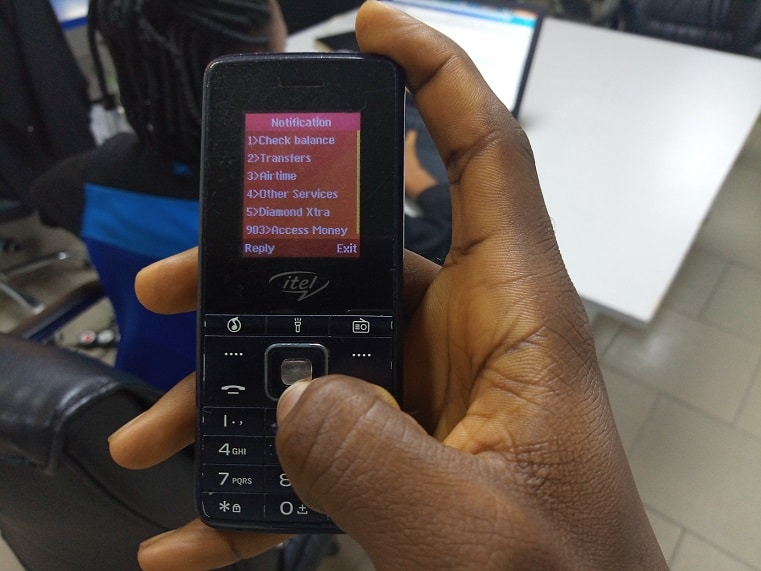

A few days ago, MTN Nigeria’s message stating it would begin charging ₦4 for every 20 seconds of Unstructured Supplementary Service Data (USSD) access to banking services beginning from October 21 went viral.

Y’ello @MartinsOdunayo , Thank you for reaching out. Kindly be informed that you will be charged N4.00 for all bank transactions using USSD codes. This is a directive from your various financial institutions. Kindly contact your bank for further inquiries. ~CA

— MTN Nigeria Support (@MTN180) October 21, 2019

In a swift response, the office of the Minister of Communications, Dr Isa Pantami, released a press statement saying he was unaware of such developments and immediately ordered the NCC to suspend the plan until the minister was fully briefed.

In another report, Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), also opposed the move by MTN, claiming it would hamper the CBN’s drive for financial inclusion.

Suggested Read: Why Payment Service Banks might not impact Nigeria’s financial inclusion drive

While these responses are seemingly in the interest of regular users of USSD channels, the story is still being told with half-truths, denials, and much finger-pointing.

First of all, charges for a bank’s USSD services — end-user billing — are not new and after a few rounds of enquiry from various users, Techpoint gathered that while MTN has been granting users free access, other telcos have been charging users for access to USSD services.

Some Airtel users reported that they have always been charged ₦15 for every transfer, whether successful or not. 9mobile users also reported a ₦20 charge for each transaction, while Glo currently charge ₦5 per session for USSD services.

MTN is still far better that Airtel, Glo, etc combined. MTN sneezed (USSD CHARGES) and all Nigerians caught cold last week, the same sneeze that has been troubling Airtel for years( Airtel has been charging for USSD for years). No one cared!

— MajaSaint (@majasaint) October 23, 2019

According to the NCC’s USSD pricing plan, that took effect on September 1, 2019, telcos are entitled to charge a minimum of ₦1.63 and a maximum of ₦4.86 for a 20-second USSD session.

While the document does not indicate who should bear the cost of these charges, it enjoins digital financial services providers and regulators to ensure fair pricing to the benefit of the consumer and other parties involved.

It is therefore unclear why the FG was swift to halt MTN’s proposed plan when it is in fact backed by the NCC’s latest regulation and other telcos already charge customers.

In a seemingly hands-off manner, MTN stated that the move to charge customers was made at the request of the banks.

On October 21, 2019, the Body of Bank CEOs released a press statement, categorically denying the message. They asserted that, just like charges for calls and SMS, the decision to charge for USSD services was the sole prerogative of the telcos.

Suggested Read: Seemingly driven by fear, Nigerian banks have become everyone’s competition

However, the story gets weirder in a letter from the Association of Licensed Telecommunications Operators of Nigeria (ALTON) dated October 18, 2019 — a day before the viral text message was sent.

Apparently a reply to previous correspondence from the Body of Bank CEOs, the letter indicated that the banks demanded implementation of end-user billing by telcos as against the corporate level billing requiring banks to pay ₦4.50 per USSD session.

The telcos, on the other hand, insisted that this would be the same as a bank asking its customers to pay an access fee to its landlord before entering the bank premises. Also pointed out is the fact that the USSD price of ₦4.50 represents only 9% of the ₦50 banks typically charge for a transaction.

Though so far it seems MTN has heeded the directive of the communications minister and has not implemented the USSD charge, a lot is still up in the air.