Breaking news out of Beijing has sent shockwaves through the global tech world: China has officially banned Nvidia’s AI chips. This move is about power, sovereignty, and the future of artificial intelligence. With the stroke of a policy pen, China has escalated the tech war, creating ripple effects across industries, supply chains, and international relations. What does this ban really mean for AI progress, Top AI Chip maker, Nvidia’s dominance, and the balance of global trade? Let’s break it down.

In this guide, you will learn:

- The immediate and long-term impacts of China’s Nvidia chip ban on AI and tech.

- How this decision reshapes global supply chains and trade relations.

- What opportunities and risks emerge for companies, governments, and investors?

- The scenarios experts predict for the future of global technology competition.

Background context: the road to the ban

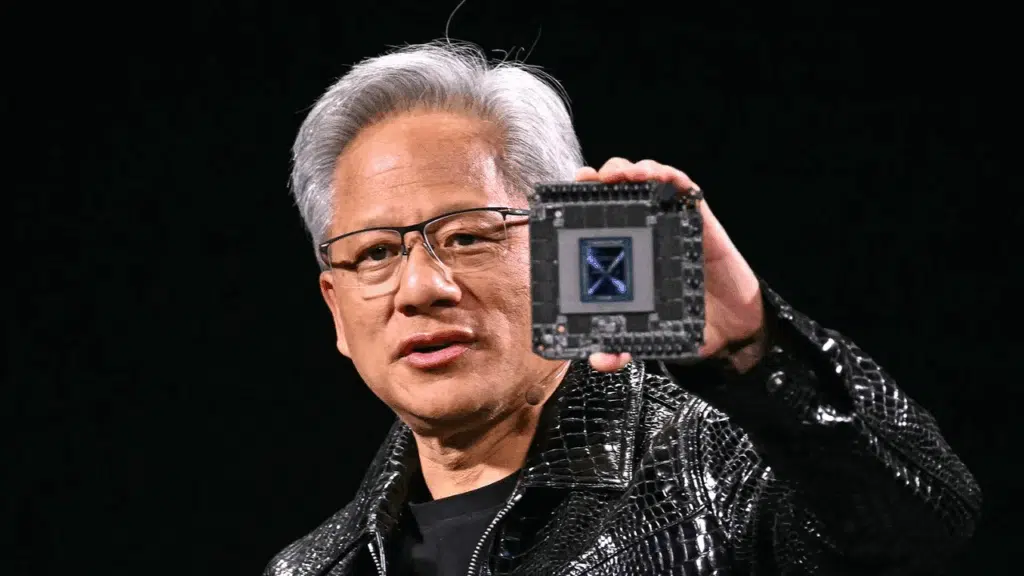

Nvidia wasn’t always the center of geopolitics. The company started out in the 1990s, making graphics cards for gamers. Its big break came when researchers realized GPUs could crunch massive amounts of data faster than CPUs. That discovery turned Nvidia into the go-to supplier for AI labs.

China quickly became one of its biggest markets. Tech giants like Alibaba, Baidu, and Tencent built their AI ambitions on Nvidia’s A100 and H100 chips. By some estimates, China accounted for up to a quarter of Nvidia’s data center revenue in recent years.

The U.S., meanwhile, watched with growing unease. Washington had long criticized Beijing’s support for state-owned enterprises and its push for technological self-sufficiency. When AI began to look less like a commercial race and more like a national security issue, Nvidia’s products landed squarely in the crosshairs.

In 2022, the first export restrictions arrived. Nvidia could no longer sell its top-tier chips directly to Chinese buyers. The company responded by creating modified versions — the A800 and H800 — designed to meet U.S. rules while keeping a foothold in China. That workaround bought time but didn’t end the scrutiny.

Now, with tighter rules in place, even those custom chips are off the table.

Strategic drivers behind China’s decision

- Technological sovereignty: Reducing dependence on foreign-made AI infrastructure.

- Economic retaliation: Responding to continued US semiconductor restrictions.

- Industrial policy: Fast-tracking domestic semiconductor and AI development.

- Geopolitical positioning: Signaling independence in the global technology race.

- National security: Ensuring Chinese AI capabilities aren’t shaped by external influence.

Even before the ban, there were visible signals of where things were heading. China’s policymakers had grown wary of critical dependencies, particularly on Nvidia’s GPUs that powered everything from research labs to consumer cloud services. To shield its domestic industry, Beijing poured resources into homegrown firms such as SMIC and Cambricon, while encouraging new players to expand capacity.

At the same time, research budgets expanded as local scientists were encouraged to develop competitive AI hardware from scratch. On the diplomatic front, China leaned into partnerships with suppliers outside the US orbit, reinforcing its long-stated “Made in China 2025” strategy.

Immediate fallout

The market didn’t wait long to react. Nvidia, whose cutting-edge GPUs power everything from ChatGPT to China’s self-driving pilots, saw its stock dip on the news. Investors understand that China accounts for nearly a quarter of its data center sales — a revenue stream that can’t be replaced overnight.

For Chinese tech giants like Baidu, Tencent, and Alibaba, the ban felt like the floor suddenly dropped out. Their AI roadmaps — everything from chatbot rollouts to logistics algorithms — hinge on Nvidia’s A100 and H100 chips. Without them, training next-gen models takes longer, costs more, and risks falling behind U.S. rivals. Startups are hit even harder, losing both the prestige of Nvidia hardware and the ecosystem benefits that come with it.

Then there’s the global ripple. Cloud providers brace for higher GPU prices. Smaller firms look to AMD and Intel, though their chips still lag behind Nvidia’s bleeding-edge. In Europe, labs already struggling to acquire GPUs fear being priced out entirely. Even in the U.S., competition for access could tighten if Washington prioritizes domestic allocation.

In just weeks, one policy decision reshaped balance sheets, product timelines, and the entire AI hardware supply chain. And this is only the opening move.

China’s long game

If the immediate fallout looks messy, Beijing’s long-term play is much more deliberate. The Nvidia ban only reinforces a strategy China has been pursuing for years: reducing reliance on U.S. technology. At the center is the “Made in China 2025” vision, which frames semiconductors as a crown jewel of national security and economic independence.

Billions of dollars are being invested in homegrown players such as SMIC (Semiconductor Manufacturing International Corporation), Cambricon Technologies, and Horizon Robotics. These firms aren’t yet ready to match Nvidia in cutting-edge AI chips, but with state subsidies, government contracts, and a protected domestic market, they are given room to scale.

The push for self-sufficiency also extends to universities and research labs. China is training thousands of semiconductor engineers annually and luring back talent from abroad with generous incentives. It’s not a short sprint—it’s a decade-long race where consistency may matter more than quick wins.

At the same time, Beijing is widening its circle of partnerships. Europe and Japan, though cautious, are seen as possible collaborators in non-sensitive areas. India has emerged as a potential alternative supply chain partner, particularly as Washington strengthens its ties with New Delhi. By diversifying relationships, China signals it won’t be boxed into technological isolation.

The irony is that U.S. restrictions, intended to slow China’s progress, may actually accelerate it. Being cut off from Nvidia could prompt Chinese firms to innovate more quickly, relying on creative architectures or software optimizations to compensate for weaker hardware. If they succeed, the outcome isn’t dependency—it’s resilience.

China’s long game, then, is less about short-term patchwork and more about reshaping the entire semiconductor ecosystem. The ban hurts today, but it also hardens Beijing’s resolve to ensure that, in the future, no single American company can hold such leverage again.

Global tech fragmentation

The Nvidia ban doesn’t just affect one company or one country—it accelerates a split in the global technology landscape. What used to be a relatively integrated system of design, manufacturing, and research is tilting toward parallel tracks.

Three major shifts stand out:

- Diverging Ecosystems

- Western firms continue to anchor their AI development on U.S. and European standards.

- Chinese companies, cut off from top-tier chips, start building platforms optimized for their own hardware and software stack.

- The result is reduced interoperability, as apps, tools, and frameworks evolve differently depending on their origin.

- Splintered Standards

- Instead of shared global benchmarks, we could see separate sets of protocols and certifications.

- AI safety, data privacy, and performance testing may no longer adhere to a single global standard. That makes collaboration and even regulation much more complicated.

- Research Divide

- Joint papers and cross-border AI projects have already slowed in sensitive areas.

- As geopolitical suspicion grows, collaboration between U.S. and Chinese universities may shrink further, creating isolated knowledge hubs.

- Talent Realignment

- Engineers and researchers may feel compelled to take sides.

- Visa restrictions, investment controls, and security concerns could lead to talent being funnelled into siloed geographies.

In the short term, fragmentation increases costs, including duplicating supply chains, redesigning software, and navigating restricted markets. But the longer-term impact is cultural. Innovation becomes shaped not by shared problem-solving, but by national interests.

The irony is that AI—the technology often praised for connecting the world may ultimately reinforce its divides. Instead of one global brain, we could see two or three regional ones, each advancing at its own pace, often in competition rather than collaboration.

Industry spotlight

The Nvidia ban doesn’t just hit chipmakers; it ripples through entire industries that have built their future on AI. Some sectors feel the pinch more sharply than others:

- Automotive: Self-driving projects and advanced driver-assistance systems (ADAS) depend heavily on GPUs to process road data in real time. With limited access, Chinese automakers face delays in testing and rolling out smarter cars, potentially losing ground to global rivals.

- Healthcare: AI-driven imaging and precision medicine require vast computing power to scan, detect, and predict. Hospitals and biotech startups may now struggle to maintain momentum, as local alternatives still trail Nvidia’s performance. Patients may indirectly experience slower adoption of cutting-edge diagnostics.

- Finance: From fraud detection to high-frequency trading, financial institutions rely on GPUs for speed and accuracy. With a restricted supply, banks may need to scale back experiments in AI modeling; a risky trade-off in a sector where microseconds can influence billions.

- Manufacturing: Smart factories are central to China’s “Made in China 2025” vision. AI-guided robotics and predictive analytics need powerful chips to optimize efficiency. Slower upgrades could drag productivity gains, delaying Beijing’s ambition of industrial dominance.

Across all these industries, the theme is clear: without access to top-tier GPUs, innovation slows. While some firms may adapt through alternative suppliers or in-house chip projects, the near-term disruptions will test their resilience. The ban, therefore, is not just a story about technology but a direct challenge to economic modernization itself.

Global tech fragmentation

China’s ban on Nvidia chips is accelerating a shift toward a bifurcated AI ecosystem, with two parallel paths emerging: one driven by Western hardware and standards, the other by Chinese alternatives.

Key effects include:

- Divergent AI architectures: Chinese AI models are now optimized for domestic chips, such as those from Cambricon and Horizon Robotics, while Western companies continue to refine platforms from Nvidia, AMD, and Intel.

- Talent mobility challenges: Engineers and researchers face a landscape where expertise in one ecosystem doesn’t automatically transfer to the other. Cross-border collaboration becomes politically sensitive.

- Standards fragmentation: Technical protocols, benchmarks, and certifications are diverging, making interoperability across regions more complex.

- Research silos: Academic and industrial AI research is increasingly regional, with breakthroughs concentrated within each ecosystem.

The broader result is a tech landscape that is both competitive and fragmented. While this encourages regional innovation and self-sufficiency, it also introduces inefficiencies: supply chains are more localized, software development multiplies in complexity, and global AI progress no longer moves along a single, unified track.

What it mean going forward

The Nvidia ban isn’t just a short-term disruption—it reshapes the AI and tech landscape for years. How companies, governments, and investors respond will determine who benefits and who struggles.

Scenario 1: Rapid Chinese catch-up

If China successfully accelerates domestic AI chip production within 18–24 months, the global market could become permanently fragmented. Companies outside China will compete with parallel ecosystems, driving innovation but increasing costs for hardware and software development.

Scenario 2: Gradual Adaptation

A slower, measured shift over 3–5 years allows Chinese firms to adopt alternative hardware and optimize existing systems. Disruptions are temporary, giving the global industry time to adjust supply chains and investment strategies.

Scenario 3: Deepening fragmentation

Should diplomatic tensions worsen, we may see a hard split between Chinese and Western AI markets. Standards, software frameworks, and talent pools would diverge, creating a long-term dual-track ecosystem.

Winners and losers

Startups and alternative chipmakers stand to gain from the demand surge for non-Nvidia solutions. Conversely, firms reliant on seamless access to Nvidia hardware face higher costs and slower AI development. Investors must recalibrate portfolios to reflect geopolitical and technological risks.

Overall, AI innovation will continue, but the path forward is no longer a single global track—it’s branching, competitive, and increasingly shaped by geopolitics.

Conclusion

China’s ban on Nvidia chips marks more than a trade restriction—it’s a turning point in global technology. From AI development to supply chains, industries must navigate a landscape defined by fragmentation, competition, and geopolitical strategy. Companies, investors, and policymakers alike need to monitor hardware alternatives, diversify partnerships, and plan for multiple technological futures.

The era of a single, unified AI ecosystem is coming to an end. Staying informed, agile, and proactive will determine who thrives in this new, high-stakes environment.