Bok,

Victoria from Techpoint here,

Here’s what I’ve got for you today:

- Mauritania slams telcos over poor service

- Rayda ditches asset tracking, goes all-in on sourcing

- PayU Kenya shuts down after six years

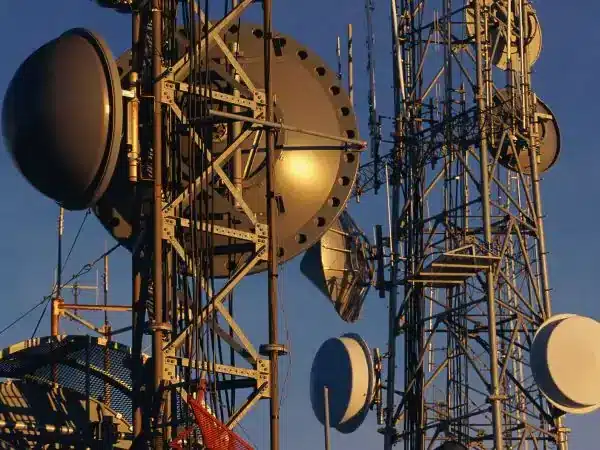

Mauritania slams telcos over poor service

Mauritania’s telecom watchdog is once again calling out the country’s three operators — Chinguitel, Mauritel, and Mattel — for failing to meet quality standards on voice and data services. Despite past fines and penalties, service levels remain poor, and the regulator has now issued a fresh formal notice giving them 30 days to fix things.

The latest warning follows an inspection carried out between July and August, which flagged network shortcomings in 62 cities, several localities, and 11 major roads. The findings were damning: Mattel struggled with voice services in 24 cities and 4G in 22; Mauritel had gaps in 24 cities for voice and even more for 3G and 4G; while Chinguitel fared worst, with failures recorded in dozens of localities across all services.

This isn’t the first time Mauritania’s Autorité de régulation (ARE) has taken action. In January, Chinguitel was singled out after 162 of its sites went dark for days. Back in November 2024, all three operators were slapped with heavy fines running into hundreds of millions of ouguiyas, along with temporary cuts to their 2G, 3G, and 4G licences.

And it’s not just Mauritania. In August, Chad’s regulator issued similar warnings to local operators over patchy service quality, while in Zambia, the ICT authority has also been on the operators’ necks, commissioning new towers and reminding telcos to deliver reliable coverage. Across the region, regulators are clearly stepping up pressure to push for better connectivity.

Operators, on the other hand, say they’re making moves. Mattel wrapped up a major two-year network expansion last year, while Moov announced a $35 million investment plan to upgrade its systems. But for regulators like ARE, those promises mean little if customers are still dealing with dropped calls and weak Internet.

Industry groups like the GSMA caution that some regulatory targets may be unrealistic and could even discourage investment. They’re calling for co-regulation — more collaboration and transparency between regulators and operators — to set fair goals, track improvements publicly, and reward the companies that actually deliver.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Rayda ditches asset tracking, goes all-in on sourcing

When Francis Osifo worked at 54gene, a simple laptop purchase turned into a nightmare. Buying one in Kenya was too pricey, so the team ordered from Nigeria and shipped it over. That laptop sat in customs for two months, racking up costs and stress. By the time it was released, it would have been cheaper to buy it locally. That was Osifo’s first taste of how hard it was for startups with global teams to get IT equipment where it was needed.

After leaving 54gene in 2022, Osifo set out to solve the problem. He launched Rayda, initially as a fixed asset management platform to help companies track and manage their devices. Startups like Curacel, Mira, and Ajocard signed up, bringing in about $15,000 a month. But convincing firms to ditch Excel sheets was an uphill battle.

Then came Nigeria’s naira devaluation in 2023, and everything changed. Revenue in naira was growing, but when reported in dollars — the only number investors really cared about — it was shrinking fast. Clients were also cancelling or missing payments as their own costs ballooned. Rayda needed a new playbook.

By mid-2024, the startup doubled down on marketing and SEO. Soon, inquiries started flowing in from the UK and US, companies asking Rayda to help manage physical assets beyond just laptops. The big break came when a fintech needed to send a laptop to a Nigerian hire. Their supplier quoted $3,000 and a 12-week wait. Rayda got it done in two days, at 60% less.

From there, the pivot became clear. Rayda dropped everything else and went all-in on global equipment sourcing. Requests from Binance, Semrush, and others followed, and the company began shipping devices to employees in Nigeria, South Africa, and beyond.

Today, Rayda positions itself as the go-to partner for global companies with distributed teams. It helps them buy, store, manage, and recover IT equipment across multiple countries. And that first fintech client? They’ve now used Rayda to deploy devices in eight countries. But how does the startup work? Find out in Chimgozirim’s latest for Techpoint Africa.

PayU Kenya shuts down after six years

PayU Kenya is shutting down after six years in the market. The company has officially gone into liquidation and appointed Sonal Tejpal as the liquidator from August 19, 2025.

The move, filed under Kenya’s Insolvency Act and announced in a local paper, means Tejpal will now oversee the winding up of the firm’s operations and clear any pending liabilities.

PayU first entered Kenya in 2019 through a partnership with local fintech Cellulant. That deal gave the global payments company access to mobile money, card, and bank transfer options for online merchants.

At launch, PayU pitched itself as a bridge for global merchants eyeing the East African market. Backed by Cellulant’s local expertise, the partnership was seen as a strong play in Kenya’s fast-growing digital payments space.

But despite securing licences and setting up shop, PayU never really gained ground. Kenya’s payments sector remains dominated by mobile money giants, leaving little room for new players to scale.

The company hasn’t explained the reasons for its exit, nor is it clear if the decision ties into a wider global shake-up by its parent firm, Prosus. For now, creditors and interested parties have been invited to file claims under the ongoing liquidation process.

In case you missed it

- Meet mPharma’s new CEO, Kwesi Arhin

What I’m watching

- How to Talk to ANYONE (Once You Know Their Color!)

- Warren Buffett’s Most Iconic Lecture EVER (MUST WATCH)

Opportunities

- Businessfront, the parent company of Techpoint Africa, is hiring a Sales Associate. Apply here.

- Businessfront, the parent company of Techpoint Africa, is looking for a Managing Editor (FMCG). Apply here.

- Flutterwave is hiring for several roles. Apply here.

- Paystack is recruiting a performance marketing specialist in Nigeria. Apply here.

- Kuda is hiring for several roles. Apply here.

- Kuda Technologies is hiring a Legal Counsel. Apply here.

- FairMoney is looking for a Head of Business Banking Product. Apply here.

- Moove is recruiting a Customer Success Executive. Apply here.

- Ecobank Nigeria is hiring a Chief Information security officer. Apply here.

- The Institute of African and Diaspora Studies at the University of Lagos is looking for a Junior Research Fellow. Apply here.

- MTN Nigeria is hiring an Operational Risk Specialist. Apply here.

- Co-Creation HUB (CcHUB) Nigeria is looking for a Head of Communications. Apply here.

- Group Vivendi Africa is hiring an IT Manager. Apply here.

- Sun King is hiring across different states in Nigeria. Apply here.

- Paystack is hiring for several roles in Nigeria and South Africa. Apply here.

- Paga is recruiting for several positions. Apply here.

- Moniepoint is hiring for several positions. Apply here.

- Are you building a startup can feel isolating, but with Equity Merchants CommunityConnect, you can network with fellow founders, experts, and investors, gaining valuable insights and exclusive resources to help you grow your business. Click here to join.

- Help us make Techpoint better for you! Your feedback shapes what comes next (your responses may potentially save my job. A bit dramatic, but still). It will only take 30 seconds to tell us what works and what doesn’t. Fill it here.

- To pitch your startup or product to a live audience, check out this link.

- Have any fresh products you’d like us to start selling? Check out this link here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a wonderful Wednesday!

Victoria Fakiya for Techpoint Africa