain Association of Kenya (BAK) with developing the preliminary version of the Virtual Asset Service Providers (VASP) bill, also known as the Crypto Bill.

The BAK drafted the first-ever VASP bill in February 2024, releasing it for public comment. This signals a step towards creating a regulatory framework for the cryptocurrency market in Kenya.

In case you missed it

- FG to provide Internet access to 774 local governments and create over 300 jobs in Nigeria

What I’m reading and watching

- YouTube rolls out new channel pages for creators on its TV app

- Biology’s Case Against God

- The Black Scholar Hated by Western Historians : Cheikh Anta Diop

Opportunities

- Curious about the role of investors in a funding downturn? Join us for an insightful discussion tomorrow, Thursday, February 22, 2024, at 6 p.m. WAT, in our X space! Set a reminder here.

- UpdraftPlus is looking for a PHP Software Developer lead. Apply here.

- Phantom is hiring a senior Product Designer. Apply here.

- Selar launches Selar Tuition Funds, offering ₦100,000 to 50 final year Nigerian students to ease education costs. Additionally, internship opportunities will be provided to enhance their career growth. Apply by February 21, 2024, here.

- Application for the Innovest Afrika accelerator programme is open. Apply by February 14, 2024, here.

- Kenyan startups focused on embedded finance, future fintech, SME productivity tools, and content like local gaming and mobile advertising can apply for Safaricom’s Spark Accelerator programme. For more information, check this out.

- The International Center for Journalists (ICFJ) is looking for an editor to support the Arthur F. Burns Fellowship. Apply here.

- Application for the Meltwater Entrepreneurial School of Technology (MEST) Class of 2025 is now open. Check out the one-year, fully sponsored, graduate-level programme in tech entrepreneurship here before March 18, 2023.

- Do you live in Nigeria and work with a local or foreign company? Whether it’s remotely, on-site, hybrid, full-time, part-time or as a freelancer, @TheIntelpoint is trying to understand the Nigerian workspace: how you work, and toxicity in the workspace among others. Please, fill out the questionnaire here.

- Explore this website to find multiple job opportunities in Data that align with your preferences.

- If you are a software engineer, creative designer, product manager, design researcher, or a techie looking for an internship role, please, check out this website.

Have a wonderful Wednesday!

Victoria Fakiya for Techpoint Africa.