Running out of funds before the next salary arrives is an experience most Nigerians can relate to, especially given that only 2% of the population earn more than ₦200,000 monthly. Another report even revealed that the number of people earning up to ₦500,000 dropped by 57% between 2023 and 2024.

This reality makes access to credit essential for many, positioning earned wage access (EWA) as a promising business in Nigeria. From PaidHR to Cadana, several startups already offer solutions in this space.

But after a personal experience that left him unable to access healthcare because his salary ran out before the month’s end, Temidayo Dauda decided to build his own EWA startup and called it DailyPay.

Speaking with Techpoint Africa, Dauda recalled the frustration of being unable to afford hospital bills despite earning well.

“I just lay there thinking to myself, ‘I work hard, I earn well; why should it be so difficult for me to take care of myself?’ It was really stressful for me, and I wished there was a way to access my salary.”

Although platforms like Earnipay and InCash already exist, Dauda’s solution comes with an interesting twist.

Why DailyPay pays daily

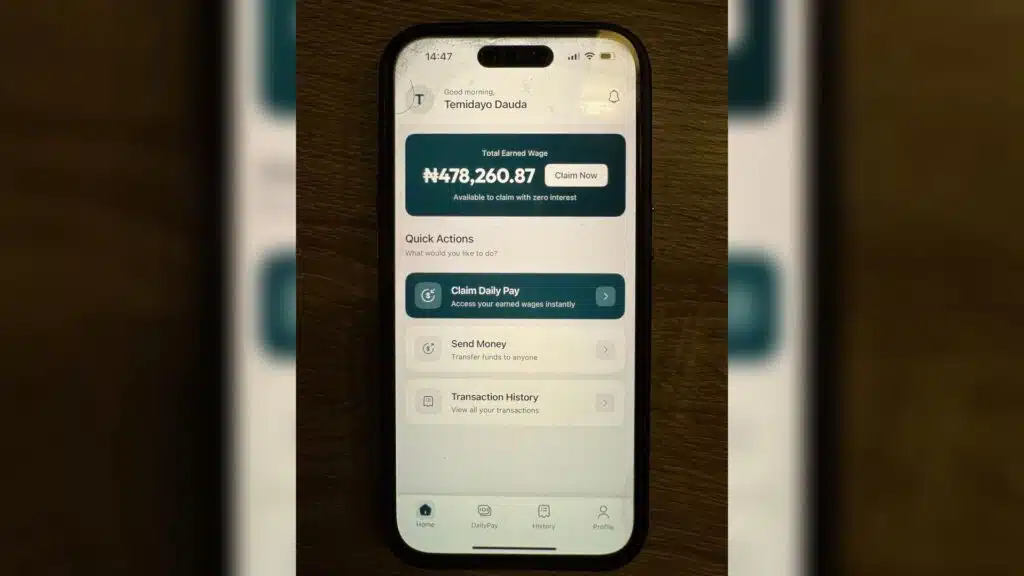

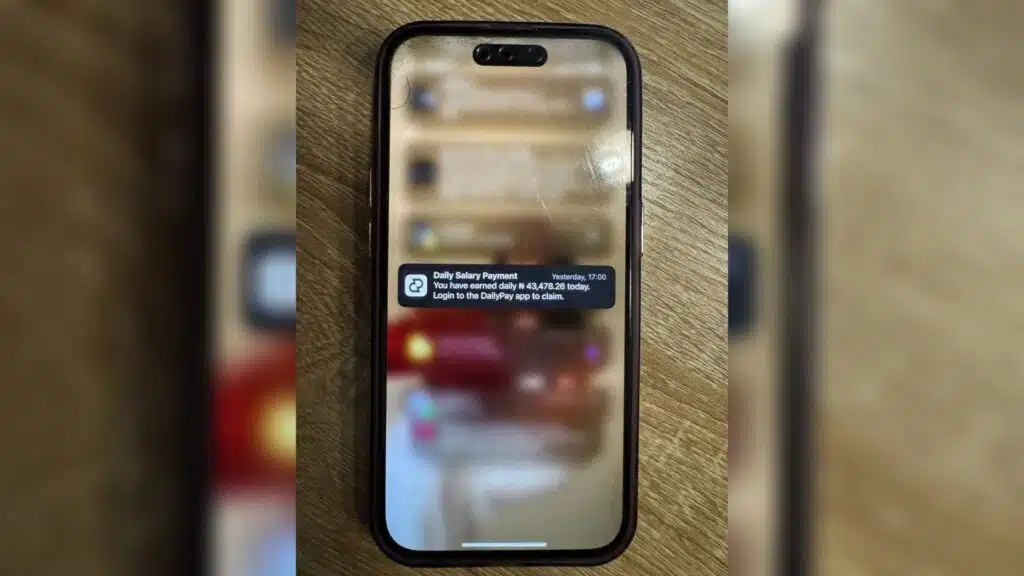

If you earn ₦1 million a month, DailyPay will send you a credit alert of ₦47,619 by 5 p.m. every workday— an interesting approach to salary access.

While seeing how much you’ve earned at the end of each day might be exciting, it’s not entirely new. What truly sets DailyPay apart is its business model. Unlike other EWA companies, such as PaidHR and SeamlessHR, that use a B2B approach, DailyPay is built entirely for employees.

“If you look around, you won’t find a financial institution dedicated to salary earners. If you work and earn a living, you should have a better quality of life. It’s beyond just earned wage access,” Dauda explained.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

The idea is simple: give employees complete control over how and when they access their salaries. In PaidHR’s case, for example, an employee can access 100% of their salary before payday by default, but the employer decides what percentage is actually available. DailyPay flips this dynamic, putting that power in the hands of the employee.

Still, the company takes precautions to minimise risk. When a salary earner signs up, DailyPay conducts KYC checks and reviews their employment and salary history, verifying payments through Mono. But it doesn’t stop there.

“We send a mandate to your hiring manager to confirm that you work for the organisation, that you earn the amount you claim, and to let them know you’ve authorised your salary to be paid into your DailyPay account,” Dauda said.

The mandate serves as a kind of three-factor authentication system, but more importantly, it helps DailyPay build a relationship with employers, even while maintaining an employee-first model.

Once all the details are verified and the employee switches their salary account to DailyPay, the daily payments begin.

Traction and growth

DailyPay is currently in its beta testing phase, with 500 users signed up — 50 of whom are already using the platform actively. According to Dauda, the feedback from these early adopters has been encouraging.

“We really believe we’re building something people genuinely want, so we don’t need unnecessary marketing. We haven’t even launched publicly, yet we’ve already gotten 500 users through word of mouth,” he said.

With this kind of organic traction, Dauda envisions impressive growth metrics — aiming for 50% user growth month-on-month. This ambitious projection isn’t based only on current momentum but also on a pipeline of complementary products that will strengthen DailyPay’s ecosystem.

The startup, which operates as a subsidiary of Wage Labs Limited, will eventually become one of several products under the digital bank. Its employee-first principle will shape these upcoming products, creating a sticky ecosystem designed to keep users within its network.

Making money

For now, DailyPay’s liquidity is provided by angel investors who’ve taken a bet on the company in exchange for a share of its revenue. Those revenues come from transaction fees deducted when employees claim their daily payments.

Dauda explained that these charges vary depending on how much is withdrawn and when.

“If you make a claim early in the month, the charge is higher; if it’s closer to payday, the charge is lower,” he said.

These charges are calculated using artificial intelligence (AI), and Dauda hinted that AI could soon play a much larger role in DailyPay’s operations. It’s not surprising — he also runs an AI startup called OrditAI, which he recently built.

“I’m a lawyer, but I’m also a software engineer. I’ve been in tech for a lot of years,” Dauda said.

Indeed, Dauda isn’t new to building products. He’s something of a serial entrepreneur, having previously launched a fintech called Swipe before venturing into the world of agentic AI with OrditAI — all while simultaneously building DailyPay.

Risk and challenges

DailyPay’s employee-first model is refreshing, but it also comes with significant risks. Unlike the B2B approach used by other startups, which reduces exposure and offers more control, DailyPay’s setup places it closer to the employee — and therefore closer to potential risk.

In the case of a company like PaidHR, which already has access to employer payroll systems, the chances of loss are minimal. DailyPay, on the other hand, could continue paying an employee’s daily wages for an entire month before discovering that the person has been fired or had their salary reduced.

“The frequency of these things happening is very low,” Dauda said.

Still, the possibility exists — and as the company scales, the likelihood increases. In such a case, Dauda explained, the unpaid balance would effectively become a loan to the employee. This, he added, is why building strong relationships with hiring managers is crucial, ensuring DailyPay receives updates about changes in employment status before it’s too late.

“One of the things we include in the mandate is for the employer to inform us if they’re letting an employee go,” Dauda said. “But we also can’t make it a liability on that business if they don’t inform us.”

Failing to get timely updates from employers could be costly. While DailyPay currently relies on angel investors for liquidity, any misuse or loss of those funds — for example, continuing to pay unemployed users — would be a serious hit.

Despite these risks, Dauda remains unfazed. His confidence in DailyPay’s model is unwavering, and he envisions great things for the company. The real test, however, will be how well DailyPay competes in a market dominated by players like PaidHR and SeamlessHR — both of which already have deep employer integrations and strong liquidity channels.