Cryptocurrency

Top stories

Nigeria’s ₦2 billion capital requirement for crypto exchanges is meant to create a stronger crypto ecosystem, but it may end making foreign players stronger and local players weaker.

When Nigerian businesses struggle with broken payment rails, stablecoins are filling the gap. From iShowSpeed paying a jeweller with crypto to Breet launching a stablecoin API, digital dollars are becoming real infrastructure

Worldcoin has deleted all biometric data collected from Kenyans after a High Court ruled the project’s data practices unlawful.

Eric Annan bought bitcoin at $354, but after losing all his crypto earnings to failed businesses, the lessons he learned led him to build Aya HQ, one of Africa’s biggest Web3 incubation programmes.

Breet reveals the truth about P2P in Nigeria after analysing 20,000 related tweets and initiating over 100 trades on different platforms.

Flutterwave is set to begin stablecoin payments on the Polygon blockchain. The fintech will begin a pilot that will allow merchants to use USDC for cross-border transactions.

Nigerian crypto exchanges control only a small share of the local market, as international platforms and peer-to-peer (P2P) channels dominate nearly 90% of trading activity across the country.

85% of Nigerian crypto investors earn below ₦250,000 monthly. According to a new report, most crypto investors in the country are students, self-employed, and freelancers.

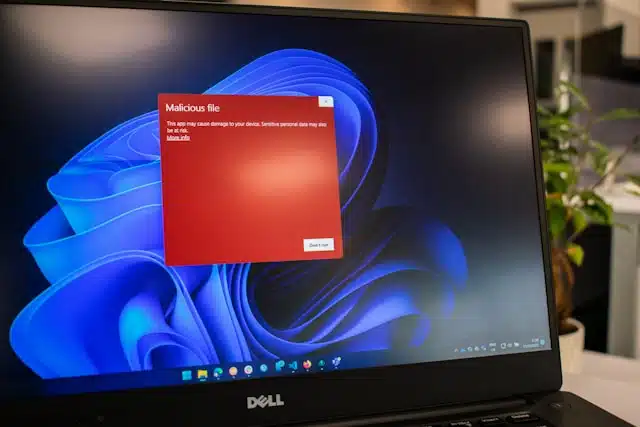

ModStealer is a new strain of malware that appears as a job ad, but can steal crypto from browser-based wallets. Here’s how it works an how to avoid it.

As Nigeria’s first regulated stablecoin, cNGN, expands in use and circulation, some experts are voicing concerns and criticisms.

Riyadh-based venture capital Adaverse recently invested in cNGN, Africa’s first regulated stablecoin project; Here’s why.

The Kenyan Government imposed a 10% excise duty on all crypto transaction fees by exchanges. Here is what Tax experts in Kenya think

ViFi Labs acquires OneRamp to tap a $540bn institutional stablecoin market across Africa and LATAM, positioning itself as the go‑to on‑chain FX venue.

In a little over two years, Zap Africa has processed over $17 million in crypto transactions and now generates $100,000 in monthly revenue. The founders share their journey and strategy.

Ghana plans to regulate crypto platforms by late September 2025, aligning with Africa’s broader move to bring digital assets into the formal financial system.

Seychelles has received the most blockchain funding in Africa over the past four years, accounting for 33% of the continent’s total blockchain funding in 2024, according to CV VC’s African Blockchain Report.

South Africans spend $112,000 monthly in crypto to buy everyday items, according to data from Luno Pay, highlighting the growing adoption of digital currencies for routine purchases

Since Nigeria’s SEC secured the Investment and Securities Act 2025, changing the way local crypto exchanges operate, proper regulatory oversight has gained favour with operators in the ecosystem.

Opera which owns 9% ($258 million) of OPay is officially launching a stablecoin app for Africans. Previously embedded in the Opera browser, the app already has 7 million users.

This post will cover how meme coins work, the reasons behind their sensation as crypto’s crazy bubble, how to trade, and cautions to take, as advised by successful meme traders.