African (especially Nigerian) fintechs have not been able to catch a break for some weeks now. From Flutterwave being embroiled in several controversies to virtual card shutdowns, being a fintech founder is becoming a hard job.

Today on the Techpoint Africa podcast, we discuss the virtual dollar card shutdown by many African fintechs and fraud charges against two Nigerian fintechs in Kenya.

But before we went into the trials of fintech founders, we talked about MTN’s plan to acquire its rival, Telkom, in a $1 billion deal.

If the deal pulls through, MTN gets access to Telkom’s fibre assets. Oluwanifemi went on to reveal that the assets could help MTN achieve its 5G dreams. However, the deal could give MTN an unfair competitive advantage, creating a telecoms duopoly in South Africa.

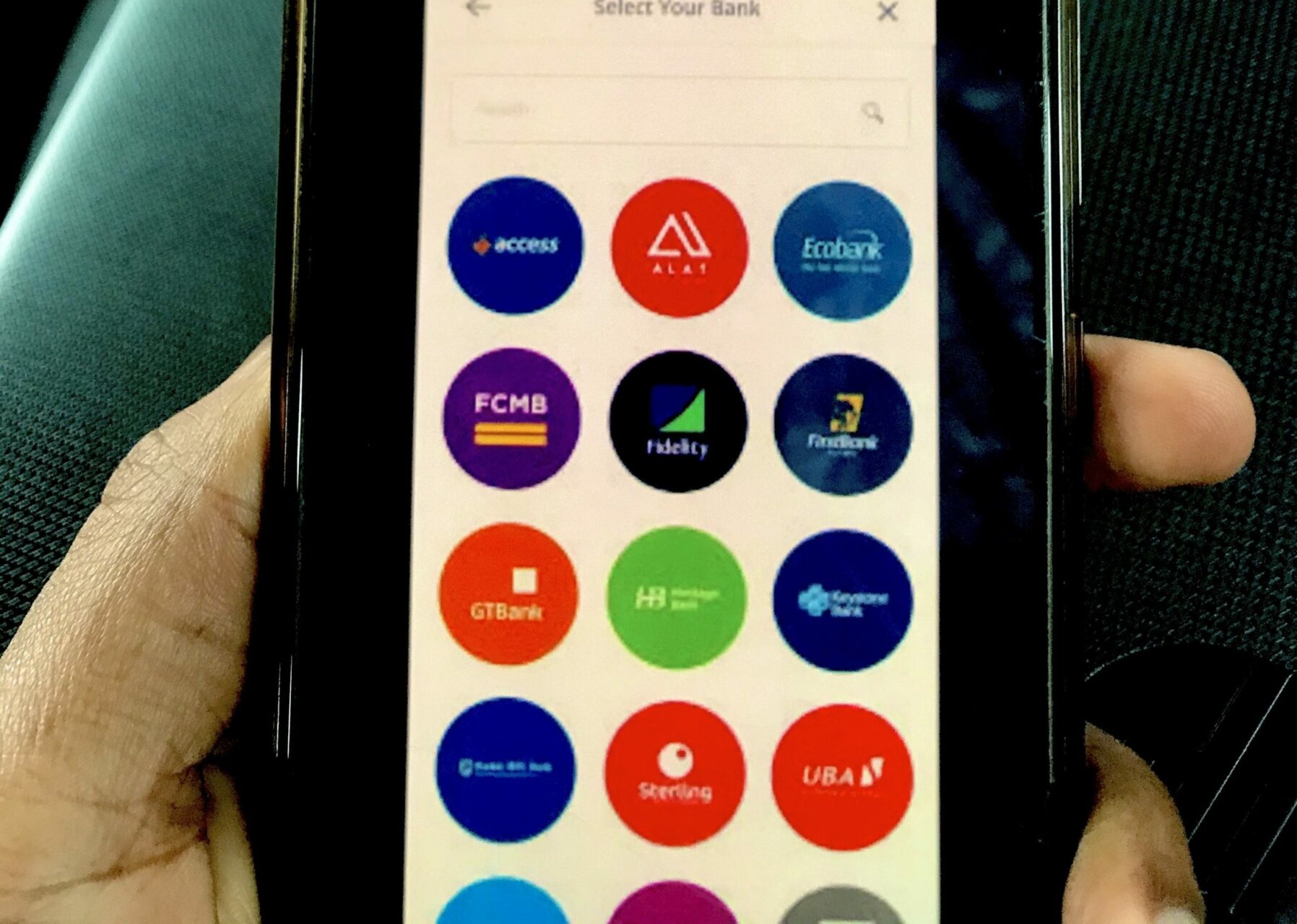

From MTN’s plan to rule telecoms in South Africa, Chimgozirim reveals discussed why some African fintechs are suspending their virtual dollar card service.

According to him, their card partner — Unioin54 — which facilitated this service for them had to suspended the system due to chargeback fraud.

In other fraud related stories, a Kenyan court has frozen the accounts of two fintech companies, , Korapay Technologies Limited and Kandon Technologies Limited for allegedly laundering $51 million into Kenya.

We discussed in the details why these issues are befalling fintechs and Oluwanifemi had a special advice for fintech founders.

You can listen to our discussion on Google Podcasts, Apple Podcasts, and Spotify. You can also email us at podcast@techpoint.africa or tweet at us with the hashtag #TechpointAfricaPodcast.