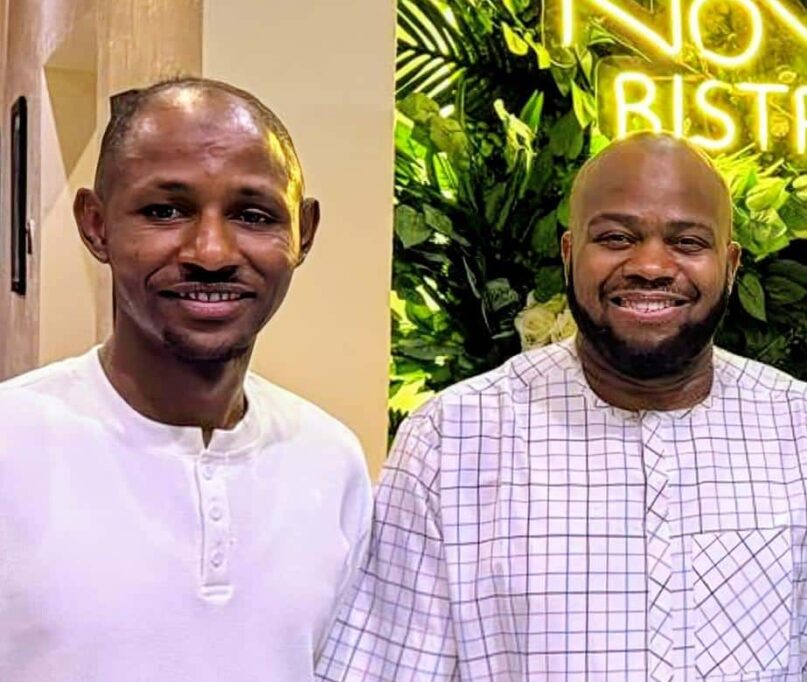

Bello Kano and Tayo Akintoye have been PoS agents since 2018, long before Moniepoint and OPay came to dominate the market. “It was during the time of Firstmonie,” Bello recalled.

The pair had been friends for years, so they decided to pool resources and start a PoS business, investing ₦400,000 ($285). “The day we started, we knew we were more than just PoS agents,” Kano said.

They were right. Within three years, their ₦400,000 investment had grown into ₦50 million ($35,700). “We gave really good customer service; people preferred coming to us rather than going to the bank.”

But customer service was only part of the story. Kano had another secret: he built what could be described as a mini Computer Village in Kano State, Nigeria. That was the first leg of their PoS journey — creating the very market they would later serve.

“There were a lot of people selling by the roadside; I got land, designed, and built shops for them. While some investors would disregard them and build shops they couldn’t afford, I saw their value.”

That value was cash flow — and plenty of it. Kano’s Computer Village eventually grew to nearly 1,000 sellers who needed banking services in a region where physical bank branches were scarce. Kano and Akintoye decided to step into that gap.

“I made it possible for them to deposit their cash with us for free instead of wasting so much time at the bank. Some sellers were depositing as much as ₦5 million ($3,570) a day, which meant I had enough liquidity for people who needed withdrawals.”

The genius of Kano’s PoS model wasn’t just creating a market; it was creating a market that trusted him.

He didn’t earn that trust only by becoming their landlord but also by legitimising their gadget businesses, which made them confident enough to entrust him with their money.

Victoria Fakiya – Senior Writer

Techpoint Digest

Make your startup impossible to overlook

Discover the proven system to pitch your startup to the media, and finally get noticed.

From PoS agent to fintech founder

Kano’s digital market still stands today, and if he had chosen to remain the designated PoS agent for the community, he would likely still be successful. But he and Akintoye wanted more. Together, they decided to launch a fintech company — BellBank Microfinance Bank.

“We knew we had to take it beyond being an agent. Even banks wanted us to open accounts and distribute ATM cards on their behalf, but we said ‘No, we want to build our own company.’”

Akintoye, now CTO of BellBank, holds a degree in computer science from the University of East London, UK, while Kano, the CEO, is no stranger to entrepreneurship.

Still, their motivation for starting BellBank wasn’t just rooted in their backgrounds; it was driven by a belief that Northern Nigeria desperately needs more financial inclusion.

“Despite the revolution fintech has brought, there are still rural people who remain financially excluded,” Kano said.

Financial inclusion has indeed come a long way in Nigeria, reaching 64% in 2023. Yet, clichés aside, the problem remains stark: 26% of adults — approximately 28 million people — are still excluded, most of whom reside in rural areas.

While Moniepoint and OPay have made significant strides, especially in urban centres, the gaps are obvious. According to the Nigerian Financial Service Market Report (2023), 21% of all PoS agents are located in Lagos, while 70% of unbanked adults live in rural areas where such services are needed the most.

To address this gap, BellBank is building a range of services from personal banking to business banking, and even banking-as-a-service. But their most striking innovation, designed specifically for the unbanked, is a smart speaker — their reimagining of the PoS device.

A new kind of PoS device: The BellBox

For Kano and Akintoye, PoS devices provided by agency banking heavyweights like Moniepoint and OPay are prohibitively expensive for many small traders.

“It costs over ₦80,000 (about $53) to get a PoS device,” Akintoye said. “It’s no surprise that not all traders in the country have one. The suya seller and akara seller don’t have PoS because it would cost Moniepoint too much money to give them one.”

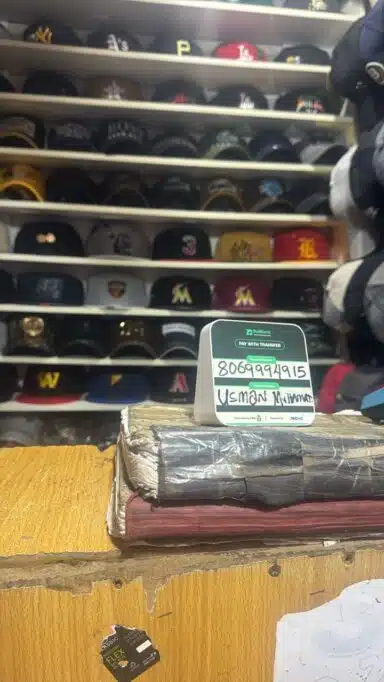

BellBank’s alternative for those who cannot afford a PoS device is the BellBox — a compact speaker that announces incoming payments to both seller and buyer. Instead of ₦80,000 ($53), it costs just ₦5,000 (about $3).

To illustrate its importance, Akintoye painted a familiar scenario: “Let’s say you buy something in a shop where there’s no PoS and you want to pay by transfer.

“They’ll probably have to go ask the shop owner if an alert has come through. With our BellBox, there’s no need to do that. Once payment is made, it announces it. There’s no need for a smartphone or the Internet.”

While the BellBox is a fresh innovation in Nigeria, it’s already common in China, where Kano and Akintoye drew their inspiration.

Known there as payment soundboxes, these devices give merchants instant voice alerts whenever a digital payment goes through — whether via QR codes, mobile wallets, or other cashless channels. For businesses handling dozens of transactions daily, they eliminate guesswork by confirming payments in real time.

But the obvious question is: How is this different from using a regular mobile phone for payment alerts? After all, most merchants already receive SMS or app notifications when transfers come in.

The founders argue that the BellBox is faster, more reliable, and designed for the realities of chaotic market environments where poor networks, noise, and missed messages often create problems.

In China, these devices are directly integrated into the country’s payment network, ensuring instant alerts. BellBank says it is leveraging the Zone Payment Network, designed to process payments faster than traditional switches.

Beyond speed, the BellBox also has some clear advantages. Its battery lasts up to seven days on a single charge, making it especially useful for traders in areas with erratic power supply.

How BellBank plans to make money

Like most fintech products, the BellBox isn’t just about solving a problem; it’s about building a sustainable business model. Merchants will pay a one-time fee of ₦5,000 (about $3) to acquire the device, followed by a monthly subscription of ₦1,000 (less than $1) for the services attached to it.

But the founders are also thinking bigger. BellBank could white-label the BellBox for other financial institutions that want to offer the device under their branding.

In practice, this means a traditional bank or another fintech could distribute its version of the BellBox, while BellBank powers the technology behind the scenes.

For BellBank, that creates a steady revenue stream through licensing fees and bulk orders. For the institutions, it’s a ready-made solution to strengthen relationships with merchants.

Over time, this mix of merchant subscriptions and institutional partnerships could make the BellBox both a consumer product and an enterprise solution, extending BellBank’s reach beyond its customer base.

Still, whether BellBank can replicate China’s success remains to be seen. Nigerian merchants and banks may embrace the soundbox, or it could struggle to find its place in a payments market already crowded with solutions.