Did you know that searches for Starlink in Nigeria were between 10k – 100k in February 2023? That same month, Payday, a Nigerian neobank for the gig economy, said it processed $300,000 worth of Starlink payments.

The Internet service division of US aerospace company, SpaceX, announced the launch on the final day of January 2023, and it caused a storm.

Since that peak, we’ve gone from regulators and pundits exaggerating its impact to users complaining about the effects of rain on the service. We could attribute the buzz to the star power of SpaceX’s Founder, Elon Musk, or general dissatisfaction with existing Internet services, but something salient flew under the radar.

There are some local players in the satellite Internet space that are truly moving the needle where it matters in Nigeria, and a satellite giant, Eutelsat, has quietly been in the fray for years. In November 2022, it partnered with a young YC-backed startup, Tizeti, to provide services in unserved areas.

For us to properly appreciate this, we need to understand the state of Internet access in Nigeria.

The challenges of Internet access in Nigeria

Nigeria’s Internet penetration rate falls between 38% and 55%, depending on your preferred methodology. When you dig out deeper factors like location and gender, you start seeing disparities at various levels.

About 61% of rural dwellers in Nigeria are not connected to the Internet, per a 2022 GSMA survey; for context, that’s ~60 million rural dwellers unconnected to the Internet. The data also shows more people are connected in southern Nigeria than up north.

Sadly, there’s also a gender divide when it comes to Internet usage, nay, awareness. The scenario worsens in northern Nigeria compared to the south.

Factors such as poverty, illiteracy, and access to infrastructure could be contributing to this divide, and existing Internet solutions like traditional broadband and mobile Internet might not solve this. I mean, what’s the incentive?

Mobile and broadband Internet service providers are profit-making ventures, and they’ll go where they’re assured that customers can pay today, or in the near future.

Mobile operators like MTN and Airtel are more aggressive in pushing 4G coverage to areas where people are yet to get the devices to leverage it, but the same can’t be said for traditional broadband providers like MainOne, FiberOne, Spectranet, or Tizeti.

At 48%, broadband penetration has been growing at a slow pace compared to mobile. Why? It’s far more expensive and there are arguably way more regulatory bottlenecks to cross. As some experts, we spoke to explain, without regulatory bottlenecks, the business case has to make sense.

Even Nigeria’s most urban city, Lagos, can’t boast of having a complete fibre backbone for broadband coverage. Not yet at least.

Satellite Internet has a huge potential

Most of us already use satellites to watch our favourite TV shows, but they have more extensive applications. In 1990, researchers proposed a use case for Internet services, but it didn’t quite kick off. Today, the story is different.

Companies are using constellations of low-earth-orbiting (LEO) satellites that communicate with each other while beaming signals down to earth. The closer the satellite is to earth and the more of them there are, the better.

Companies can extend coverage to new locations, without having to expend too much on building additional infrastructure.

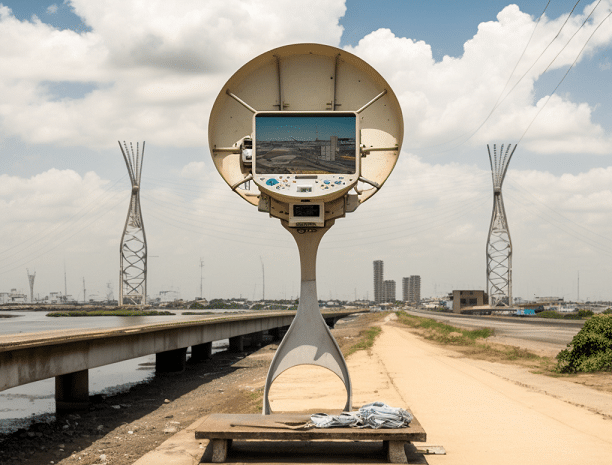

“For regions without fibre backbone, all you would need is a power source, a router, and a clear view of the sky to access the Internet,” says Temitope Osunrinde, Vice President, Sales and Marketing at Tizeti.

Businesses, public secondary schools, and healthcare facilities do not have to be in urban locations to leverage things like remote learning and telemedicine.

Now, that we’re all caught up, you can understand why the launch of Starlink, which has one of the world’s most advanced satellite Internet services, was met with much excitement.

However, the Internet company’s service has proven to be more of a luxury than a life-saver for those in rural or underserved communities.

In come the local players

There were some players in Nigeria’s satellite Internet space long before Elon Musk set his sights on the country. Companies like Eutelsat, SES, Viasat, Avanti, YahClick, and Coollink have been doing an amazing job connecting rural areas since 2013, but have largely gone unnoticed.

In November 2022, Tizeti signed a partnership with satellite Internet provider, Eutelsat. Osunrinde explains that this move aligns with the company’s drive to use technology to solve Nigeria’s connectivity problems.

“The partnership with Eutelsat covers all of Nigeria, specifically unserved and underserved locations, so obviously, outside major cities, such as Lagos. However, we will do this in phases. The first phase covers some states in the South-West, which is ongoing. Installation is in progress, and we plan to launch commercially over the next few days.”

Osunrinde reveals that Tizeti already has coverage in five states in Nigeria — Lagos, Ogun, Oyo, Edo, and Rivers — with plans to add ten more in 2023.

With this partnership, the company hopes to make it more than a regular commercial urban affair.

“Our partnership with Eutelsat will allow us to reach remote communities throughout Nigeria with fast and affordable Internet services.”

Tizeti and other local players might not be as fast as Starlink, but their pricing makes them more affordable entry points for people in rural areas. While Starlink costs $43 (₦19,333) per month, Coollink offers its service for as low as $15 (₦7,000) and Tizeti $1.2 (capped at 1GB per month).

N:B Since Starlink does not yet settle in naira, you might have to use black market rates, and actual subscription costs might get as high as ₦33,000.

With much more affordable pricing, these startups have the potential to truly move the needle for Internet coverage and penetration in Nigeria, when compared to Starlink.

This is not a Nigerian thing, as Starlink could probably turn out to be a luxury for rural dwellers across the globe.

Challenges and competition

Starlink, which has become a darling to some of Nigeria’s tech-savvy middle class, is still a legitimate competition to local satellite Internet providers. These companies can stand out with affordability and prompt customer service, key areas Starlink is yet to improve.

So far, a company like Tizeti has done well for itself. The Nigerian Communications Commission’s (NCC’s) latest data shows that Tizeti has over 18,000 Internet subscribers, second only to Internet service giant, Spectranet with 118,000+ subscribers.

For Osunrinde, the competition for broadband in the next few years will heat up, going beyond satellite Internet.

“It will be anchored by three pillars: subsea cables, delivering connectivity via cables into the country; terrestrial networks, with middle-mile and last-mile fibre and wireless infrastructure; and low-earth-o0rbit-satellites, such as Starlink and Eutelsat.”

Something fascinating about Nigeria’s Internet infrastructure space is that the lines are blurred between competition, clients, and partners. Building a robust infrastructure in Nigeria is hard, and you’d often find supposed competitors collaborating.

While Facebook and Google are bringing subsea cables, MainOne and WIOCC are building data centres, and Telcos and ISPs are investing in fibre cables and base transceiver stations. A network of complementing services to achieve digital inclusion.

“I see it as more of coopetition, which is cooperation and competition, than a zero-sum game,” Osunrinde avers. “Satellite Internet will complement existing fibre broadband. That’s why we’re partnering with Eutelsat, and we expect to see more partnerships like this.”

While you might be erroneously tempted to think Starlink will blow traditional telcos and ISPs out of the water, the reality is that Elon Musk’s initiative will need to partner with existing players in Nigeria to make significant headway.

Payday processing $300k worth of Starlink payments roughly translates to about 500 users.

If other major payment processors like Changera, Chipper Cash, Grey Finance, and Geegpay, among others, processed similar numbers, we’d be having roughly 2,500 to 3,000 users.

Unless Starlink makes major changes, it would be hard to see an upward trend in adoption. But adoption could come in unexpected ways.

Plotting the future with Starlink, local Internet players in mind

Since its launch in 2017, Tizeti has secured strategic partnerships with key players in the ecosystem like MainOne to deploy fibre backbone and Google and Netflix for local caches. In layman’s terms, this is to ensure your Netflix or Google experience is faster on the Tizeti network. The journey, though, is tough, as it should be.

For instance, the company combats Nigeria’s epileptic power supply and high diesel costs with solar energy in its transceiver stations.

With the difficulty in operating physical infrastructure, Osunrinde is adamant that communication satellites will be useful for a country like Nigeria.

“Fiber might be superior, but satellite Internet can provide an alternative to fibre Internet in areas where fibre is not available.”

Beyond basic Internet connectivity, satellite Internet could power the future of connectivity like 5G.

Considering how expensive it is to build 5G infrastructure all around the country — spoiler alert: It’s really tough — Osunrinde avers that mobile and fibre operators can leverage satellite infrastructure to expand their coverage areas.

“Operators can offload important functionalities like multicasting, backhauling, and mobility access to satellite as it’s a better access technology.”

With this possibility, companies like Eutelsat and Viasat with deep roots in Nigeria might have a better head start. It would be interesting to see how SpaceX approaches its Nigerian coverage.

To recap, Starlink might not be a reliable service for the urban-dwelling Nigerian or an affordable service for the rural dweller. If you live in a sparsely populated area and can afford it, Starlink is easily the perfect option. If that box is not ticked, local companies stand a better chance of truly moving the needle when it comes to connecting Nigerians to the Internet.

However, don’t expect a zero-sum game, as we may well see strategic partnerships between competitors in the space, as we’ve so often seen. The consensus I’ve gotten so far is there’s so much more sharing and collaboration to be done.

If you enjoyed or disliked this story, please give the author some feedback at emmanuel@techpoint.africa. Also, share with your friends and network to help promote our understanding of Nigeria’s Internet space, and the companies powering it.