Wealth in South Africa has a long memory. You can trace it through the mines of Kimberley, the retail shelves of every major city, and the shifting ownership of banking institutions. It’s woven into land deals, luxury goods, and, lately, into tech and green energy plays.

Some fortunes began over a century ago. Others took shape only in the last two decades. But whether it started with gold, diamonds, or data, the numbers today speak for themselves.

The richest individuals in South Africa don’t just appear on rich lists. They influence boardroom decisions, shape job markets, and direct major investments across the continent.

This list gives you the ten biggest players in terms of personal net worth in 2025. But it also shows the industries behind them, the moves they’ve made, and what their wealth tells us about South Africa right now.

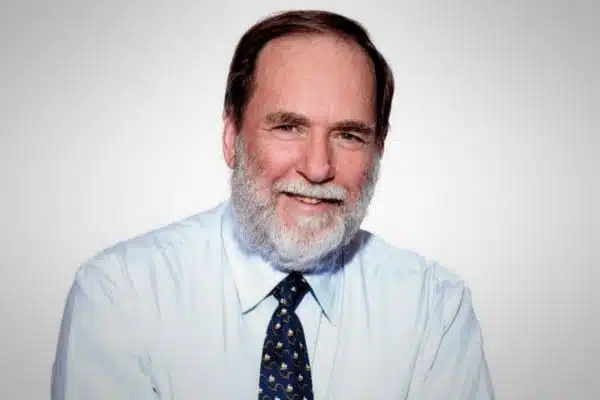

1. Johann Rupert

Net Worth (2025 estimate): US $15–18 billion

Johann Rupert is the chairman behind one of the world’s largest luxury conglomerates, Compagnie Financière Richemont—home to Cartier, Montblanc, Jaeger-LeCoultre, and more. His net worth hovers between $15.2 billion (Forbes) and $17.7 billion (Bloomberg), with substantial jumps in early 2025 due to Richemont’s stock rally.

Born in Stellenbosch on 1 June 1950, Rupert inherited a strong commercial foundation from his father, Anton Rupert, who built the Rembrandt Group in the 1940s. After studying economics and law at Stellenbosch University, Rupert moved to New York for banking experience, working at Chase Manhattan and Lazard Frères before returning home to establish Rand Merchant Bank and eventually take leadership of the family empire.

In 1988, Rupert spun off the European assets into Richemont, which is now a staple on the SIX Swiss Exchange, generating nearly €20 billion in annual revenue. Besides Richemont, he chairs Remgro and Reinet Investments, diversified holdings including stakes in healthcare, banking, and tobacco.

Despite immense wealth, Rupert is known for his low-profile approach. He famously donates all his board salaries to charity, supports universal basic income, and actively opposes fracking on his Karoo land. His influence stretches from corporate boardrooms to conservation and sports philanthropy.

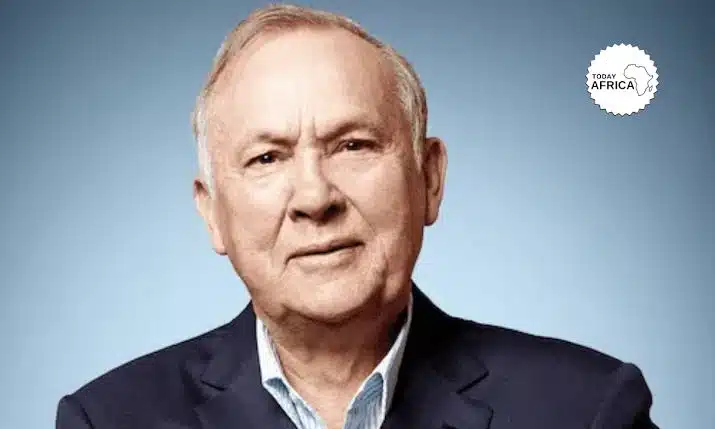

2. Nicky Oppenheimer

Net Worth (mid‑2025 estimate): US $10.5–11 billion

Nicky Oppenheimer inherited one of Africa’s most iconic fortunes. His family controlled De Beers, the world’s dominant diamond company for nearly 80 years. In 2012, he sold their 40% stake to Anglo American for approximately US $5.1 billion. Since then, his net worth has hovered around $10–11 billion, placing him as South Africa’s second-richest individual.

Born on 8 June 1945 in Johannesburg, Oppenheimer attended Harrow School before earning an MA in Philosophy, Politics, and Economics from Christ Church, Oxford. He joined Anglo American in 1968, became deputy chairman in 1983, and in 1998 took the helm of De Beers. There, he steered the company away from its once near-monopoly and helped initiate the Kimberley Process in 2003 to eliminate conflict diamonds.

Since stepping back in 2012, Oppenheimer has focused on strategic private investments. He co-founded Stockdale Street and Tana Africa Capital, putting money into African, Asian, and global ventures. He also launched Fireblade Aviation in 2014, offering VIP charters from Johannesburg.

A passionate conservationist, he and his son own at least 720 square miles of land across South Africa, Botswana, Zimbabwe, and Mozambique. They operate the Tswalu Kalahari reserve and run the Brenthurst Foundation, which supports economic development and education on the continent.

3. Ivan Glasenberg

Net Worth (mid‑2025 estimate): US $9–9.5 billion

Ivan Glasenberg built much of his wealth through Glencore, the commodity trading and mining giant he led as CEO from 2002 to 2021. He remains Glencore’s largest individual shareholder, with the company’s share and commodity prices forming the backbone of his fortune.

Glasenberg was born in Johannesburg on 7 January 1957. He earned commerce and accountancy degrees at the University of the Witwatersrand and studied for an MBA in Southern California. He qualified as a chartered accountant before joining Glencore in 1984, working his way from coal trading roles in South Africa and Australia to global leadership.

During his 19 years as CEO, he transformed Glencore from a discrete trading business into one of the world’s leading integrated mining and commodity firms. He led the 2013 merger with Xstrata and grew operations spanning coal, copper, oil, and agricultural commodities.

Glasenberg stepped down in 2021 but retained his position as the biggest single shareholder. In June 2025, his stake was valued between US $9 billion (Grizzly Bulls) and US $9.5 billion (Forbes, Goodreturns).

Beyond Glencore, he holds citizenship in South Africa, Australia, and Switzerland and lives in Rüschlikon, near Zurich. He is known for keeping an active lifestyle. He remains a keen runner and swimmer and has been praised for significant local tax contributions following Glencore’s IPO.

Glasenberg turned a trading career into a mining empire. His post‑CEO wealth stands on two pillars, his Glencore stake and a sharp eye for global commodity trends.

4. Patrice Motsepe

Net Worth (mid-2025 estimate): US $3.2 billion

Patrice Motsepe stands out as South Africa’s first Black billionaire, with his fortune built from mining. He launched African Rainbow Minerals (ARM) in 1997, converting underperforming gold and platinum shafts into profitable ventures. Today, he owns a 45.9% stake in ARM and holds a non‑executive chair position at Harmony Gold—both key players on the Johannesburg Stock Exchange.

His net worth has climbed steadily in 2025. According to Forbes and Billionaires.africa, it rose from around $3 billion in March to $3.2 billion by late May. That jump stemmed from a roughly 10 % surge in ARM’s share price and Harmony Gold gains earlier in the year.

Beyond mining, Motsepe founded African Rainbow Capital (ARC), an investment vehicle operating across fintech, financial services, renewable energy, and payments. ARC has backed Tyme Group (a digital banking unicorn) and Lesaka Technologies and is ramping up solar-energy firm GoSolr—part of a R10 billion ($537 million) push into clean energy.

Sports and philanthropy also define his influence. He’s owned Mamelodi Sundowns since 2003 and has served as president of the Confederation of African Football since 2021—reelected for a second term in May 2025. His Motsepe Foundation continues to support economic development, education, health, and the Giving Pledge he signed commits at least half his wealth to charity.

Motsepe’s influence goes far beyond minerals. His reach stretches from digital finance to solar energy, football governance to philanthropy, mirroring South Africa’s shift toward diversified wealth and social impact.

5. Koos Bekker

Net Worth (mid‑2025 estimate): US $3.2 billion

Koos Bekker is the architect of Naspers’ transformation from a local newspaper publisher into a global tech and media powerhouse. As CEO from 1997 to 2014, he engineered Naspers’ shift into pay‑TV with M‑Net and Multichoice. Then he made a legendary early bet on Tencent in 2001, investing just $34 million for a stake that today accounts for Naspers’ largest value driver.

That gamble paid off. In early 2025, his combined holdings in Naspers and its Amsterdam-listed subsidiary Prosus surged on renewed interest in AI and Tencent, bringing his net worth to about $3.2 billion—a jump of roughly $200 million in just one week. As of January 2025 Forbes pegged him at $2.9 billion, and local indexes similarly list him around $3.2 billion.

Born on 14 December 1952 in Potchefstroom, Bekker studied law and literature at Stellenbosch and Wits, later earning an MBA from Columbia. His MBA thesis sparked the idea for M‑Net, and he was key in launching the platform in 1986. Under his leadership, Naspers grew its market value from $1.2 billion to $45 billion—remarkably, he was paid exclusively in stock options, not salary.

Today Bekker remains Naspers chair. He’s also poured millions into luxury hospitality. Through a family trust, he sold over R6 billion in Prosus shares between 2023 and 2024 to fund developments at Babylonstoren (South Africa), The Newt (UK) and new estates in Italy.

Bekker’s wealth is built on turning media ownership into tech investment and then strategically cashing out to build global hospitality.

6. Michiel le Roux

Net Worth (June 2025 estimate): US $2.6 billion

Michiel le Roux co-founded Capitec Bank in 2001 and guided it into becoming a dominant player in South African retail banking. He retains roughly 11 percent ownership and holds a board seat.

Capitec operates over 800 branches and employs more than 15,000 staff countrywide. In April 2025, its share price surged by more than 15 percent. That rally added nearly US $300 million to his net worth in under two weeks.

Born in 1948, Le Roux studied commerce and law at Stellenbosch University before embarking on a banking career with Boland Bank. He and Riaan Stassen launched Capitec with a clear goal: to simplify banking for the emerging middle class. They succeeded in cutting fees, introducing easy-to-use accounts, and winning over millions of customers.

Le Roux secured his ownership stake early. He invested his own money when the startup needed capital. Capitec’s growth ride lifted his fortune and established him as one of the country’s richest investors.

He is known for quietly backing political causes. Among his major contributions is support for the Democratic Alliance, making him its single biggest individual donor.

Despite his wealth, he keeps a low public profile and rarely gives interviews. He does, however, exert influence. His board seat and political donations grant him access to the highest business and government levels.

His fortune is tied directly to Capitec’s success. The bank’s mission to serve the underserved continues to fuel both his wealth and his impact on South African finance.

7. Christoffel Wiese

Net Worth (mid‑2025 estimate): US $1.6 billion

Christo Wiese built his fortune on bargain retail in South Africa. He acquired Pepkor in the early 1980s and used it as a springboard to take control of Shoprite, which has grown into Africa’s largest supermarket chain.

At 82 years old, he holds 10.67 percent of Shoprite—about 63 million shares. His stake fell below US $1 billion during early 2025 after retail stocks softened, but recovered to an estimated US $1.6 billion thanks to strong consumer demand and cost control in the first half of the year.

Wiese studied law at Stellenbosch University and initially practised as a lawyer. He pivoted back into the family retail business and led Pepkor to buy Shoprite in 1979 for just R1 million. From a handful of stores, he built an empire that employs over 150,000 people and operates some 3,500 outlets across Africa.

Retail remains his most valuable asset, but he also diversifies. He holds stakes in Brait, Invicta Holdings, Collins Property Group, and Premier Group, and chairs or sits on the boards of several listed companies.

In 2017, he stepped down as Steinhoff chairman amid the accounting scandal. A long legal battle followed, and he was awarded a settlement in 2022. That payout helped restore his billionaire status after a sharp drop in net worth.

Despite having enormous wealth, Wiese rarely courts the limelight. His mantra remains consistent: low prices, customers can trust. That slogan underpins his retail empire and his ongoing success.

8. Jannie Mouton

Net Worth (June 2025 estimate): US $1.6 billion

Jannie Mouton founded PSG Group in 1995 after being ousted from his previous firm. He invested just R3.5 million to gain 51 percent of a recruitment company and by 1997 transformed it into a holding company focused on high-growth opportunities.

PSG later backed Capitec Bank, PSG Konsult, Curro, Zeder and other key names. Mouton holds about 5 percent of Capitec through his family trust—enough to cement his billionaire status when the bank’s shares climbed roughly 50 percent over the past year.

He qualified as a chartered accountant in 1973 at Stellenbosch University. His early career began at PwC as an articled clerk. He later moved into stockbroking and then into founding PSG, a strategic pivot that reshaped his path.

PSG Group was delisted from the JSE in recent years. It now functions as an unlisted incubator focused on South African growth businesses.

He remains chair of PSG and has stepped back only to manage his health after revealing early-stage dementia in 2018. Mouton is quietly influential. His children sit on PSG’s board and lead major divisions. His book, And Then They Fired Me, charts the pivot from failure to founding one of South Africa’s most respected investment houses.

Jannie Mouton turned a dismissal into a dynasty. His strategic bets, Capitec included, transformed PSG into a powerhouse and secured his legacy as a business pioneer in South Africa.

9. Stephen Saad

Net Worth (mid‑2025 estimate): US $1.2 billion

Stephen Saad co-founded Aspen Pharmacare in 1997. The business grew from a small Durban-based operation into Africa’s largest pharmaceutical manufacturer.

Aspen produces generic drugs and branded pharmaceuticals across over 150 countries. It also produces vaccines and active pharmaceutical ingredients, including fill-finish work for the Johnson & Johnson COVID‑19 jab.

Saad owns about 12.8 percent of Aspen. In mid‑2025 that stake sat at approximately US $1.2 billion, down from earlier peaks but enough to keep him firmly among the country’s wealthiest.

He was born in Durban in June 1964 to Lebanese parents. He attended Durban High School, then earned a commerce degree from the University of Natal. He qualifies as a chartered accountant and played rugby while studying abroad in Ireland.

Early in his career he made his first million by selling his share in Covan Zurich at age 29. That deal gave him the capital to launch Aspen with cohort and fellow founder Gus Attridge.

Under his leadership Aspen acquired South African Druggists and Fine Chemicals. It expanded into Latin America, Australia, and Europe. It also secured global rights to several GSK medicines. He remains Aspen’s CEO and executive director. He also chairs the Sharks, Durban’s premier rugby franchise, and sits on the board of Durban High School’s foundation.

Saad owns a private game reserve in Sabi Sands near Kruger National Park. He supports healthcare causes, including HIV/AIDS treatment and charitable foundations. Saad’s wealth is tied to the success of generic medicines across emerging markets. His stake in Aspen still commands global reach and a pandemic-era acceleration of vaccine production.

10. Allan Gray (Estate)

Estimated Impact on Wealth Rankings (2025): ~US $1.2 billion (estate-supported legacy)

Though Allan Gray passed away on 10 November 2019, his financial legacy remains a key fixture on South Africa’s rich-list. His firm, Allan Gray Limited, founded in 1973 became the country’s largest privately held investment manager. That company, along with its offshore arm Orbis, manages over US $35 billion in assets, underpinning the ongoing wealth controlled by his estate and philanthropic trusts.

Born in East London in 1938, Gray earned an MBA at Harvard before returning home to break into investment management. Initially working at Fidelity in Boston, he later launched his eponymous firm in Cape Town. That firm expanded through value-driven investing and long-term strategies, steering capital into undervalued shares, an approach likened to Warren Buffett’s methodology.

Gray’s personal wealth peaked at around US $1.8 billion in 2017, according to Forbes. But it’s his intentional decision to gift nearly all his firm’s stake to the Allan and Gill Gray Charitable Trust—completed in 2016—that has defined his legacy. The downstream Allan Gray Orbis Foundation now supports high‑potential students in Southern Africa, with bursaries, leadership development, and entrepreneurial mentorship programs.

Today, the estate’s retained assets continue to produce value for these charitable vehicles. The foundation reports that regular distributions fund scholarships and incubator programs, reaching thousands of students annually.

Allan Gray’s wealth doesn’t directly enrich individuals anymore. Instead, it fuels a high-impact legacy, turning capital into an opportunity for future South African leaders.

Final Thoughts

The faces behind South Africa’s biggest fortunes tell a deeper story about the country’s economy. Mining still matters, but it no longer dominates. We’re seeing the rise of tech-savvy investors, self-made financiers, and entrepreneurs who built their way into the billionaire club through retail, banking, and pharmaceuticals.

Legacy money hasn’t disappeared either. Names like Rupert, Oppenheimer, and Wiese still reflect the old architecture of wealth—land, diamonds, and distribution. But alongside them stand disruptors like Motsepe, Saad, and Bekker, whose empires were shaped by strategy, timing, and often, bold risk.

Do you think someone important missed the roll call? Drop their name in the comments. We’d love to hear who you believe should be part of South Africa’s billionaire conversation.