Key takeaways:

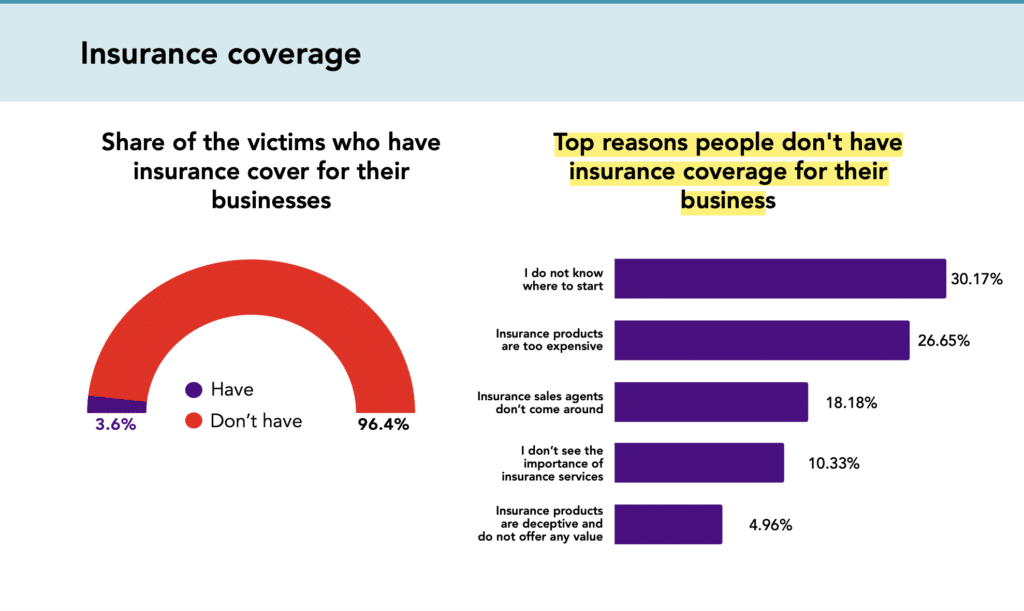

- “I don’t know where to start” and “insurance is too expensive” are the top two reasons why Nigerian businesses don’t have insurance.

- These reasons are based on a survey by Intelpoint in its The Nigerian Insurance Industry report.

- The report also highlights the lack of insurance penetration in Nigeria from a stakeholder point of view.

Out of the 388 business owners that were surveyed by Intelpoint, 96.4% did not have any form of insurance coverage for their business. This figure isn’t surprising given that insurance penetration in Nigeria has been low since the first insurance company — Royal Exchange Assurance Agency — started operation in Nigeria in 1918.

This means that 106 years since the first insurance business started in Nigeria, the penetration rate is still at 1%.

This rate pales in comparison to the banking industry, which is of comparable age but had a penetration rate of 45% as of 2021 according to The Global Economy.

There have been efforts to increase insurance penetration in Nigeria.

For example, there are nine compulsory insurance covers in Nigeria and they include third-party motor insurance, employers liability insurance, workmen’s compensation insurance, group life assurance and healthcare professional indemnity insurance.

The third-party motor insurance policy was made compulsory in 1945, but between then and 2021— 76 years — only 3.4 million of the 12 million cars in Nigeria have been insured.

According to Law firm, TONBOFA, the problem stems from a lack of awareness, which is also the number one reason business owners gave for not having an insurance policy.

Reasons why Nigerian businesses do not have insurance

I don’t know where to start

Not knowing where to start is the highest reason business owners gave for not having an insurance policy. Interestingly, 63% of insurance companies surveyed usually have a form of campaign running to increase awareness.

However, the level of insurance penetration in the country shows that these campaigns have been largely ineffective. One of the points raised by the agents is that there is a lack of trust in the insurance system.

Insurance products are too expensive

According to Leadway Assurance, the low standard of living is one of the causes of slow insurance penetration in Nigeria. This article which highlights how much Nigerians earn, reveals that 83 million people live in extreme poverty.

Businesses are also not immune to the staggering poverty level country. 97% of businesses in the country are small businesses that make below ₦223,250 according to the Nigeria Bureau of Statistics (NBS).

Interestingly, the lowest premium rate that could have saved businesses from losses in the aftermath of the #EndSARS protests in 2020 based on losses suffered is ₦250,000.

Insurance sales agents don’t come around

The report defines sales agents as a set of individuals “who bridge the gap between products and consumers, and the insurance companies themselves, whose policies and strategies shape the industry’s trajectory.”

However, the majority of sales agents believe that the amount of work they do is not commensurate with their pay. Most of the sales agents interviewed — 32% — said they earn between ₦30,000 ($31.23) and ₦60,000 ($62.46). Only 14% earn over ₦150,000 ($156.15).

As expected, low remuneration is the top reason why 73% of sales agents and financial sales associates do not spend more than two years in the insurance industry. Other reasons include unhealthy working environments and failure to meet periodic sales targets.

Subsequently, this leads to a shortage of sales agents that will create awareness about insurance products.

I don’t see the importance of insurance services

According to an article by Nigerian insurtech company, Curacel, “many Nigerians perceive insurance as an additional financial burden rather than a protective measure.”

It also indicated that cultural and religious beliefs could also influence people’s attitudes towards insurance as most beliefs contradict the concept of insurance.

Interestingly, 19.51% of business owners said religious beliefs (“Blood of Jesus,” “Under the protection of Allah”) are the reasons why they do not buy insurance products.

Insurance products are deceptive and do not offer any value

A lack of trust is the biggest challenge to selling insurance products according to financial sales associates. Adekunle Ayo, an insurance sales agent told Business Day in 2019 that “waking up to go on the field in search for prospective insurers is almost like a nightmare,” as they are disinterested once he mentions insurance.

A survey carried out in 2017 by Lagos State rating firm, Agusto & Co. estimated that 138 million Nigerians do not trust insurance.

While it is unclear why Nigerians distrust the concept of insurance, Leadway Assurance highlighted inappropriate pricing and risk profiling as some of the challenges facing the insurance industry.

However, there’s been some growth in the purchase of life insurance products over the years and although experts say that growth is tied to poor economic conditions, it could lead Nigerians to engage more with the industry.

With insurtech startups addressing issues of where to start and price, insurance penetration in Nigeria could see growth in the coming years.