Lagos’ housing issue is a supply problem, and according to Era Iyayi, Founder of Citiliving, a Lagos proptech startup, “We cannot AI our way out of it.”

Iyayi makes a good point. According to the Federal Mortgage Bank of Nigeria, Nigeria’s housing deficit was estimated at over 28 million units as of 2023, increasing by 900,000 units annually.

In Lagos alone, more than 60% of the population lives in rented accommodation, often overcrowded and substandard.

Demand is outpacing supply so severely that property prices and rents have surged. Official figures place this spike at over 30%, but for an average resident like me, it has felt more like a 100% increase in the past year.

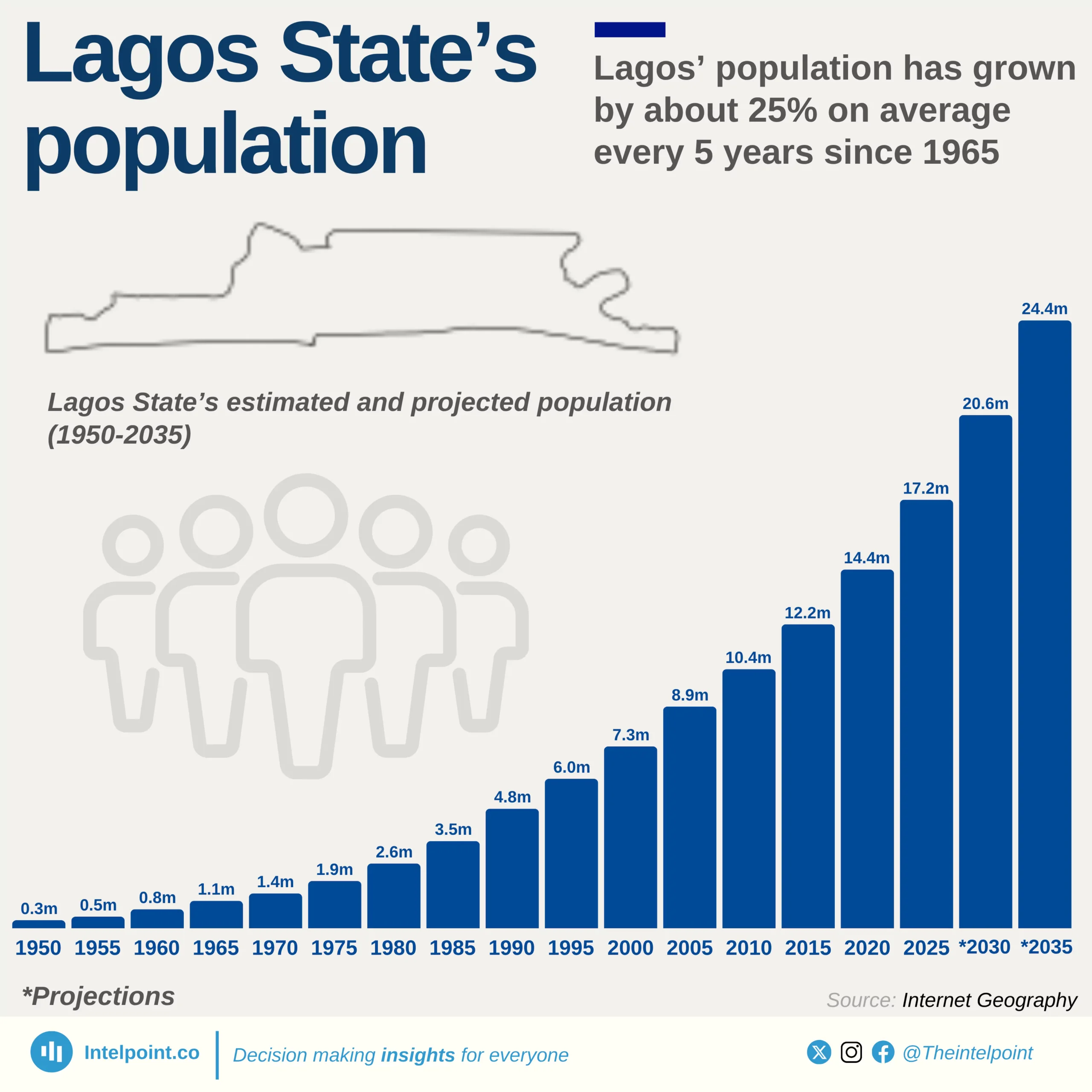

Lagos’ housing problem didn’t begin recently; it is a crisis decades in the making. One of the major drivers is rapid urbanisation.

According to Internet Geography, Lagos’ population grew 136% between 2000 and 2025, from 7.28 million to 17.6 million. Notably, these estimates are likely higher when accounting for the population of surrounding areas.

While low-cost housing was introduced under former Governor Lateef Jakande, the economic downturn of the 1980s and structural adjustment policies halted public investment and worsened overcrowding.

Government inconsistency, weak enforcement of planning regulations, forced evictions without resettlement, a bureaucratic land system, and a long-standing neglect of affordable housing have all compounded Lagos’ housing crisis.

Yet, somewhere in the gap between what is and what should be, a little-known startup is attempting something radical.

Victoria Fakiya – Senior Writer

Techpoint Digest

Make your startup impossible to overlook

Discover the proven system to pitch your startup to the media, and finally get noticed.

Unlike most proptech startups, Citiliving isn’t just listing homes or offering financial assistance to renters — it’s building them. Iyayi believes this daring move is the only real path forward.

Iyayi had a dream

Before Iyayi decided to build a startup that develops housing, he ran a consulting business. The idea for Citiliving emerged when a member of his staff needed to rent an apartment in Lagos.

The company gave her a loan to support her search, but after months of looking, she still couldn’t find anything matching her budget and lifestyle.

Her experience is all too familiar for many apartment hunters in Lagos. Even when you can afford the exorbitant rent, you either struggle to find a decent property or end up in a bidding war.

Iyayi became personally invested in her situation, even helping her search online. When all their efforts failed, it became clear to him that the problem wasn’t discovery — it was supply.

“There was no point in building another app to help people find houses that simply don’t exist,” he says. “The real solution is to build more homes.”

Though the idea for Citiliving came just over a year ago, Iyayi has since led the startup to build 47 housing units — 15 in Mende, Maryland, Lagos, and 32 in Katampe, Abuja — with additional sites currently under consideration.

The startup intentionally targets city-centre locations like Ikeja, Yaba, and Lekki, where demand is high and infrastructure is more reliable.

“We’re not in Iyana Ipaja or Kuje, not because those areas don’t matter,” Iyayi explains, “but because proximity to jobs, transit, and lifestyle amenities is what makes housing truly accessible.”

By the end of 2025, Citiliving aims to have 200 units at various stages of development.

How Citiliving gets the funding to build housing units

According to OME Construction, the estimated cost of building a standard two-bedroom bungalow in Nigeria is around ₦25 million ($15,995), depending on material quality, labour, and location.

This means that just 200 units of two-bedroom flats would cost Citiliving approximately ₦5 billion ($3.1 million) — and that’s before factoring in government fees.

To construct an average-sized two-bedroom bungalow in a prime Lagos location, developers should expect to pay between ₦100,000 ($64) and ₦500,000 in statutory fees, assuming the project does not require a costly Environmental Impact Assessment (EIA).

These fees include building plan approval assessment charges, which vary based on zoning classification (typically ₦150 to ₦320 per square metre), as well as application and registration costs (₦30,000), local planning office fees, and the mandatory 40% stage-by-stage payments required at different construction phases: foundation, structure, roofing, and finishing.

If the land is near water or a major road, developers may need to budget an additional ₦500,000 to ₦2 million for EIA and utility permits.

Surprisingly, Citiliving doesn’t directly pay to build these houses.

The company partners with landowners through joint ventures (JVs), offering them a share of completed units in return for access to strategic plots of land. “We don’t have a moneybag backing us,” Iyayi explains.

“What we have is clarity about the problem and a community of people who believe in the solution.” This JV model is backed by a growing pool of retail investors — many of them diaspora Nigerians — who purchase individual units off-plan.

“We use the funds from buyers to finance development,” he adds. “Once completed, we hand over the title, manage the property, and the investor begins to earn.”

Still, the process hasn’t been without its challenges; chief among them is trust.

That’s why Citiliving’s very first investment came from within Iyayi’s network.

“It was just a phone call to a friend,” he recalls. “That friend referred me to another friend I’ve never met. She made a 50% payment for a unit without even seeing me.”

But Iyayi knows he can’t rely on friend-of-a-friend referrals forever. As he puts it, “Truth is the foundation of our trust. If we can be truthful consistently, we will build trust.”

Tech is still needed

While Citiliving sees the housing crisis as fundamentally a supply problem, its tech platform plays a crucial role once the homes are built.

The company’s web-based platform serves as a central hub, enabling renters, investors, developers, realtors, and joint venture partners to connect seamlessly.

“Technology helps us scale trust,” says Iyayi.

“You can be in Canada and own a property in Lagos, monitor it, and earn from it — without ever visiting it.” The platform supports everything from credit checks on prospective tenants and automated rent collection to property management dashboards and verified listings.

This digital backbone enables Citiliving to operate transparently, tackling inefficiencies that have long plagued the rental process. For instance, it helps address greed, one of the supply crisis’ worst side effects.

Traditionally, renters in Lagos pay multiple fees: agency, agreement, and caution fees. Citiliving’s platform replaces these by a single, flat 10% administrative fee.

Buyers face similar issues. In one instance, an agent demanded ₦100 million to introduce Citiliving to a parcel of land.

“That’s not just a fee — it’s a barrier,” Iyayi notes.

Still, building homes while running a tech-enabled rental platform in Nigeria isn’t without its challenges.

A major one has been explaining the concept behind Citiliving. As Iyayi puts it, the company sits somewhere between a property developer and a proptech startup. The simplest way he frames it now is, “We’re simplifying the rental experience for everybody.”

Citiliving generates revenue through development sales, property management, and platform-enabled transactions.

It earns income when investors purchase newly built rental units — typically via joint ventures — and continues to generate recurring revenue by managing these properties on behalf of their owners.

The company charges a flat 10% administrative fee on rentals made through the platform, covering both agent and legal services. This effectively eliminates many of the traditional fees that burden tenants.

Additionally, Citiliving earns commissions from selling third-party developments and is building a pipeline of recurring income through service charges and maintenance for properties under its care.

Iyayi views competition in the proptech space through an unorthodox lens. For him, the problem is far too large for any one company to solve alone. “They crawled so we could walk,” he says, referring to the startups that came before Citiliving.

Perhaps Citiliving will succeed, allowing another startup to take off. But for now, Iyayi’s vision is clear: a young woman from Edo State or anywhere else in Nigeria should be able to get a job in Lagos, pull out her phone, find an apartment, pay for it, and move with ease.

It’s a lofty dream, and Citiliving needs all the help it can get. Rather than waste time looking for investors, Iyayi said he’ll use that resource to find customers. Exhibiting at the Lagos Startup Expo by Techpoint Africa, he hopes to find more people who will buy into the Citiliving dream.