Buongiorno,

Victoria from Techpoint here,

Here’s what I’ve got for you today:

- Senegal’s Teranga goes regional with fresh $3.4M in the bag

- Complete Farmer exports Africa’s harvest

- African startups bounce back in April with $343M

Senegal’s Teranga goes regional with fresh $3.4M in the bag

Senegal’s Teranga Capital just bagged about $3.4 million (CFA 2 billion) to expand beyond its home turf. The private equity firm wants to spread its wings into Mauritania, Guinea-Bissau, and Cape Verde as it eyes overlooked markets in Francophone West Africa. This is the first close of a bigger CFA 5–6 billion fundraising round, and more money could be on the way.

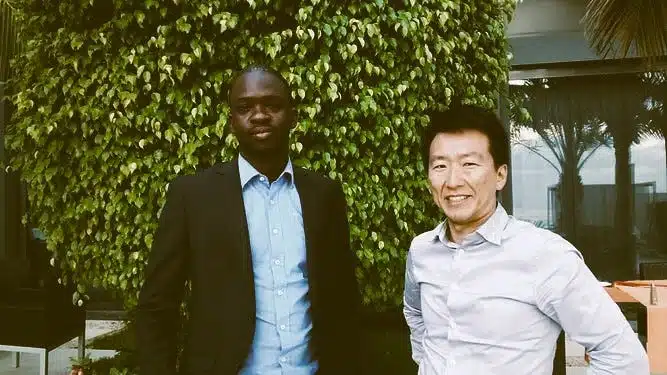

Leading the investment round were a mix of old and new faces: Senegal’s sovereign wealth fund FONSIS, I&P’s IPDEV2 fund, the firm’s co-founders Olivier Furdelle and Omar Cissé, and international supporters like the Dutch-funded CFYE and individual investor Julie Dumortier.

The new funds come after a March shareholder meeting where Teranga got the green light to scale up. It’s now allowed to write bigger cheques, up to CFA 1 billion (about $1.7 million), to support the rising needs of small and medium businesses. It’s also planning to back some of its star portfolio companies for a second time.

Since launching in 2016, Teranga Capital has made a name for itself as one of the few local investors focused on early-stage businesses in Senegal. Its portfolio spans agribusiness, health, and logistics, with a mix of equity and hands-on support. Now it wants to take that model to neighbouring frontier markets.

Teranga’s expansion strategy is bold, especially given how tricky these markets can be. Regulatory headaches, poor infrastructure, and limited exit options are real risks in places like Guinea-Bissau and Mauritania. But Teranga’s team believes its deep local roots and close ties with founders can help it navigate the rough spots.

With fresh cash in the bank, the firm expects to start looking for deals in new markets by the end of 2025. No word yet on when the second close will happen, but they’re already talking to more investors. If they pull it off, Teranga could inspire more small funds to explore Africa’s lesser-known business hubs.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Complete Farmer exports Africa’s harvest

I’ve been hearing since junior school that agriculture is the bedrock of African society, and honestly, it never gets old. It’s still true. Agriculture is what keeps many African economies running, putting food on tables and cash in pockets. It employs over 60% of the continent’s workforce and contributes a huge chunk to GDP in several countries. In Ghana, for instance, agriculture makes up 54% of the country’s GDP and employs more than half the labour force.

But for a sector this important, it faces a tonne of issues. Climate change is messing with harvests, tech and infrastructure are lagging, and access to profitable markets is still a major headache for many farmers. That’s where Ghanaian startup Complete Farmer is stepping in, trying to bridge those gaps and help farmers make more money and grow their businesses.

Complete Farmer has been around for about eight years now, and the mission is clear: give African farmers better access to markets and the tools they need to farm smarter. It all started with Desmond Koney, the founder and CEO, who had dreams of becoming a mechanical engineer. But life had other plans. After his dad passed, he inherited the family farm, and that’s where the seed for Complete Farmer was planted.

Desmond’s initial plan was to digitise the farm, but like many startups, things didn’t go exactly as planned. He told TechCrunch that the business went through several versions before settling on what it is today. And that meant figuring out everything from the right product to the most viable business model. It wasn’t a straight road, but the goal remained the same: use tech to help farmers win.

Now, Complete Farmer operates as a global platform connecting African farmers with international buyers. They also make sure these farmers have access to the right seeds, tools, and knowledge to get maximum yield. It’s more than just growing crops; it’s about growing wealth and resilience for smallholder farmers across Africa.

Want to know how a Ghanaian farm boy ended up building a tech-driven marketplace that’s changing African agriculture? Read Chimgozirim’s full story for Techpoint Africa.

African startups bounce back in April with $343M

After a slow March, Africa’s startup scene bounced back big time in April 2025. Over 39 startups raised a combined $343 million, way up from the $50 million pulled in just a month earlier. It’s the kind of rebound that turns heads.

To give some context, January saw startups on the continent raise $289 million, February brought in $119 million, and then March dipped to $50 million. But April’s surge brings the year-to-date total to $803 million across 163 deals, a solid 43% jump from the $563 million raised during the same period last year.

One of the headline deals came from South Africa’s hearX, which merged with US-based Eargo in a move worth $100 million. It’s one of the largest African startup deals so far this year and shows how cross-border mergers are starting to play a bigger role in the funding story.

Egypt also made waves with Bokra, a young Islamic fintech platform that raised $59 million through a sukuk issuance, pretty rare for a startup just a year after its pre-seed. Meanwhile, South Africa’s Stitch pulled in $55 million from its existing investors, signalling strong belief in its payment infrastructure plans.

There were also some noteworthy acquisitions: Egypt’s ADVA was scooped up by Maseera, Nigeria’s Bankly got acquired by C-One, and South Africa’s Peach Payments was bought by PayDunna as part of its expansion into Francophone West Africa.

While South Africa and Egypt led the charge, Nigeria and Kenya were unusually quiet in April. Kenya, which topped 2024’s charts with $638 million in funding, saw a particularly low month. Still, the April uptick signals that investor confidence in African startups is climbing again, with local and diaspora-backed funds getting more active.

In case you missed it

- MTN and CSCS launch *7270# USSD code to make stock trading accessible

What I’m watching

- Why people are falling in love with A.I. companions | 60 Minutes Australia

- What If It Rains Bananas For A Day?

Opportunities

- Pitch Friday is this Friday, May 9, 2025. Register here to attend.

- Want to exhibit or attend the Lagos Startup Expo in June? Visit this website here.

- OmniRetail is hiring an Account Manager. Apply here

- Airtel is looking for a Business Solutions Manager. Apply here.

- Building a startup can feel isolating, but with Equity Merchants CommunityConnect, you can network with fellow founders, experts, and investors, gaining valuable insights and exclusive resources to help you grow your business. Click here to join.

- Help us make Techpoint better for you! Your feedback shapes what comes next (your responses may potentially save my job. A bit dramatic, but still). It will only take 30 seconds to tell us what works and what doesn’t. Fill it here.

- To pitch your startup or product to a live audience, check out this link.

- Have any fresh products you’d like us to start selling? Check out this link here.

- Flutterwave is hiring to fill in several positions. Apply here.

- Paystack is hiring for several roles. Apply here.

- Moniepoint is hiring for several roles. Apply here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a wonderful Wednesday!

Victoria Fakiya for Techpoint Africa