I had a limited understanding of insurance until I joined a workforce that introduced me to health insurance. Before that, the concept of insurance, especially insuring items, like my phone, seemed unnecessary, as it appeared to be an additional expense without clear benefits.

Despite a previous incident of phone theft, I rejected the option to insure a new phone on purchase. I didn’t realise the importance and no one was there to help me. Many Nigerians excluded from insurance share a similar story, and stats confirm this.

The recently released Nigerian Insurance Industry report by Intelpoint sheds light on a significant challenge in selling insurance products — the lack of awareness. This challenge, echoed by both insurance sales agents and insurance companies, indicates a need for better education on insurance offerings.

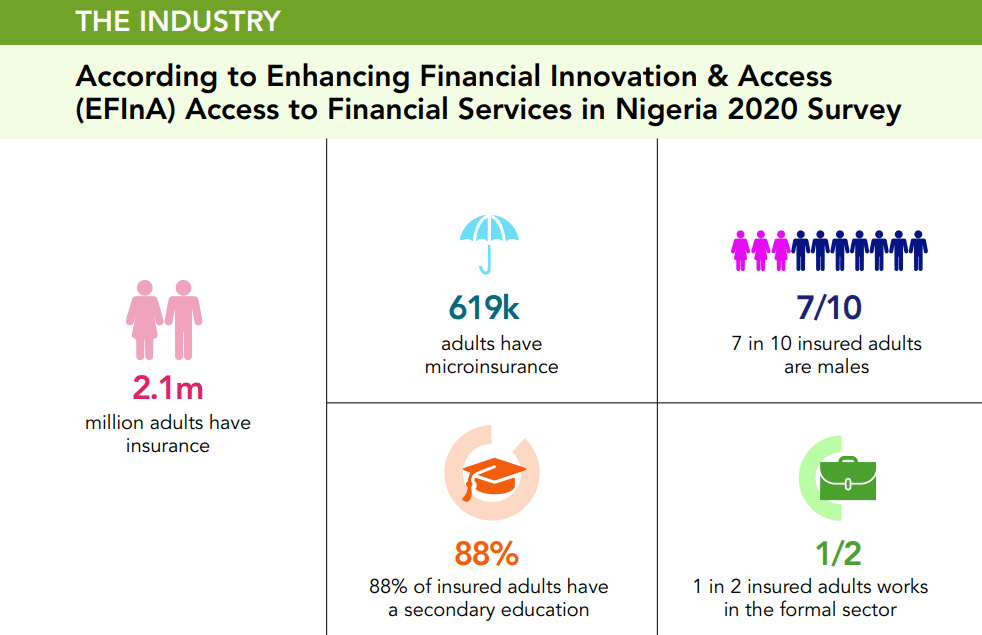

Interestingly, one out of every two adults with insurance policies is employed in the formal sector. This implies that employers, through initiatives like health insurance, contribute significantly to the 2.1 million adults covered as of 2020. Despite the hurdles in promoting insurance awareness, employers play a crucial role in providing at least one form of insurance coverage. To a large extent, these are considered some of the benefits that give companies a competitive advantage.

Health insurance, for instance, is a highly sought-after employee benefit, encompassing medical expenses, consultations, medications, preventive care, dental services, and employee assistance programs for counselling and mental health support.

Another important employee benefits package is Life Insurance, often facilitated through a Group Life Assurance policy. It’s quite cost-effective since the risk is spread across the entire group. In the unfortunate event of an employee’s demise, the insurer pays a benefit — usually a lump sum, calculated as a multiple of the employee’s salary — to designated beneficiaries.

Ordinarily, individuals may not prioritise such policies individually. It is important to note that Group Life Assurance is one of the compulsory insurance covers mandated by the Nigerian Constitution. This reflects a broader shift towards recognising the value of insurance within the employment landscape.

In a conversation with Tobi Adegun, Founder, Credley, an employee benefits and engagement startup, we further evaluated the need for Nigerian startups to provide insurance coverage for their workforce to influence good workplace wellness.

Among other insights, Adegun believes the future of employee benefits is tilted towards a more personalised approach. By implication, there’s an increasing need for the adoption of tech solutions like Credley that provide flexible and customisable benefit packages that meet diverse workforce needs. There’s more to this conversation.

In your experience, how prevalent is insurance coverage as an employee benefit among Nigerian startups? What types of insurance benefits are most common?

In my experience, insurance coverage in Nigerian startups is becoming increasingly prevalent. Health insurance is leading the way as the most common benefit provided by Nigeria’s emerging companies. A handful of startups are going beyond basic coverage to offer additional forms of insurance like life, disability, and mental health plans. However, these expanded protections are still limited to only a few forward-thinking startups.

The upward trends are encouraging, even if expanded insurance plans have not yet seen extensive adoption. Nigerian startups are recognising benefits as a strategic advantage and employees stand to gain from the workplace protections they deserve. We can expect to see benefits continuing to develop as companies balance talent, growth and sustainability priorities.

Looking at the evolution taking place in the workplace, what changes have you observed in employee preferences for insurance benefits? How should startups adapt their strategies to meet the changes?

There have been a lot of changes in employee preference, and benefits are shifting, especially towards overall wellness. As startups cater to a more health-conscious workforce, they are customising benefit offerings accordingly.

Benefits should ideally be more about employee preferences and less about the company’s. We’re increasingly seeing companies provide flexible packages that support mental, physical and emotional wellbeing. Flexibility here is key because most employees value options or services that best fit their needs and lifestyles.

Building this level of choice and personalisation into benefits policies allows companies to better support their workforce and foster a culture where employees feel empowered to address their unique well-being needs.

Can you share insights on how comprehensive insurance benefits influence employee engagement and retention in Nigerian startups?

Comprehensive insurance benefits serve a dual purpose for startups – they aid engagement and retention while also enhancing employee well-being and productivity. Employees reciprocate when companies invest in their well-being, rewarding them with hard work, creative ideas, loyalty and retention.

Using health insurance, the most common employee benefit in Nigeria, as a case study. Employees who have access to physical and mental healthcare are more likely to participate actively in their roles and feel secure knowing the company has their back. So rather than worrying about coverage gaps or unexpected or emergency healthcare costs, they can focus their energy on driving the business forward. At the same time, a healthy workforce with strong well-being support performs better both individually and collectively.

What are the major challenges startups face in providing insurance benefits to their employees?

The primary challenge and barrier for most startups tends to be cost and limited budgets, given most early-stage companies are not yet profitable. Even when startups can provide insurance benefits to employees, the complex nature of insurance policies and limited awareness among employees tend to hinder full utilisation.

Policy documentation makes it hard for employees to understand what is covered and how to file claims correctly.

Also, finding insurance providers that can keep up with the unique needs of startups can be difficult. Traditional insurance providers struggle to adapt to the fluid nature of startups and the unconventional needs they may have. A very good example of the mismatch between startup benefit needs and insurance providers is the lack of mental health coverage or innovative wellness programs.

We all know that people, especially young people, are becoming more aware of their mental health and well-being. It would be nice for insurance companies to provide coverage for mental healthcare, whereby employees can easily access and talk to mental health professionals, and speak freely with guaranteed privacy, such that the company will not have access to their sessions/conversations. The inclusion of these kinds of benefits will be a really good changer for every insurance company, as there is a huge demand for it.

What lessons can other businesses learn from startups that have successfully implemented insurance benefits for their employees?

Several Nigerian companies are leading the way in providing comprehensive benefits. Flutterwave, Andela, and Paystack have become known for their comprehensive insurance benefits and other offerings. However, I should add that listing these companies doesn’t mean that the benefits are available to all employees; some of them may be limited to top or mid-level employees, but they definitely offer comprehensive insurance to their staff. Startups like Zola Electric and Mono are also making employee benefits a priority.

There are a few key lessons other companies can take from these examples. First, understand your employees’ needs and have transparent conversations about what benefits are available. The leaders in this area openly communicate about their offerings as a core part of their culture. That way, potential employees know that these are the kinds of benefits the company offers.

Secondly, robust benefits are a great talent attraction and retention strategy. With employees paying close attention to benefits nowadays, companies that provide these perks are easily able to differentiate themselves. Employees are more likely to join a company and less likely to leave if their needs are met.

In summary, the key things for companies looking to strengthen benefits are:

- Evaluate their workforce needs

- Clearly communicate available offerings as part of their culture

- Realise benefits can drive recruitment and retention.

Healthy benefits reflect a commitment to employees that also serves the company’s interests. As more Nigerian startups and established players make moves in this area, I believe others will follow their lead.