Since 2015, African fintech startups have raised over $3 billion across 722 rounds. During this time, Nigeria has often raised the most capital and, in 2022, was responsible for 46.1% of the continent’s fintech funding. Digging further into the numbers shows that most of the country’s fintech startups play in the payments space, with the most valuable expectedly in that space.

One reason for the rise of payments startups is the economy’s informal nature, which has spurred payments innovations. Recently, however, there have been calls by users and investors for entrepreneurs to focus on other fintech verticals.

Mayowa Kuyoro, Partner and Head of West Africa Financial Services at McKinsey & Company, is one such individual. The growth of payments startups, she says, has been driven by necessity as people need convenient payment options.

“If you look at the macro level and see payments as a vertical, everybody needs to exchange goods and services. Whether it’s cash or electronic, you need to exchange goods and services, and so payments are almost embedded into our everyday life.”

But that’s not the only reason payments have seen such tremendous growth. In 2012, the Central Bank of Nigeria (CBN) launched its financial inclusion plan to reduce the number of financially excluded Nigerians from 46.3% in 2010 to 20% by 2020. Part of the CBN’s goals was to have the percentage of Nigerians with access to payments services grow to 70%. That has not happened despite a series of policies meant to accelerate financial inclusion. In addition, the creation of the NIBSS Instant Payments (NIP) has also fast-tracked developments in the payments sub-sector.

“One reason people have adopted account-to-account transfers is that we have instant payment systems. I remember when I was living in Australia, I was confused as to what was going on with the banking system. I didn’t understand why it took two days for me to see the money that was paid into my account.

“There has also been a concerted push for financial inclusion. When you have your store of value, and I use the term store of value very deliberately, sitting in an electronic form, it’s almost more convenient to make an electronic payment.”

But despite the growth recorded by payments startups, Kuyoro believes startup founders must begin to think about building solutions in other sectors.

“I believe we need to have more startups entering other verticals beyond payment,” she says. “Payments overwhelmingly makes up the bulk of fintechs that we see in this market, and we need to see people providing other financial services.”

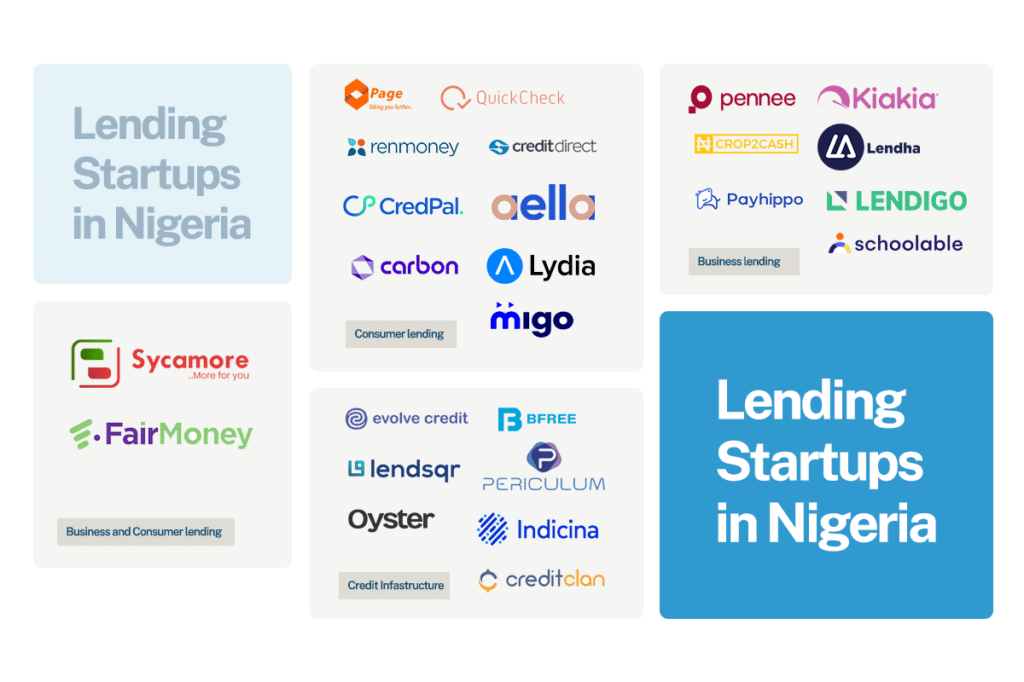

Two areas she identifies as potential growth areas are the lending and wealth management sectors.

“There’s a lot of informality today in the way people borrow, and I feel like there is more room for innovation there to be able to extend credit to both individuals and small businesses.”

Access to credit remains a huge challenge for individuals and businesses in Nigeria. According to the Credit Bureau Association of Nigeria (CBAN), only 4% of Nigerian MSMEs have access to credit. Individuals do not fare better, as seven out of ten bank customers in Nigeria do not have access to credit.

Already, fintech startups are rising to the occasion, drawing on customer data to provide credit to Nigerians. However, more needs to be done if access to credit will be expanded to most Nigerians. Here, Kuyoro argues that the government can make policies that encourage startup founders to build solutions in other sectors. Just like the creation of an instant payments system drove the adoption of instant payments, the government must work to provide the necessary infrastructure that founders can build upon.

“What helped drive payments was that the basic infrastructure was there. The government said, ‘We want to go cashless, so we need to have instant payments.’ If we do more of those sorts of things where we’re putting the infrastructure in place to help deal with some of the infrastructural voids we have in our country, I think that can help get folks looking into other verticals in the financial system.”

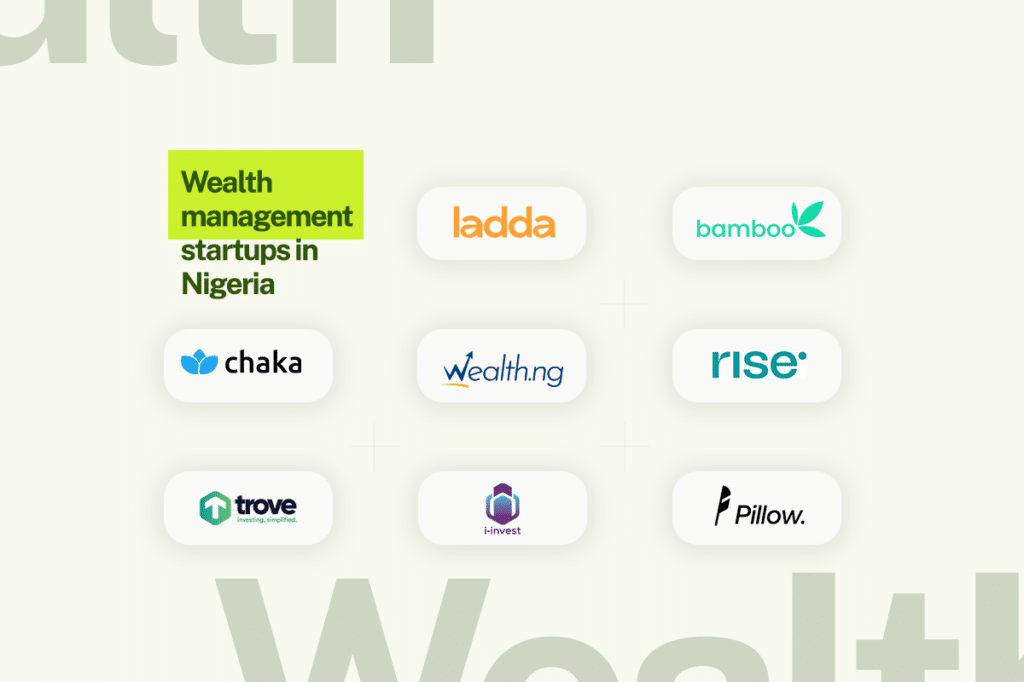

Wealth management startups, on the other hand, have slowly sprung up since 2016. Startups like Bamboo, Chaka, and Risevest allow Nigerians to invest in foreign companies with as little as $10. Kuyoro thinks that as Nigerians have more disposable income, they would require wealth management solutions.

“I think if we see the sort of growth that the IMF and the World Bank are projecting, people will become slightly richer and therefore have slightly more disposable income. Consequently, they might want wealth management solutions.”

Building the enabling infrastructure is not all the government can do, and Kuyoro adds that partnering with relevant stakeholders to achieve certain outcomes is necessary, in addition to creating an environment that encourages innovation.

“One of the things that a country like Singapore has is sandboxes enabling startups and innovators to experiment in controlled environments. Do we have functional sandboxes that help people with innovative solutions to figure out how to extend other financial services to the population better?”

In January 2023, the CBN announced that its regulatory sandbox had gone live, with eligible businesses encouraged to apply. Considering this is the CBN’s attempt at a regulatory sandbox, its outcome could provide a glimpse into how the apex bank intends to offer regulatory support through sandboxes.

Between 2010 and 2020, Nigeria’s financial exclusion rate shrunk by 10.4%. At least 35% of Nigeria’s adult population is financially excluded, and a KPMG report estimates that it would take about 40 years to reach a 10% financial exclusion rate. Kuyoro argues that increasing the financial inclusion rate in Nigeria requires working on factors such as gender parity and education.

“If you look at the numbers, they will tell you that the folks who are predominantly excluded today tend to be women, tend to live in northern Nigeria, and also tend not to be as educated as the median in the country. I think once you address some of the broader factors like gender parity and people having the agency to make their decisions etc., we can improve financial inclusion.”

While the focus is often on getting people access to a transaction account, she argues that financial inclusion goes beyond that, and financial services providers must build products that meet the needs of their customers.

“We need to think about financial inclusion beyond just having access to a bank account or a wallet but having access to a full suite of financial services that speak to the needs of folks who are going to be using them.”