Fintech

Top stories

Though several Nigerians seemingly adopted online platforms during the lockdown, the volume of financial transactions dropped. Numbers seem to be recovering, but businesses may soon need to be wary of regulators

When Safaricom and Vodacom acquired M-Pesa from UK telecoms operator, Vodafone, details of their stakes and acquisition costs were still unclear. But we can tell from their financials.

OPay responds to shutdown claims of its businesses in Nigeria as it reveals plans to restructure. For the Chinese-backed startup, it seems current economic situations have forced it to limit its focus

Nigeria’s apex bank has released a regulatory sandbox framework for both new and existing fintech companies. With the proposal, new fintech products might have to be tested and approved before a full market launch.

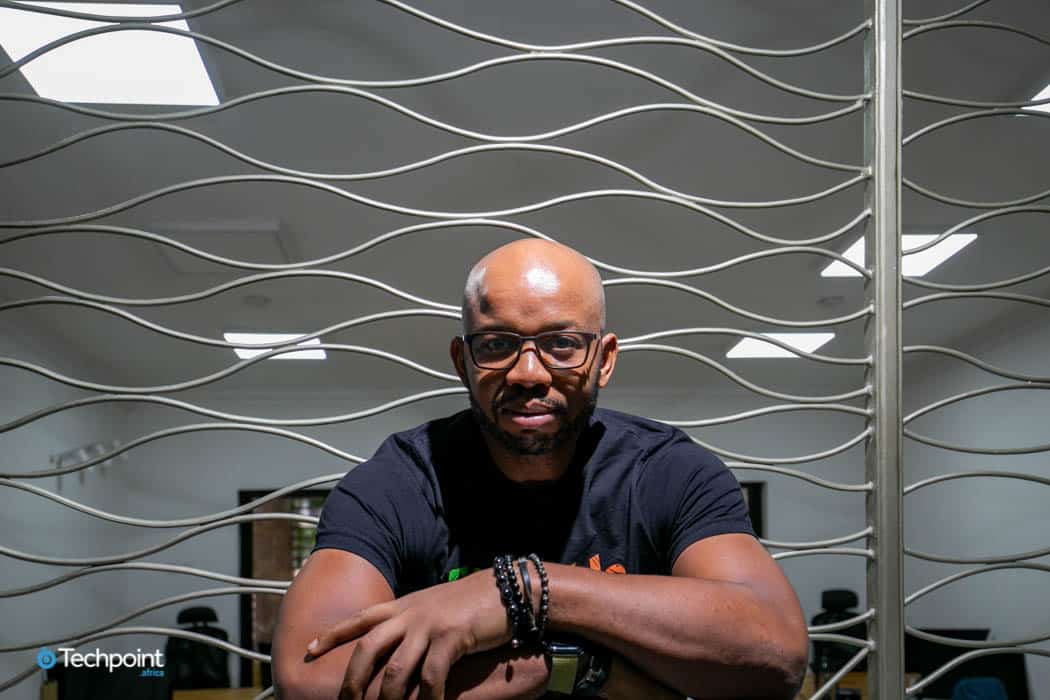

Ex-Diamond Bank CEO, Uzoma Dozie sits for a chat with Techpoint Africa’s Adewale Yusuf to discuss his shift from traditional banking to digital banking with ‘Sparkle’, potential competition with his brothers (Carbon) and his entrepreneurial journey so far

Egyptian fintech platform MoneyFellows has secured $4 million in a Series A investment from venture capital (VC) firms Partech and Sawari Ventures, as it works towards helping millions of new users reach their financial goals.

Voyance, a Nigerian data science company, has launched Sigma to help fintechs tackle the constant problem of fraud. We have a chat with its co-founder, Abdul, and a fintech founder to weigh the merits of this new platform.

The rise of fintech firms in recent years has disrupted Nigeria’s financial sector. However, the outbreak of the pandemic has highlighted a number of challenges that only the most innovative will surmount.

Nigerian fintech startup, OPay has added more verticals to its platform. With the termination of ORide in Lagos earlier this year, we address speculations about the startup’s survival and explore possible action plans

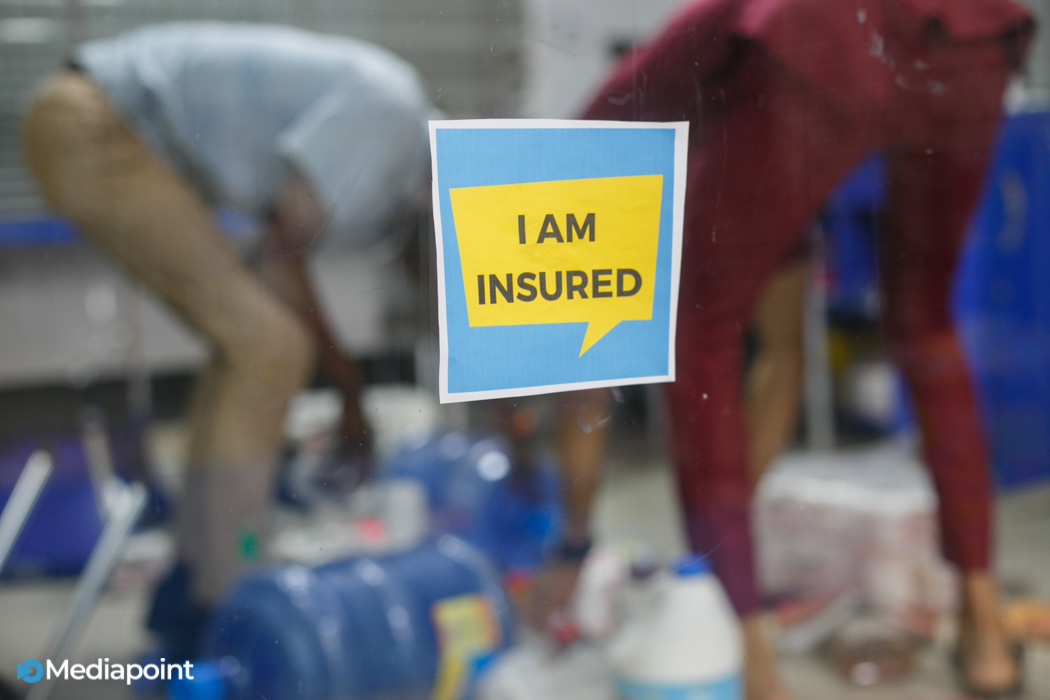

CBN’s guidelines for financial institutions require lenders to present loan insurance to borrowers. This means borrowers out of employment due to the pandemic can claim personal insurance, if they know about it.

Though remittances in Africa have been on the increase, as a result of the pandemic, sub-Saharan Africa is set to lose $9 billion in remittances in 2020. But could other factors yield positive results in the long run?

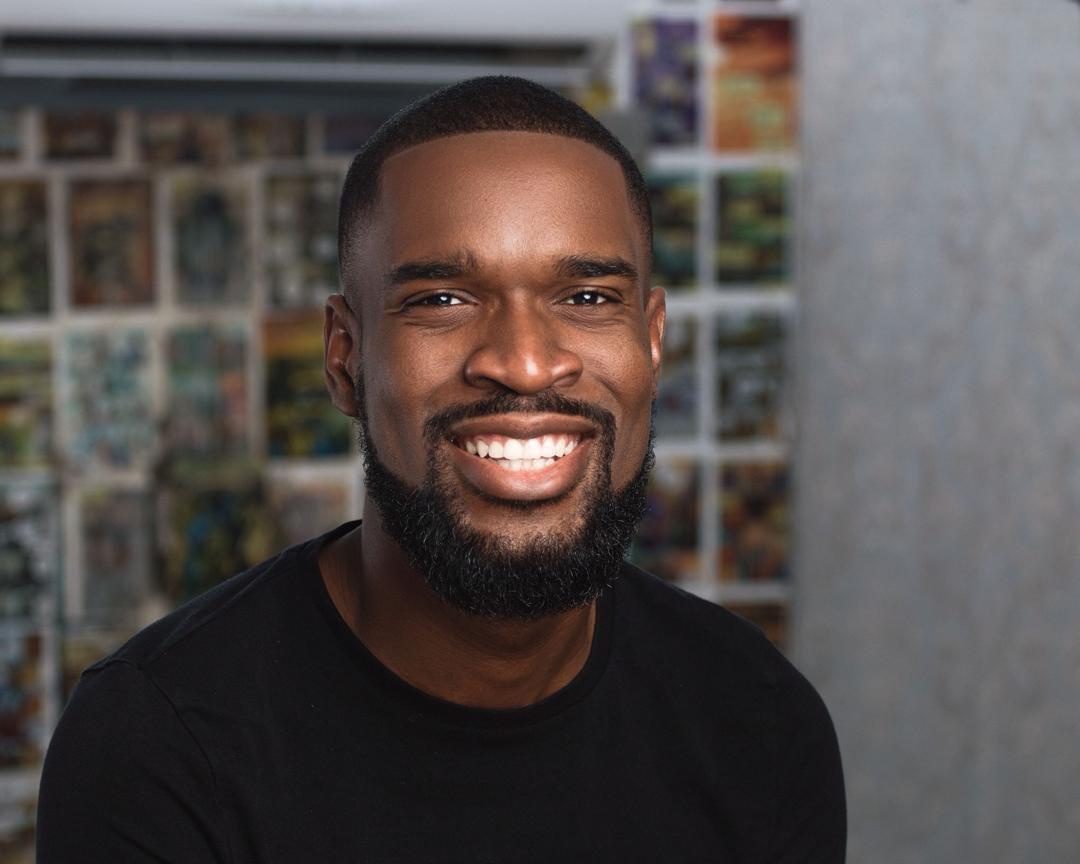

Launching officially today, Bundle will create a world where traditional fintech and open finance co-exist in parallel through the power of blockchain technology

In what could potentially be financially trying times for most individuals in Nigeria, we take a closer look at the activities of digital lenders and what it could mean for low and average income earners in Nigeria.

Team Digital came out tops in CBN and NIBSS backed fintech sandbox hackathon. We take a look at the solution that seeks to use soundwaves from mobile phones to ease last-mile payments for low-income earners in Nigeria.

Visa’s non-equity partnerships with African fintech startups could lead to future equity investments

Paga recently announced its partnership with Visa and while no investment was made in the Nigerian payments startup, Visa says it could happen down the line just as it did with Paystack, Flutterwave, and Interswitch.

With fintech startups, finance has evolved from analogue to digital. The next stage is decentralisation, enabled by the blockchain technology, and tech startups are gradually positioning themselves

Recent moves, such as open banking and sandbox initiatives, have been made to improve financial innovation in Nigeria. Based on recent studies, could they really be the answer to deepening financial inclusion?

Recent moves, such as open banking and sandbox initiatives, have been made to improve financial innovation in Nigeria. Based on recent studies, could they really be the answer to deepening financial inclusion?

In keeping with an increasing focus on Africa’s remittance market by financial players, Ecobank partners with Alipay in a move that could take the reach of its remittance platform to about 1.2 billion persons worldwide