Sälemetsiz be,

Victoria from Techpoint here,

Here’s what I’ve got for you:

- Ethiopia’s cheap data era faces reality check

- Flutterwave acquires Mono

- Netflix, Bolt, Starlink hit by new Zimbabwe tax

Ethiopia’s cheap data era faces reality check

In this new year, mobile users in Ethiopia have started paying more for data, and both operators are pointing to the same culprit: the economy. Ethio Telecom and Safaricom Ethiopia have announced tariff increases, pointing to the same pressures: a weaker birr, rising costs, and the heavy price of expanding and maintaining nationwide networks. It’s a shift that signals a tougher phase for a market that has enjoyed falling data prices in recent years.

Safaricom Ethiopia’s increase has drawn the most attention. The operator announced an average 44% hike in mobile data prices, its most aggressive pricing move since launching in Ethiopia two years ago. While the company says the change is about long-term sustainability, the move has sparked public backlash, especially from students, freelancers, and small businesses that rely heavily on mobile Internet.

Much of the strain comes from Ethiopia’s decision to let the birr float freely in mid-2024, triggering a sharp depreciation. That has hit telecom operators hard, particularly Safaricom, which earns revenue in birr but pays a large share of its costs in dollars. The company says about 85% of its capital spending and roughly half of its operating costs are foreign-currency denominated.

Ethio Telecom, meanwhile, has framed its own adjustment as modest and protective. The state-owned operator says dozens of commonly used low-value data bundles remain unchanged, including small ETB 1, ETB 2, and ETB 5 packages. Special bundles for students, teachers, and people with disabilities were also left untouched, while discounts on telebirr data purchases were increased to 20%.

The contrast has sharpened the debate around affordability. Industry data shows Ethiopia’s entry-level mobile broadband prices have fallen sharply over the past six years and now sit near global affordability benchmarks tied to income levels, largely due to Ethio Telecom’s earlier tariff cuts. That progress expanded access and digital inclusion, making any price rise especially sensitive.

Still, operators say reality is catching up. Safaricom reports narrowing losses in Ethiopia and aims to break even by March 2027, after growing its customer base to 11.1 million users. Ethio Telecom, with about 86 million subscribers, remains the backbone of Ethiopia’s digital economy. For policymakers and consumers alike, the question now is how to balance sustainability with affordability as telecom reform enters a more difficult phase.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Flutterwave acquires Mono

For a while now, African fintech exits have been few and far between. That’s why Flutterwave’s quiet acquisition of Nigerian open banking startup Mono is turning heads. The deal, completed in December 2025 but only just made public, is one of the more notable fintech exits on the continent in recent years.

Per TechCrunch, the acquisition was structured as an all-stock deal. While neither company disclosed exact numbers, Mono CEO Abdulhamid Hassan told Techpoint Africa the value is well above the $17.5 million the company raised since launching in 2019, a solid outcome for early backers in a tough funding climate.

Mono, which is backed by Y Combinator, built APIs that let businesses access bank data and initiate account-to-account payments. Often described as Africa’s answer to Plaid, the startup became a key piece of Nigeria’s open banking story, serving fintechs, lenders, and digital platforms. Investors, including Ventures Platform, Voltron Capital, and Ingressive Capital are now seeing rare liquidity.

For Flutterwave, the deal is about infrastructure. By bringing Mono into the fold, the payments giant gets direct access to the open banking layer, increasingly critical for credit scoring, lending, and real-time payments. CEO Olugbenga “GB” Agboola says the acquisition will help Flutterwave build more inclusive financial products by improving how businesses use financial data.

Mono will continue operating as a standalone product, but with bigger ambitions. The startup plans to launch a treasury management tool in 2026, allowing businesses to manage multiple bank balances in one place. Hassan says Mono has already connected about eight million bank accounts, giving it deep insight into how consent-driven financial data can power new enterprise tools.

The deal also fits into a broader trend. African fintechs are increasingly acquiring specialised startups, from Moniepoint’s move for Kopo Kopo to Rivvest buying Kenya’s Hisa, as they defend market position and expand capabilities. For Mono, Flutterwave’s scale across 35+ countries’ licences could be the boost open banking needs to move from promise to infrastructure across Africa.

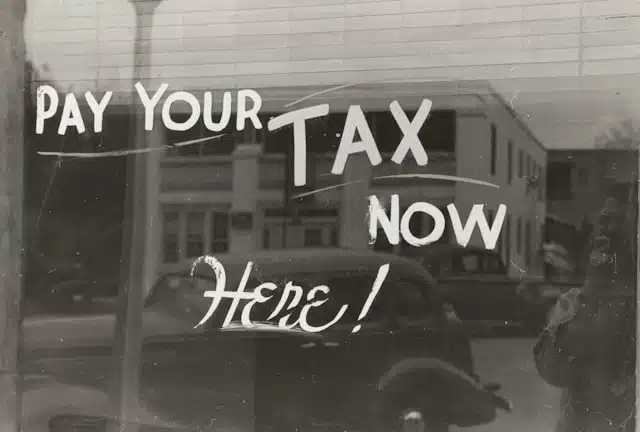

Netflix, Bolt, Starlink hit by new Zimbabwe tax

Paying for Netflix, Starlink, or ride-hailing apps in Zimbabwe just got more expensive. From January 1, 2026, the government began applying a 15% digital services withholding tax on payments made to foreign digital platforms, targeting a fast-growing part of the economy that has largely operated outside the local tax net.

The new tax applies to multinational digital service providers such as Netflix, Starlink, InDrive, and Bolt, among others. Rather than chasing the companies directly, Zimbabwe is placing the responsibility on banks and payment processors, which must now deduct the tax at the point of payment before the money leaves the country.

Banks have already started notifying customers. Stanbic Bank, for instance, sent text messages to depositors on January 3 confirming that the tax had taken effect under the 2026 Finance Act. The bank said the 15% levy is charged on the gross value of each transaction, ensuring offshore providers are paid in full while the tax portion is retained locally.

The policy reflects a broader push by the government to keep up with the digital economy. Finance minister Mthuli Ncube has argued that offshore platforms can now supply services directly to Zimbabweans from streaming and satellite Internet to e-hailing and online advertising without setting up a physical presence in the country.

Authorities say these companies earn significant revenue from local users and should contribute to the tax base like traditional businesses. For consumers, however, the change likely means higher prices or smaller balances when paying for digital services, another reminder that governments across Africa are moving quickly to tax the digital economy as it grows.

In case you missed it

- Sora raises $2.5 million additional seed to eradicate malaria in Africa with AI-powered drones

What I’m watching

- In Praise of Nice People

- What Expiration Dates REALLY Mean (It’s NOT What You Think!)

Opportunities

- Don’t Miss the Africa Business Convention (ABC) 2026. It’s Africa’s #1 Business Conference & Investment Expo. Book your seat today here.

- Moniepoint is hiring for over 100 roles. Apply here.

- We’re hosting a debate on AI in daily life. Join us to share your insights and perspectives.

- Techpoint Africa is creating a video series where people discuss and debate policies and current events. If you enjoy thoughtful conversations, fill out this form. Apply here.

- Are you building a startup can feel isolating, but with Equity Merchants CommunityConnect? You can network with fellow founders, experts, and investors, gaining valuable insights and exclusive resources to help you grow your business. Click here to join.

- Help us make Techpoint better for you! Your feedback shapes what comes next (your responses may potentially save my job. A bit dramatic, but still). It will only take 30 seconds to tell us what works and what doesn’t. Fill it here.

- To pitch your startup or product to a live audience, check out this link.

- Have any fresh products you’d like us to start selling? Check out this link here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a lovely Tuesday!

Victoria Fakiya for Techpoint Africa