Fintech

Top stories

A recent report suggests Opera’s micro-lending platforms may have violated Google’s policies but other lending platforms are not exempt from this. Should they be worried?

OPay takes lending feature, OKash, off its app. This might be in response to reports that recently emerged stating that Opera’s lending businesses have been in constant violation of Google’s Playstore policies.

Fintech expert, Adedeji Olowe makes some educated guesses on the Nigerian fintech space in 2020, with WhatsApp predicted to put fintechs under threat, a major fintech acquisition and the arrival of the Monzo of Africa

A look at the predictions of Open Banking Nigeria trustee, Adedeji Olowe, for the financial technology space in 2019 shows that some of them came to pass.

Tanzanians abroad can now send money directly to recipients’ M-Pesa wallets as Vodacom Tanzania partners with WorldRemit in a mobile money transfer deal

OPay continues to try out different services on its mobile application with a messaging feature now added to an existing log of 15 services. We explore what this might mean for the startup’s super app plans.

Backed by the CBN and NIBSS, Financial Service Innovators has launched a fintech industry innovation sandbox to help innovators develop creative financial solutions and scale regulatory hurdles

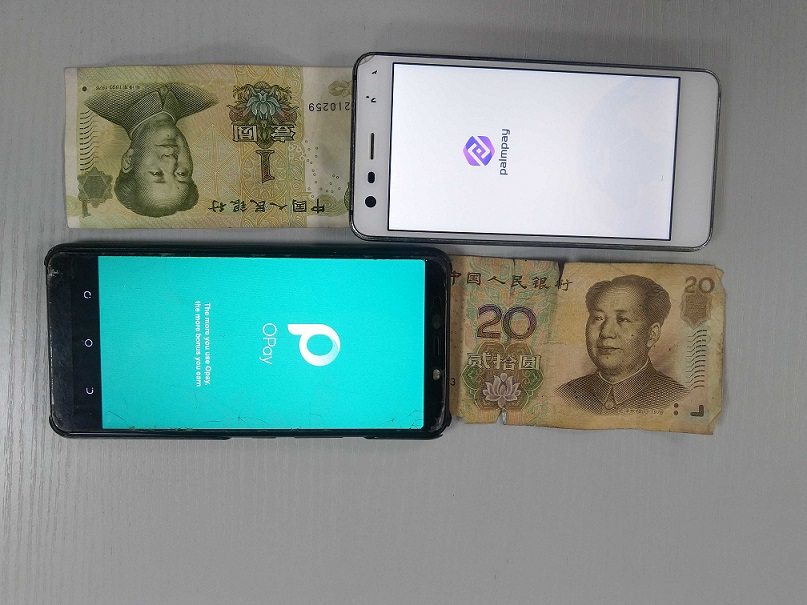

There is a competition brewing between OPay and PalmPay, and this thinking is down to the strong investor network of both sides. But how deep does the investor tie really go?

Looking to grow your money without worrying about Naira fluctuations and inflation? These 4 platforms help you invest in foreign stock markets using local funds

Transsion Holdings, the company behind the TECNO, Infinix and Itel brands, may have finally entered the African mobile payment market with PalmPay. Could this signal a competition with Opera’s OPay?

Visa is reportedly about to acquire a 20% stake in Interswitch for $200m, effectively making it Nigeria’s first unicorn; i.e. a privately-held company valued at $1 billion or more.

Insights from merchants and customers all point to the fact that the ₦50 stamp duty on POS transactions is counterintuitive to CBN’s cashless society project.

OPay recently reviewed the transfer bank charges fee on its platform. The implication is that users no longer have the luxury of paying ₦10 for bank transfers on the platform. But the payment platform has another agenda

Chaka is giving Nigerian access to invest in assets listed on both local and foreign exchanges.

In what looks like a move to cement its pan-African payment status, Flutterwave is testing cross-border money transfers.

On Thursday, Eyowo launched as a digital bank which makes use of mobile numbers to enable peer-to-peer transactions. It has also included businesses in its service offerings with Eyowo Retail.

The low rate of insurance penetration and the role that technology can play in capturing the untapped market.

A decade after its inception, cryptocurrency still remains a grey area in many parts of the world and Nigerian industry players express their thoughts on plans to regulate its activities.

Hakeem Adeniji-Adele, Deputy Managing Director, eTranzact calls for the need to build payment products to fit into the Nigerian culture.

It appears Carbon (formerly Paylater), a Nigerian-based fintech startup that started as a loan offering platforms, is launching in Kenya soon.