Fintech

Top stories

Following an outage at the beginning of the year, Safaricom’s M-PESA service is currently down. Safaricom has yet to explain why the recent outage has inconvenienced millions of Kenyans.

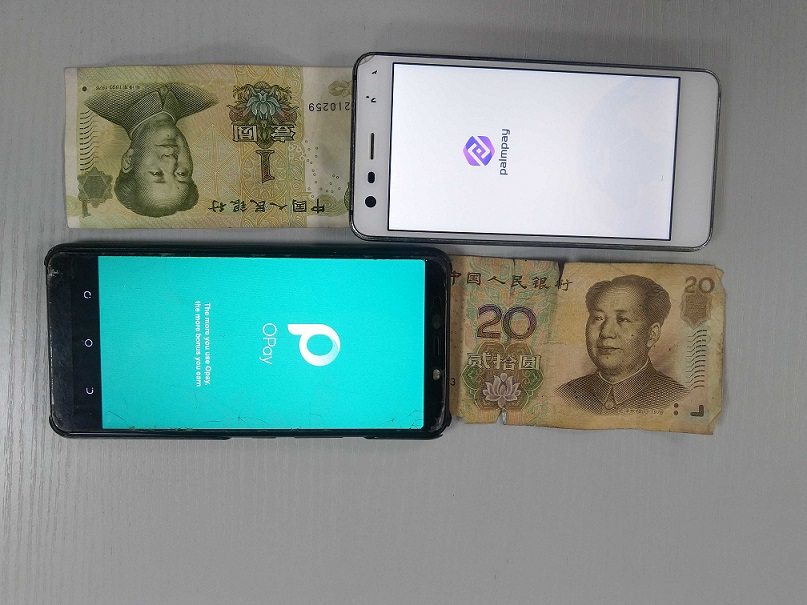

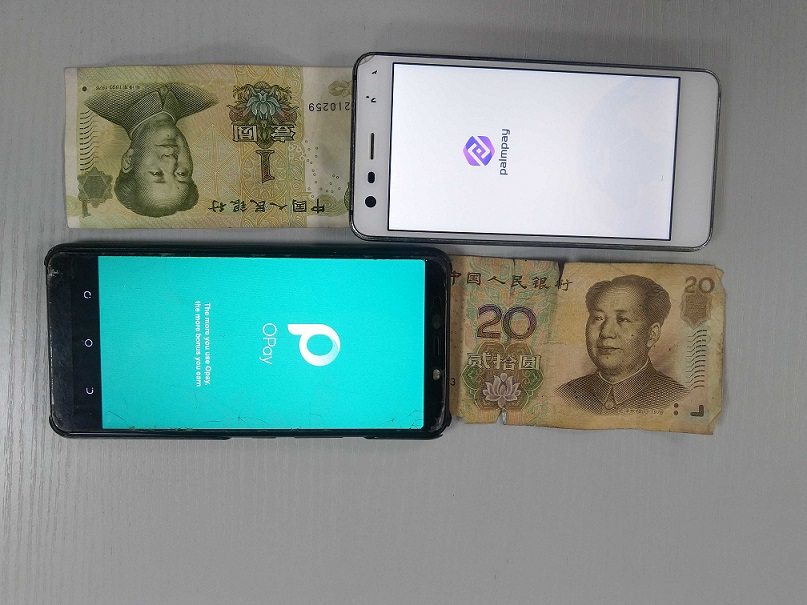

Interswitch has partnered with OPay to offer users a secure and streamlined payment solution via the Interswitch Payment Gateway.

Bank Zero, a South African neobank, is working on three new features, including Phone Tap Payments, which allows banks to integrate smartphone wallets for tap payments.

Paystack has introduced a new feature that allows Ghanaian merchants to transfer funds to local bank accounts. This is on top of the single or bulk transfers available to any mobile money wallet in Ghana.

Visa and the Ghana Interbank Payment and Settlement Systems (GhIPSS) have partnered to increase payment services and lower transaction costs in Ghana.

Several Egyptian banks have reportedly restricted their traveller customers to withdrawing only $50 in cash when they spend abroad.

TymeBank, a South African neobank, has reached profitability six months after it posted a loss of R858 million (~$45 million).

Starting February 2024, Coinbase wallet users in 20 African countries will be able to send USDC for free on any platform that allows them to share a link, such as WhatsApp, Telegram, and email.

MTN and Ericsson, a Swedish networking and telecommunications company, have strengthened their collaboration to enhance mobile financial services five years after they partnered to launch the Ericsson Wallet Platform throughout the MTN network.

Mastercard and Rawbank’s fintech arm, illicocash, have partnered to launch virtual cards in the Democratic Republic of the Congo to provide consumers and businesses with a new and convenient way to conduct eCommerce transactions.

Four years after launching the UnionPay card in South Africa, UnionPay International and Standard Bank intend to expand the service to several African countries.

Eight days following a cyberattack, the Central Bank of Lesotho has restored interbank transfers. Due to manual payment processing, the bank warned customers to expect delays.

Pezesha has submitted a petition to liquidate MarketForce, a troubled B2B eCommerce platform, due to “unpaid debts.” This fresh update follows MarketForce’s $40 million funding announcement in February 2022.

PalmPay has introduced a new security update, mandating new users to include their BVN or NIN numbers before creating a wallet. OPay also disclosed a new update to make it easier for users to authenticate BVN.

M-PESA plans to offer tap-to-pay card payments to customers 18 months after partnering with Visa to launch GlobalPay, a virtual card offering.

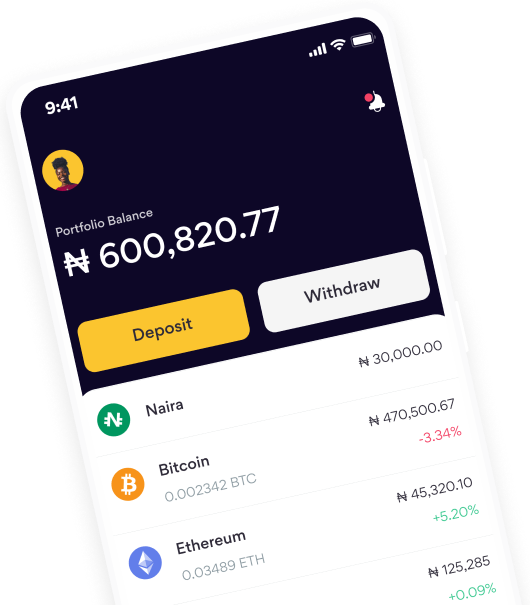

Fraudsters are exploiting loopholes in OPay and PalmPay, opening accounts with others’ identities. This alarming trend, raises urgent questions about fintech regulations and consumer safety in Nigeria’s digital finance sector.

Flutterwave hires six executives from Cash App, Paypal, Binance.US, and others a few days after it announced its acquisition of money transfer licences in 13 US states.

The Central Bank of Nigeria (CBN) has directed all financial institutions in the country to suspend the initial processing fees imposed on deposits above ₦500,000 for individual accounts and ₦3,000,000 for corporate accounts.

African fintech startup, Chipper Cash has laid off staff for the fourth time in a year. It says it is doing well and will be profitable in a few months.

Flutterwave has acquired money transfer licences for 13 states in the United States. This move will enable customers to have access to 29 states in the US.