Fintech

Top stories

Flutterwave powers African payments. Offers diverse tools, but watch for delays & security issues. Compare with Paystack, Monnify, etc. Assess fees, features, & security to pick the best fit.

Pre-Series A funding bridges seed & Series A, fueling growth. Investors back potential, product traction. Challenges: valuation, market, fit. Secure funding with clear pitches & strong metrics.

Track equity changes with roll forward. Crucial for startup transparency & investor confidence. Manage dilution, funding rounds, & compliance. Use tools for accuracy. Vital for growth.

Incentive units (LLCs) vs. stock options (corps): Units grant ownership, options offer purchase rights. Units: flexible, taxed at vesting. Options: ISOs (capital gains), NSOs (income). Choose based on company type & goals.

Nigeria’s fintech sector is revolutionizing financial inclusion with mobile banking, digital payments, and more, enhancing accessibility, job creation, and economic growth across the country.

Egyptian fintech Valu is set to list up to 25% of its shares on the Egyptian Exchange, marking a major step in its evolution. Its IPO reflects a growing trend of African fintechs going public.

As Nigerian financial institutions advocate for contactless payments, consumer habits and security concerns present challenges. However, experts believe widespread adoption hinges on securing merchant participation.

Due to chip shortage and naira devaluation, the cost of issuing cards has gone from ₦600 to ₦1,800. But contactless payment could crash the price to ₦400.

Flutterwave has received approval from the Bank of Ghana to offer inward remittance services, marking a significant enhancement of its operations within the country.

Revolut, a London-based digital banking giant, is reportedly setting up operations in South Africa and has applied for a full banking license, according to sources familiar with the matter. This move positions Revolut to compete with local digital banks such as TymeBank, Discovery Bank, and Bank Zero. In a statement to Techpoint Africa, Revolut confirmed…

Access Bank has partnered with Visa to launch ‘Tap to Phone’ which will allow merchants receive card payments with their phones instead of a PoS system. It said customers will simply tap their cards against a merchant’s phone to pay.

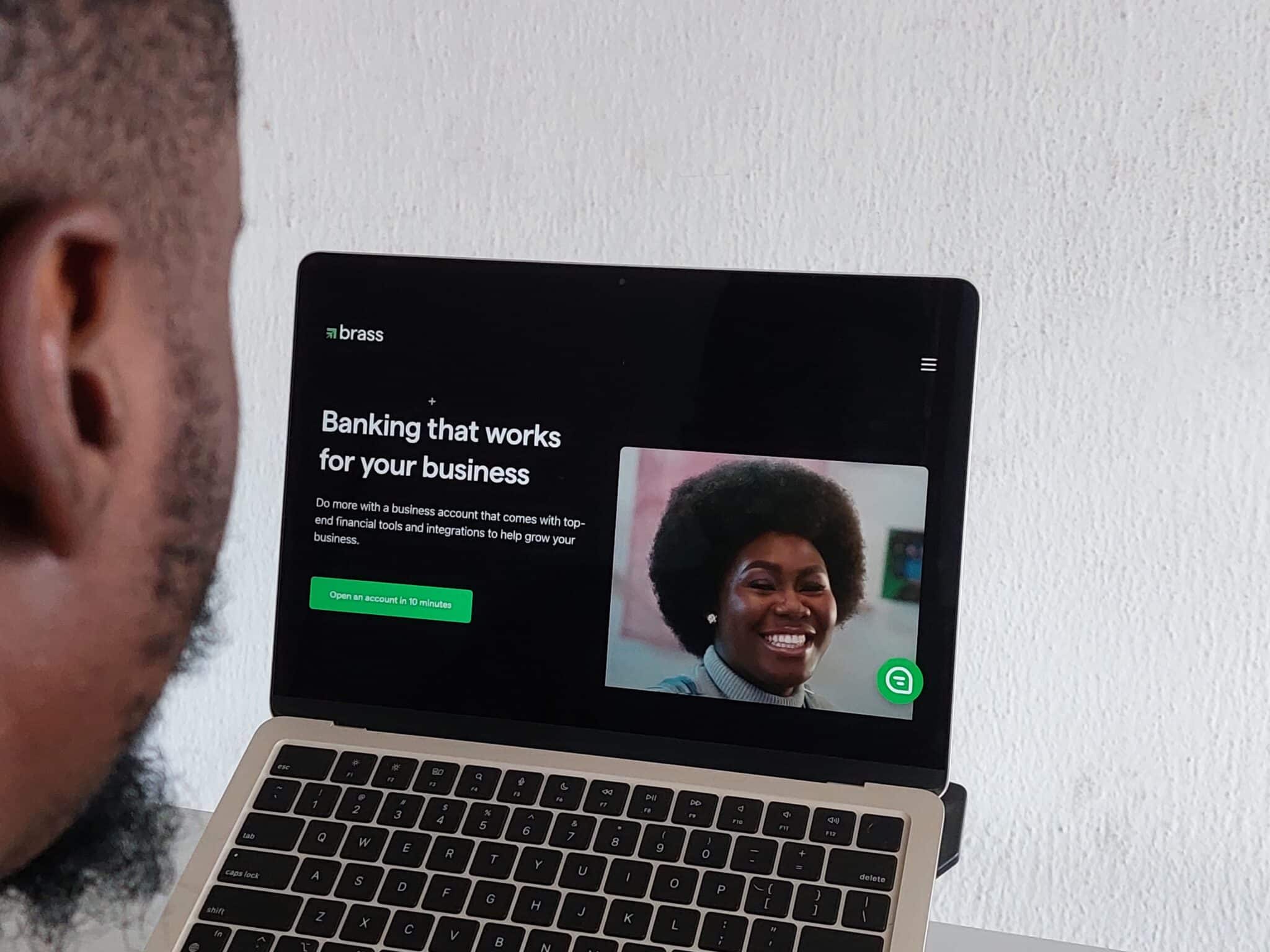

Brass is preparing for a public relaunch months after its acquisition. In recent months, the company has undergone restructuring, layoffs, and a rebranding to Copper Brass.

For 13 years, Remita has facilitated payment collection for Nigeria’s federal government through the treasury single account, but a new payment system is ending this partnership.

Flutterwave has secured a Payment System licence from the Bank of Zambia, officially launching its operations in the country.

As speculation grows around Flutterwave’s IPO plans, a listing on the Nigerian Exchange Limited could pave the way for more local tech companies to follow suit.

The problem with cross-border payments within Africa is bigger than finetchs. In this article, central bank executives share the real reason why technology is not key to instant cross-border transaction in Africa.

Why is it easier to pay across Africa with a Visa or MasterCard but not with mobile money? Experts say lack of interoperability is making cross-border transactions expensive. Could the AfCFTA Digital Trade Protocol be the solution?

A growing emphasis on intra-African trade highlights the need for more effective cross-border payment options. Merchants of record providers hope to fill this gap while aiding business expansion.

POS operators say that the new ATM withdrawal fees announced by Nigeria’s central bank could affect the cost of POS transactions.

Merchants using GTBank’s POS terminals no longer have to pay processing fees as the bank attempts to boost adoption of its POS terminals.