If you’re curious about what’s happening in Nigeria’s tech scene, fintech is one of the best places to look. It’s where some of the smartest ideas are being built with ideas that help people send money in seconds, save, access loans, and even invest in global assets straight from their phones.

These are companies building useful products for real problems, like delayed bank transfers, limited credit access, or the hassle of daily financial tasks. Some focus on businesses, offering smooth payment gateways and APIs. Others are helping individuals manage their money better.

In this article, you’ll find 20 fintech companies in Nigeria, from household names like Paystack and Flutterwave to newer players like Risevest and Spleet. You’ll get a sense of what each one does, who they serve, and why they stand out in a fast-growing, high-impact space.

Whether you’re just curious or looking to understand the market better, welcome.

Let’s get into it.

1. Paystack

Founded: 2015

Founders: Shola Akinlade and Ezra Olubi

Headquarters: Lagos, Nigeria

Acquired by Stripe in 2020 for $200 million

Paystack launched to make online payments easy for African businesses. At the time, processing digital payments in Nigeria was complicated. Failed transactions, poor integration options, and unreliable bank APIs made it hard for businesses to collect money online.

Paystack solved this by offering smooth checkout experiences, developer-friendly APIs, and integrations with popular platforms like Shopify and WordPress. It quickly became the go-to choice for startups, creators, and small businesses needing fast, reliable payments. Larger brands soon followed. Since then, Paystack has expanded into Ghana, Kenya, and South Africa, while continuing to grow in its home market.

What Paystack Offers:

- Online payments via cards, bank transfers, USSD, QR codes, and Apple Pay

- Easy-to-use invoicing and subscription billing tools

- Plugins for e-commerce platforms like WooCommerce and Shopify

- Secure APIs built for developers and businesses of all sizes

Who It Serves: Startups, SMEs, large businesses, freelancers, and developers.

2. Flutterwave

Founded: 2016

Founders: Iyinoluwa Aboyeji, Olugbenga Agboola, and Adeleke Adekoya

Headquarters: San Francisco, USA (with key operations in Lagos)

Funding: Over $475 million

Valuation: Over $3 billion (as of 2022)

Flutterwave was founded to simplify cross-border payments for businesses operating in Africa. Unlike companies focused solely on local transactions, Flutterwave built infrastructure that allows merchants to accept and send payments across currencies and countries.

Its first product, Rave, offered flexible payment options, including cards, mobile money, bank transfers, and USSD. Over time, Flutterwave expanded its services to include an online store builder for small businesses and Send, a money transfer app for the African diaspora.

Today, Flutterwave operates in more than 30 African countries and works with global brands like Uber and Flywire. Its platform powers payments for hundreds of thousands of businesses and processes billions of dollars annually.

What Flutterwave Offers:

- Payment gateway for local and international transactions

- Cross-border payment support across Africa, Europe, and North America

- Store and checkout tools for online sellers

- Send app for international money transfers

- Scalable APIs and tools for banks, developers, and large enterprises

Who It Serves: Businesses of all sizes, developers, the African diaspora, and enterprise clients.

3. PiggyVest

Founded: 2016

Founders: Odunayo Eweniyi, Somto Ifezue, and Joshua Chibueze

Headquarters: Lagos, Nigeria

Originally launched as Piggybank.ng

PiggyVest’s goal was to help Nigerians save money digitally, especially those who struggled with discipline or access to traditional banking tools. It launched as Piggybank.ng in 2016, offering a simple savings model inspired by the idea of the physical piggy bank, but automated and accessible through a mobile app.

In 2019, the company rebranded to PiggyVest and expanded its offerings. Beyond regular savings, users could now lock funds for fixed periods, create savings targets, and invest in low-risk opportunities. The platform also introduced features like SafeLock to encourage long-term savings habits with better returns.

Today, PiggyVest is one of Nigeria’s most widely used savings and investment apps, with over four million users. It’s known for user-friendly design, consistent interest payouts, and a strong focus on transparency.

What PiggyVest Offers:

- Automated savings with daily, weekly, or monthly options

- Target savings for specific goals like rent, travel, or tuition

- SafeLock for time-locked savings at higher interest rates

- Investment options through verified third-party partners

- Flex Naira wallet for withdrawals and interest tracking

Who It Serves: Individuals seeking consistent saving habits, budget control, and simple investment access.

4. Cowrywise

Founded: 2017

Founders: Razaq Ahmed and Edward Popoola

Headquarters: Lagos, Nigeria

Regulated by the SEC as a fund/portfolio manager

Cowrywise was built to simplify wealth management for everyday Nigerians. Its goal was to provide easy access to savings and investment opportunities that were previously reserved for the wealthy or institutional investors. From the beginning, Cowrywise positioned itself as more than just a savings app. It focused on helping users grow their money through structured, automated investment tools.

The app allows users to invest in mutual funds, fixed income products, and halal-compliant plans. It also supports automated savings, recurring contributions, and flexible withdrawal settings. Cowrywise places strong emphasis on education, offering detailed insights into how investment products work, along with tools for tracking goals and performance.

In 2021, Cowrywise became one of the first Nigerian fintechs to be licensed by the Securities and Exchange Commission (SEC) as a digital fund manager, a major step for credibility in Nigeria’s growing investment-tech space.

What Cowrywise Offers:

- Access to mutual funds and low-risk investment products

- Automated savings and investment plans with flexible settings

- Halal-compliant investment options

- Goal-based financial planning and portfolio management

- Educational content to guide new investors

Who It Serves: Individuals seeking digital investment tools, beginner investors, and Muslims seeking Shariah-compliant finance options.

5. Carbon

Founded: 2012 (originally as OneCredit, rebranded to Paylater, then Carbon in 2019)

Founders: Chijioke and Ngozi Dozie

Headquarters: Lagos, Nigeria

Funding: Raised $15M debt financing from Lendable in 2019

Carbon began as OneCredit, a consumer lending business, before launching Paylater in 2016, one of Nigeria’s first fully digital lending platforms. Its goal was to offer fast, collateral-free loans through a mobile app, avoiding the usual paperwork and delays of traditional banks.

In 2019, the company rebranded to Carbon and expanded its services beyond lending. It introduced bill payments, fund transfers, investment options, and a virtual debit card. Carbon positioned itself as a digital financial services provider offering everything from credit to payments and savings, all from a single app.

The company also built Carbon Score, a credit rating system that helps users track their borrowing behavior. It was one of the first Nigerian fintechs to issue instant loans without human intervention, using only digital data to assess creditworthiness.

What Carbon Offers:

- Instant personal loans with flexible repayment options

- Bill payments and airtime purchases

- Peer-to-peer transfers and a virtual debit card

- Investment tools with fixed returns

- Credit score tracking via Carbon Score

Who It Serves: Individuals in need of short-term loans, digital banking tools, and basic investment options.

6. Kuda

Founded: 2019

Founders: Babs Ogundeyi and Musty Mustapha

Headquarters: Lagos, Nigeria (with HQ incorporation in London)

Funding: Over $90 million raised from investors including Target Global, Valar Ventures, and SBI

Valuation: Over $500 million (as of 2021)

Kuda set out to build a full-service digital bank tailored to the Nigerian market. Its goal was to offer banking without the typical frustrations: no card maintenance fees, no minimum balance requirements, and fully app-based service.

Kuda gained attention for offering free transfers, free debit cards, and smart spending tools aimed at younger Nigerians. Within a few years, it became one of the most downloaded finance apps in the country and built a strong brand around convenience, transparency, and control.

The platform allows users to receive salaries, save automatically, pay bills, and set spending limits. Kuda also offers overdrafts based on user activity, introducing a form of credit without requiring formal applications.

What Kuda Offers:

- Free bank account with no maintenance fees

- Smart budgeting and automatic savings features

- Bill payments, airtime top-ups, and cardless withdrawals

- Overdrafts based on transaction history

- Physical and virtual debit cards delivered to users

Who It Serves: Mobile-first individuals, students, freelancers, and professionals looking for an alternative to traditional banks.

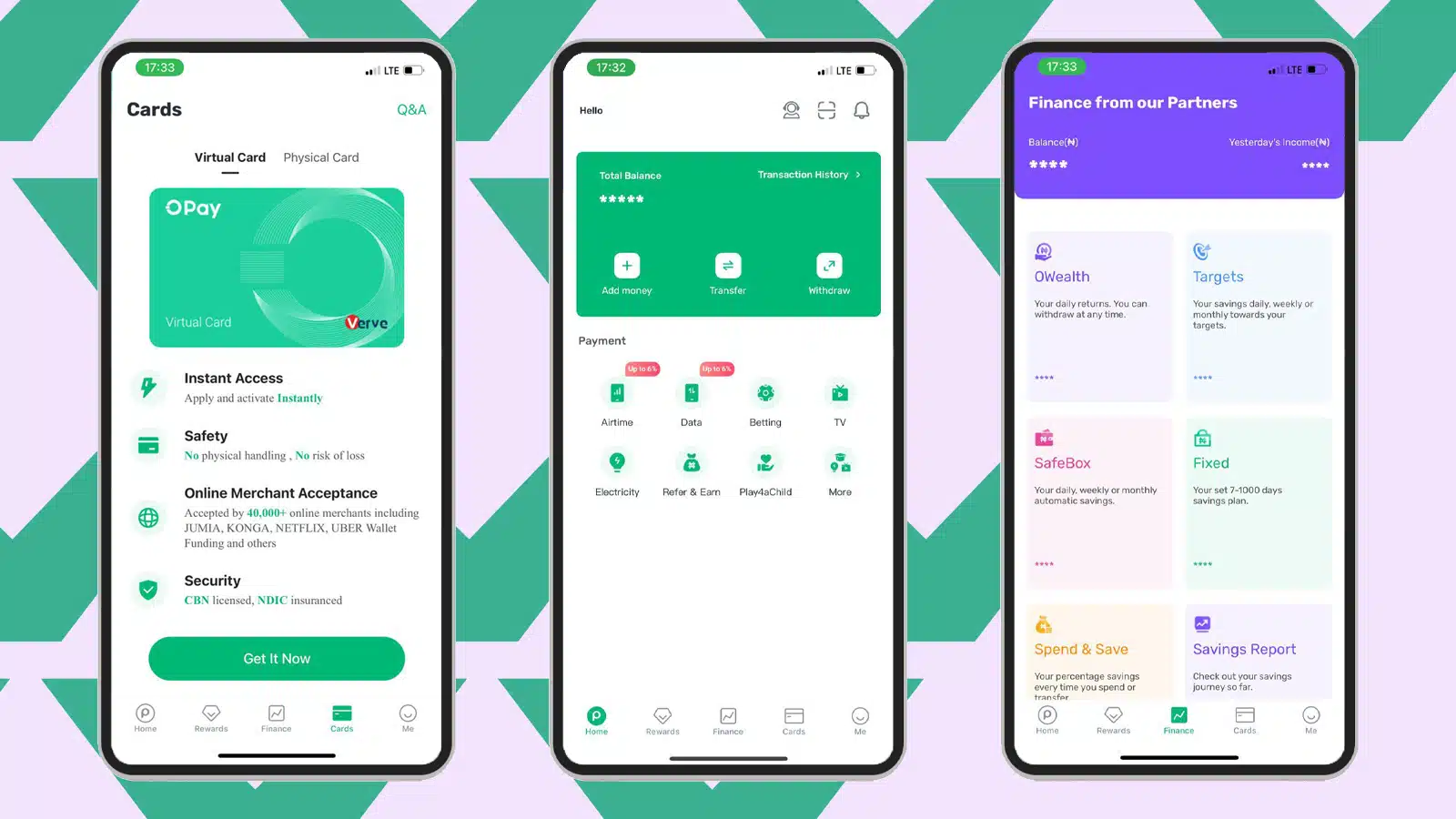

7. OPay

Founded: 2018 (in Nigeria)

Parent Company: Opera (Norway-based tech company)

Headquarters: Lagos, Nigeria

Funding: Over $570 million raised from investors including SoftBank, Sequoia China, and Meituan

Valuation: Over $2 billion (as of 2021)

OPay entered the Nigerian market in 2018 as a mobile payments platform backed by Opera. Its early strategy was aggressive: offer low-cost financial services while bundling them with lifestyle products like ride-hailing (ORide), food delivery (OFood), and bike logistics (OExpress). While those non-financial arms shut down in 2020 due to regulatory pressure and focus shift, OPay doubled down on fintech.

Today, OPay operates primarily as a mobile money platform with a wide agent network, helping users send and receive money, pay bills, and buy airtime, all through the app or in-person at agent locations. It is especially popular among the unbanked and underbanked, offering fast, low-barrier financial access across Nigeria.

What OPay Offers:

- Mobile wallet with peer-to-peer transfers

- Bill payments and airtime purchases

- Access to ATM withdrawals through OPay debit cards

- Agent banking services with thousands of agents nationwide

- Business tools for merchants

Who It Serves: Unbanked and underbanked users, small businesses, and urban dwellers seeking fast, mobile-first transactions.

8. Paga

Founded: 2009

Founder: Tayo Oviosu

Headquarters: Lagos, Nigeria

Funding: Over $35 million raised from investors including Adlevo Capital, Omidyar Network, and Flourish Ventures

Paga was one of the earliest players in Nigeria’s mobile payments space, starting operations well before the current fintech boom. Its goal was to make financial services accessible to everyone, especially those without bank accounts, by turning mobile phones into wallets.

Paga grew through a hybrid model: a digital wallet app for users who have smartphones, and a vast network of offline agents for those who don’t. Through these agents, people can deposit cash, send and receive money, and pay bills, all without visiting a bank.

Over time, Paga expanded its offering to include API integrations for businesses, in-app merchant payments (Paga Checkout), and banking features like interest-earning savings wallets.

What Paga Offers:

- Mobile wallet with send, receive, and pay functionalities

- Agent banking with over 27,000 agents across Nigeria

- Paga Checkout for online businesses

- Bill payments, airtime top-up, and QR code payments

- Basic savings and wallet-to-bank transfers

Who It Serves: Individuals without access to traditional banks, small business owners, and everyday consumers making daily transactions.

9. FairMoney

Founded: 2017

Founders: Laurin Hainy, Matthieu Gendreau, and Nicolas Berthozat

Headquarters: Lagos, Nigeria (parent company registered in Paris, France)

Funding: Over $57 million raised from investors including Tiger Global, Speedinvest, and Flourish Ventures

FairMoney started as a digital lending platform, offering instant, collateral-free loans to Nigerians via mobile phones. The app uses alternative data like smartphone usage and transaction history to assess creditworthiness, allowing users to get loans in minutes without traditional paperwork.

Over time, FairMoney expanded into full digital banking services. Users can now pay bills, buy airtime, transfer funds, and manage their finances through a mobile account. In 2021, FairMoney received a microfinance banking license from the Central Bank of Nigeria, which allowed it to broaden its offering and become more competitive with traditional banks and neobanks alike.

What FairMoney Offers:

- Instant personal loans with flexible repayment terms

- Bill payments, airtime, and data top-up

- Digital account with transfer capabilities

- Debit card for ATM and POS usage

- Interest-bearing savings wallets

Who It Serves: Individuals with limited access to traditional credit, students, salary earners, and mobile-first users.

10. Moniepoint (formerly TeamApt)

Founded: 2015

Founder: Tosin Eniolorunda

Headquarters: Lagos, Nigeria

Funding: Over $100 million raised from investors including QED Investors, Novastar, and Lightrock

Regulated by: CBN as a microfinance bank and switching company

Moniepoint began as TeamApt, a B2B-focused company building financial infrastructure for banks and fintechs. It later shifted focus to the underserved retail economy by offering banking services through a vast agent network. The company eventually rebranded its flagship product as Moniepoint, and in 2023, it adopted Moniepoint as its official company name.

The platform enables small businesses to process payments, access working capital, manage cash flow, and run their day-to-day banking through POS devices and mobile apps. Moniepoint serves millions of Nigerians through its agents, making it one of the most widespread fintechs in the country.

What Moniepoint Offers:

- POS terminals for cash-in and cash-out services

- Agent banking with deposits, transfers, and withdrawals

- Business current accounts and dashboards

- Access to working capital loans and credit tools

- Expense management and reporting for SMEs

Who It Serves: Small business owners, agent bankers, market traders, and informal sector entrepreneurs.

11. PalmPay

Founded: 2019 (launched in Nigeria)

Parent Company: Transsnet (a joint venture between China’s Transsion Holdings and NetEase)

Headquarters: Lagos, Nigeria

Funding: $140 million+ raised from investors including TECNO and MediaTek

PalmPay entered the Nigerian market in 2019 with a heavy launch strategy, including device pre-installations through Transsion (makers of TECNO, Infinix, and itel phones) and wide offline marketing. Its goal was to offer fast, reliable, and reward-based digital payments to the mass market.

Users can send and receive money, pay bills, and access cashback rewards through the PalmPay app. The platform also supports agent banking via POS terminals and has rapidly grown its presence in Nigeria’s retail transaction space. Its rewards system, offering discounts, cashbacks, and referral bonuses, played a major role in driving early adoption.

PalmPay now operates a wide agent network and partners with mobile manufacturers, telcos, and retail businesses to expand its ecosystem.

What PalmPay Offers:

- Mobile wallet for transfers, bill payments, and airtime

- Cashback rewards and referral bonuses

- Virtual and physical PalmPay debit cards

- POS solutions and merchant tools

- Agent banking and cash services

Who It Serves: Low-to-middle-income earners, mobile-first users, and small business owners.

12. Branch

Founded: 2015

Founder: Matt Flannery (co-founder of Kiva)

Headquarters: San Francisco, USA (operations in Nigeria, Kenya, India, and Tanzania)

Funding: Over $250 million in debt and equity from investors including Visa, Andreessen Horowitz, and Foundation Capital

Branch began as a digital lending platform offering instant microloans through a mobile app. Its model relies on alternative data, like smartphone usage patterns and repayment history, to assess creditworthiness without formal documentation.

In Nigeria, Branch quickly gained popularity for providing quick access to loans without collateral or face-to-face screening. It later expanded into financial services, offering savings products, bill payments, and money transfers through a sleek mobile interface.

The company has issued millions of loans across Africa and Asia, and continues to improve its credit scoring technology using machine learning and mobile data.

What Branch Offers:

- Instant microloans with flexible repayment

- In-app bill payments and airtime purchase

- Investment and savings features with interest

- Wallet for transfers and payment tracking

Who It Serves: Smartphone users seeking fast access to credit, especially underserved or thin-credit-profile individuals.

13. Eyowo

Founded: 2019

Parent Company: Softcom

Headquarters: Lagos, Nigeria

Licensed by: CBN as a mobile money operation

Eyowo provides digital banking through phone numbers, making it possible to send and receive money without a traditional bank account. Users can pay bills, save, and access virtual or physical debit cards. It also supports offline transactions via USSD, offering financial access to both smartphone and feature phone users.

Eyowo aims to drive financial inclusion by making banking simple and flexible. The platform also supports small businesses through merchant tools and easy collections.

What Eyowo Offers:

- Send/receive money using phone numbers

- USSD and app-based wallet

- Savings and bill payments

- Virtual and physical debit cards

Who It Serves: Unbanked individuals, mobile users, and micro merchants.

14. VBank

Founded: 2020

Parent Company: VFD Group

Headquarters: Lagos, Nigeria

Licensed by: CBN as a microfinance bank

VBank is a fully digital bank that allows users to open accounts, save, transfer funds, and manage spending. It offers zero maintenance fees, flexible savings plans, and tools for financial tracking.

The platform targets Nigeria’s growing digital-savvy population, particularly freelancers, remote workers, and young professionals. With no physical branches, it focuses on convenience and transparency.

What VBank Offers:

- Digital account with no maintenance fees

- Bill payments and free transfers

- Auto-saving and budgeting features

- Debit cards for online and ATM use

Who It Serves: Students, freelancers, salary earners, and mobile-first users

15. Renmoney

Founded: 2012

Headquarters: Lagos, Nigeria

Licensed by: CBN as a microfinance bank

Renmoney is a digital lender that provides personal and small business loans to Nigerians without requiring collateral. Its app-based system allows users to apply, get approved, and receive funds quickly. Renmoney also offers fixed deposit savings accounts with competitive interest rates.

Loans typically range from ₦6,000 to ₦6 million, with flexible repayment terms. The platform uses alternative credit scoring to evaluate applicants, helping users with limited credit history access financing. Though known mainly for consumer lending, it has steadily added savings and payment features to diversify its offerings.

What Renmoney Offers:

- Instant personal and business loans

- Fixed savings accounts

- Loan calculator and online applications

- Basic transfer and bill payment tools

Who It Serves: Salaried workers, business owners, and individuals needing fast, collateral-free loans

16. Chipper Cash

Founded: 2018

Founders: Ham Serunjogi and Maijid Moujaled

Headquarters: San Francisco, USA

Funding: Over $300 million raised; backed by FTX, SVB Capital, and Ribbit Capital

Chipper Cash provides free cross-border money transfers and mobile payments across multiple African countries, including Nigeria. Users can send and receive money instantly, buy airtime, pay bills, and make cardless withdrawals.

The app also supports crypto trading, stock investing (in select markets), and virtual debit cards. Known for its zero-fee model and sleek interface, Chipper targets mobile-savvy users who need fast, low-cost financial tools.

What Chipper Cash Offers:

- Free peer-to-peer and cross-border transfers

- Airtime and bill payments

- Crypto and stock trading

- Virtual debit cards

Who It Serves: Individuals sending money across Africa, crypto users, and mobile-first users.

17. ALAT by Wema Bank

Founded: 2017

Parent Company: Wema Bank

Headquarters: Lagos, Nigeria

Licensed by: CBN as a digital bank under a traditional bank

ALAT is Nigeria’s first fully digital bank, launched by Wema Bank to serve a younger, mobile-first audience. It allows users to open accounts in minutes, save automatically, schedule payments, and request physical debit cards without visiting a branch.

ALAT also offers virtual dollar cards for international payments and tools to set saving goals with interest. Its sleek interface and early market entry helped it gain traction among students, freelancers, and salary earners.

What ALAT Offers:

- Account opening via mobile app

- Automated and target savings

- Virtual and physical cards (including dollar cards)

- Bill payments and transfers

Who It Serves: Digitally savvy users, students, freelancers, and remote workers

18. Kora

Founded: 2017

Founders: Dickson Nsofor and Pelumi Aboluwarin

Headquarters: Lagos, Nigeria (with presence in Canada and the UK)

KoraPay provides API-based financial infrastructure for businesses, enabling collections, payouts, and cross-border payments. It allows platforms to accept money from customers via cards, bank transfers, and mobile money, and disburse payments globally.

It caters to fintechs, e-commerce platforms, lenders, and any business that wants to embed payments into its service. Kora is focused on making African payments programmable, scalable, and borderless.

What Kora Offers:

- Payment APIs (collections and payouts)

- Bank account issuance

- Mobile money and cross-border infrastructure

- Developer support and documentation

Who It Serves: Tech platforms, fintechs, and enterprise businesses needing custom payment solutions

19. Brass

Founded: 2020

Founders: Emmanuel Okeke and Sola Akindolu

Headquarters: Lagos, Nigeria

Target: SMEs and startups

Acquired by Paystack in 2024

Brass is a digital bank built specifically for small and growing businesses in Nigeria. It offers business accounts, tools for managing cash flow, expense tracking, payroll, and multi-user access.

Unlike personal banking apps, Brass focuses on solving operational challenges faced by SMEs. It also provides working capital loans and integrations that help with team management and financial visibility.

What Brass Offers:

- Business current accounts

- Bulk transfers and payroll

- Expense cards and team permissions

- Cash flow insights and short-term credit

Who It Serves: SMEs, startups, and business owners looking for tailored financial tools

20. Eversend

Founded: 2017

Founder: Stone Atwine

Headquarters: Kampala, Uganda (operates in Nigeria and across Africa)

Eversend is a multi-currency wallet focused on cross-border money transfers and currency exchange. Though founded in Uganda, it operates in Nigeria and supports naira wallets, making it a key player for diaspora remittances and currency conversion.

Users can send money across countries, buy airtime, and pay bills. Eversend also offers virtual dollar cards for online payments and security features like insurance options inside the app.

What Eversend Offers:

- Cross-border transfers

- Multi-currency wallets and FX

- Virtual USD cards

- Airtime and bill payments

Who It Serves: African users needing cross-border payments, foreign currency access, and digital banking tools.

Wrapping up

So, that’s a look at 20 fintech companies shaping how money moves in and out of Nigeria. From tools built for everyday savings to platforms powering cross-border payments, there’s clearly more happening here than meets the eye.

If you’ve used any of these apps or platforms, drop a comment and share your experience — the good, the frustrating, or the unexpected. Also, if there’s a fintech product you love that didn’t make the list, let’s hear about it. This space moves fast, and there’s always more to discover.

Let’s keep the conversation going.