Nigeria’s economy is predominantly cash-based, but there have been encouraging signs of a cashless drive with the gradual adoption of e-payment channels according to figures from the Nigerian Interbank Settlement System (NIBSS).

In 2018, NIBSS recorded 729.4 million instant payment transactions (PDF) valued at ₦80.4 trillion ($223 billion) compared to 370.9 million transactions (PDF) in 2017 with a value of ₦56.2 trillion ($156 billion). This shows a 96% increase in volume and a 43% increase in the value of instant payment transactions.

Suggested Read: Recent figures from NIBSS reveal Nigeria is still largely a cash-based economy

Interestingly, the average daily usage increased by 96% from 1.016 million in 2017 to 2million in 2018.

Strangely enough, an increase in the use of e-payment channels does not seem to have translated to a reduction in the use of cash. Contrarily, the amount of cash in circulation and the cost of production are on the increase.

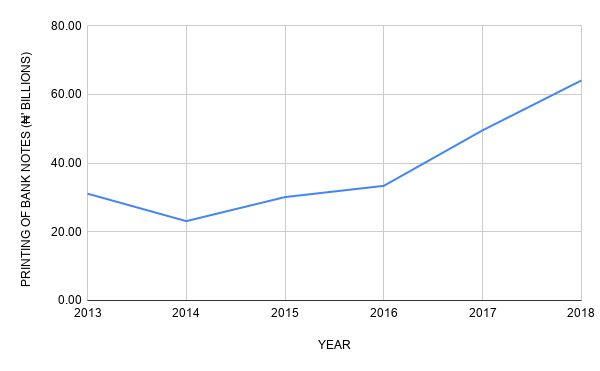

According to the 2018 annual report by the Central Bank of Nigeria (CBN) Currency Operations Department, the apex bank procured about 3.35 billion banknotes in 2018, 25.3% more than 2.67 billion in 2017. An extra cost of ₦14.52 billion ($38.6 million) was incurred as the cost of production went up from ₦49.5 billion ($136.6 million) in 2017 to ₦64.04 billion ($176.8 million) in 2018.

Since 2011, the CBN has issued a number of cashless policy directives in line with its vision for a cashless economy by 2020. A popular example was the directive for banks to charge fees on cash deposits and withdrawals exceeding a certain threshold.

In 2013, the apex bank, in its Nigeria Payments System Vision 2020, clearly stated that Nigeria has witnessed impressive growth in the use of electronic payments and a move from the dominance of cash as a means of payment.

However, current figures do not seem to agree with that statement or NIBSS’ records as between 2013 and 2018, the sheer volume of cash and the accompanying costs of producing it has been on the increase with the exception of 2014 which saw a noticeable dip.

There were also significant increments in the cost of distributing currency which went up from ₦4.1 billion ($11.3 million) in 2017 to ₦5.7 billion ($15.7 million) in 2018 while currency disposal increased from ₦594 million ($1.6 million) to ₦662 million ($1.8 million).

Adoption of e-payment channels are poised for an increase in 2019 but it appears the CBN needs a rethink on its cashless society project. Let’s hear your thoughts.