Fintech

Top stories

With the right steps and platforms, remittances from the diaspora which are expected to grow to $25.5 billion in 2019, could boost investments for small and early-stage businesses.

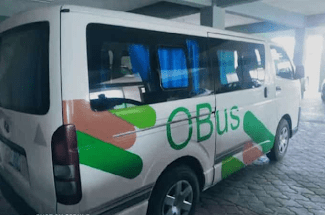

OPay continues its aggressive expansion drive with the launch of OBus, a commuter transit service that operates using branded hummer buses for intrastate trips within Lagos.

Verve extends its reach to countries outside Africa in a new partnership, and users may need to get new cards.

Opera-founded startup, Opay, has just introduced OTrike, a tricycle hailing service, in the commercial city of Aba, southeast of Nigeria, and northwestern city, Kano.

What the recent move by online savings platforms means for the Nigerian financial space.

Earlier today, two Nigerian fintech startups PiggyVest and Cowrywise announced new products that provide users with dedicated virtual account numbers, making them somewhat digital banks.

What Opera’s entry into the motorcycle e-hailing market means for the Nigerian mobile payment market.

Financial technology startups in Nigeria are breaking down investment opportunities for everyone, irrespective of their disposable income.

The possibility of cashless initiatives in the public transport system as the key to promoting the Central Bank of Nigeria’s cash-less project.

After being granted the much coveted switching license by the Central Bank of Nigeria, three year-old electronic payments company, TeamApt could have its work cut out for it

How Branch is going after Africa’s unbanked population, following its recent partnership with Visa and a successful $170m investment round.

Nigerian payments company, Paga is 10 years old and has some interesting observations and projections.

PiggyVest co-founder, Joshua Chibueze highlights the need for an efficient identity system towards driving financial inclusion in Nigeriaa

How the relationship between fintechs and banks is favouring both parties with the latter providing a support system to the former.

Airtel Nigeria appears to be launching its payment service bank ahead of MTN that first indicated interest in establishing a bank in 2019

Nearly 4 years after launch and a period of bootstrapping to profitability, Nigerian fintech startup, TeamApt raises $5.5 million in Series A round.

A recent report by the GSMA reiterates the importance of mobile in the Sub-Saharan African region, especially with respect to mobile money.

Remittance into Nigeria in 2018 was valued at $25 billion, which is multiple of what came in to the country as foreign direct investment in the same period

Figures from NIBSS shows that interbank transfers had the highest transaction value in the Nigerian banking system in 2018.