Historically, women have been underrepresented in the workplace, and this also plays out in the venture capital space. According to Crunchbase, global VC funding to female founders dropped in 2020. Their figures show that 800 female-founded startups received $4.9bn from investors — a 27% decrease from the same period in 2019.

One reason for this is low representation in VC firms. Axios reports that 12.4% of decision-makers in US venture capital firms are women. And only 10% of West African startups that cumulatively raised $1m between 2010 and 2020 had at least one female co-founder.

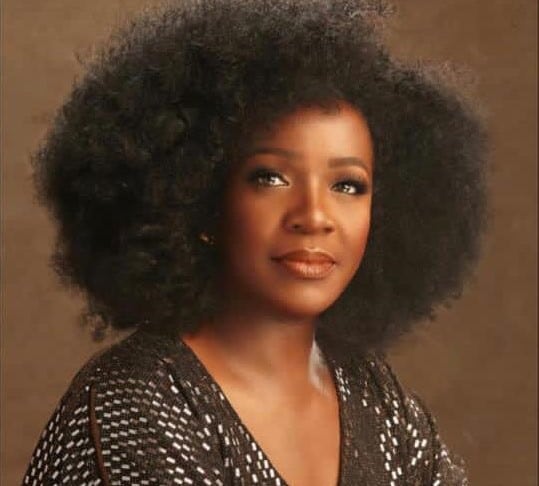

This is a problem Yemi Keri, one of a handful of women investing in African startups, is passionate about solving. After getting a taste of angel investing with the Lagos Angel Network and seeing how hard it was for women to get funded, she co-founded Rising Tide Africa to get more women involved in angel investing.

Techpoint Africa caught up with her for a chat, and she held nothing back as she shared her experience.

How did you get started with angel investing?

I got into angel investing by referral with the Lagos Angel Network. Now I’m on the board, but I got started there. I think this was 2014/2015, and Tomi Davies had started off Lagos Angel Network and wanted a group of us to come in and understand what it was all about. If I recall correctly, he brought about 50 of us together, and every so often, we would meet and listen to pitches.

I used to watch and listen to the kind of questions that were asked. My background is in information technology, so this was new to me at the time. I made two investments — in Cafe Neo and Big Cabal — with Lagos Angel Network, and that’s how I came into angel investment.

What was the attraction to these companies?

For Cafe Neo, it was the revenue and expansion model and the target audience (youthful demography). In the case of Big Cabal, the passionate team, the possibility of catering for multiple audiences, and the various products that were in the pipeline when we invested won me over.

What influenced the founding of Rising Tide?

Around 2016, I began to toy with the idea of having a female-focused angel network because many of the people who came to pitch were men who got more attention and interest than the few women who showed up. And this made me wonder. It wasn’t by design, but I began to notice that, first of all, the questions they asked women were kind of different.

Secondly, the women were not communicating effectively to the investor team, and the kinds of businesses they pitched were slightly different. Women often do their businesses with a sense of passion. As we approached 2017, a lady came to pitch one of the best products in the healthcare sector — it still is today — but she couldn’t convey it very well.

Join over 3,000 founders and investors

Give it a try, you can unsubscribe anytime. Privacy Policy.

I think it was her first few months of fundraising, so Ndidi Nnoli-Edozien and I took her aside and began to mentor her. We took her to pitches; we would put a group of women together and tell her to pitch. We would then question her thoroughly.

After a while, we brought her back to the team, and everybody was impressed and wanted to invest. They got to the point of negotiations, and the rest is history. Though we did not invest then, she’s doing well. I knew that there was a gap and that we had hit on something we could develop.

So Ndidi and I got together and started Rising Tide Africa, which has been my major focus. We founded Rising Tide to increase women’s participation in angel investing so that they can see it as an asset class; the end goal is to invest in more female founders. We believe that with more female angel investors, we can reduce the gender funding gap for female entrepreneurs.

That was the genesis of Rising Tide, and it is a vehicle in which we are now investing. Lagos Angel Network has metamorphosed into a network of networks. Now we have different networks within Lagos Angel Network.

How many startups has Rising Tide invested in?

By 2019, we had done six. By the end of 2020, we had 15 investments. In 2021 we have made six investments. That would mean 21 investments in all, and we have completed the due diligence for two others, for which we are about to call for funds.

How many investments have you made?

Right now, I’m on my 19th investment.

What is Rising Tide’s average ticket size?

We initially said we would start with $25,000, but so far, our largest ticket size is $289,000. We intend to do between $50,000 and $200,000.

You mentioned wanting to increase female participation in both startups and angel investing. What else drives your investment mission?

Rising Tide is set up on four major pillars, one of which is investments.

The other thing that we do is education. We now have about 64 members at Rising Tide, and some of them are new to angel investing, so we have to do a lot of educating.

We try to teach them about things going on in the ecosystem so they can be better investors. We also educate the entrepreneurs. Over the years, we’ve organised training and masterclasses for our founders and others in the ecosystem. We are now developing Entrepreneurship 101, which contains several courses to help entrepreneurs become investment-ready. We plan to develop other curricula that will be required for the ecosystem.

The other arm is networking. Just like what you’re doing, having us talk about investments and enabling entrepreneurs to have access to investors, we also do our bit in terms of networking. We attend events where we meet many entrepreneurs.

We organise events where entrepreneurs can meet many investors not only within Rising Tide but also outside. We do a lot of coaching and panel roles for other networks or groups of networks. So we try to develop not only Rising Tide but also the ecosystem.

The fourth arm is mentoring, which is very crucial. We act as individual mentors for our portfolio. We don’t believe that investments alone are what we need to provide for our businesses. We believe in growing with them and holding their hands.

You get a pool of people who can mentor you for a period. So we have one-offs like that. We also have mentoring sessions where we spend three to six months mentoring a business. Our goal is to mentor them until they are investment-ready, either for Rising Tide or any other network willing to invest in them.

What we’re doing is giving back to the ecosystem and ensuring that it develops so that our businesses do not die within the first three years. Those are the four pillars that Rising Tide operates by.

Are there specific markets or industries that you focus on?

We are sector-agnostic; however, we try to invest in certain sectors. We look at sectors that have volume and the most impact on our economy — like education, for instance. Apart from education, we’re looking at something related to healthcare. So education, health, agriculture, financial inclusion, essential goods, and services are our areas of interest.

How do you determine what startups to invest in?

We have an investment process that guides us. First of all, tech and tech-enabled startups get our attention. We prioritise female-owned, female-led, and gender diverse companies. We look at their business model critically. We look at the market. Of course, we look at their financials and their corporate documents.

So we filter based on our investment philosophy. After we do that, if they qualify, we look at factors like their team. We look at their qualification and prior experience, their commitment to the business itself; we don’t want people doing part-time coming to us for investment.

We look at diversity. We go as far as looking at who sits on your board of directors and talking to some of your references. We also look at your business model. Don’t forget that these are early-stage startups, and there’s only so far we can go in terms of due diligence, but we look at these basic things.

What are their revenue sources? Who are their potential customers and suppliers? What kind of pipeline do they have? What’s their value proposition? We look at the size of the market and the key drivers within that landscape. These are external things that we look at in terms of whether there’s a unique selling point, the barriers to entry, and the competitive landscape.

Some don’t have historical financials, but we look at how objective their revenue projections are? What will their gross margins be? Their burn rate of cash — how long our investment can carry them. Also, because we are angel investors, we want to exit between a three to five year holding period, so we look at the exit potential.

This is how we filter and look at the kind of businesses that we invest in. If we are not investing in Nigeria, we would require a local investment network in that country to co-invest with us because those are the people who understand the business environment.

What shouldn’t a startup be doing?

I will talk about the team first. If a founder says, "I am still keeping my day job until we get funding," that’s a red flag because it means that the founder is not confident about their business. You will quickly lose the interest of an investor. So, when you are pitching, make sure you are fully committed to your startup.

The other thing is that while you are putting your team together, try and understand the kind of skill sets that you require based on what you are doing and ensure that you have those requisite skills. Ensure that you are not relying on one person to the point that if your technology person or CTO leaves, your startup shuts down.

Some founders tend to make the CTO a co-founder, but you have to be sure about the interest of your CTO. Even though you make them your co-founder, that might not be enough to hold them down.

Don’t rely solely on raising capital from investors, solely being the keyword. Fundraising is a different ball game in itself, and sometimes, it makes you shift focus from your business. A founder needs to determine how much they need over a fixed period so that they’re not continuously raising.

When you’re raising funds, remember that an investor does not want to fund your overhead. Do not raise $100,000 and then use it to rent a place or pay salaries. That is not what we’re interested in investing in.

Even if you use some of it for your overheads, let most of it be for improving or scaling your product or whatever it is that will make the business grow. We also advise founders not to give out majority equity of their business. As angel investors, we also say, "try not to take more than 15% of the business, so you do not kill it."

They will always need to have that kind of authority because if other investors are coming in down the line and you have given away 30% already without even getting to Series A, then it starts to become a major challenge.

Another issue that investors are beginning to see is the level of valuation. It’s incredible how a company that started business 5 or 12 months ago and is still in product development is valuing itself at $1 million. That is ticking off a lot of investors. Be realistic in your valuation.

We are not in the mature European and American markets, so stop equating your business to startups in those regions; it is bad for the ecosystem. You have to be able to justify your valuation to angel investors. If we see that something is overvalued, we walk away.

What is your biggest success story?

Amayi Foods and Migo in terms of expansion into other environments. Amayi is on Amazon Prime and sells globally, and Migo — formally Mine.io — has expanded its services to Brazil.

Have you had bad investments, and how did you deal with them?

In your portfolio as an investor, you should be ready to lose some funds. Before we onboard our investors, we always tell them only to invest what will not affect their lifestyles because statistically, only one or two of your investments will become a unicorn. However, they will make up for your other investments.

We started off investing really critically in 2019. We have two that are not looking promising so far. As for the others, it’s still too early for us to say they have failed. What we do when we are investing is to position the team lead of that investment as a board observer or a board member in that startup, so they act as a liaison between Rising Tide and the startup.

We’ve tried everything from mentoring to handholding to board observing, and we’ve made recommendations, but we’re still watching. It’s still early to say that they are really bad. We hope that the recommendations we’ve made can take them out of the hole that they’re in.

What startups are in your portfolio?

So we have Migo, Amayi foods, Big Cabal, Cafe Neo, Aruwa Capital, OZÉ, Kwik, Nature’s Bounty, Eden, Blackbet — which we co-invested in with Lagos Angel Network.

Inkblot is an interesting one because we decided to try entertainment. We have Seso Global, Emergency Response Africa — very early stage but gaining a lot of traction. We have Bankly, Chekkit, and Gradely.

Are there any deals that you passed on that you regret?

(Laughs) There will always be deals that you pass on. I think in the early stages of Lagos Angel Network, we let Flutterwave go. We also let Paystack go. That’s for Lagos Angel Network. Now, I don’t know if any we let go has done well, but you will always have those companies.

There’s a company called Termii. We didn’t want to pass up on them, but before we could conclude, they had gotten other investors. At that time, our investment process took so long because we were at the teething stages ourselves. This was 2018/2019. As an investor, you win some and lose some.

How do you deal with the fear of missing out as an angel investor?

There will always be deals. If you miss one bus, there will always be others. If you miss out in the early stages, you might get another opportunity later. There will always be a chance for you to get on board, and if there is none, it wasn’t yours.

How can founders reach you?

For Rising Tide Africa, you can send an email to info@risingtideafrica.com. You can also visit the website at www.risingtideafrica.com if you want to join us as an angel investor. Finally, you can send your pitches to pitches@risingtideafrica.com