Before ChatGPT turned artificial intelligence into a buzzword and gave startups a reason to slap AI on every feature, it was already quietly powering many of the products we use every day.

Google Maps, for instance, has been using AI to predict traffic and suggest the fastest routes since around 2008. In Nigeria, Aella, a fintech that joined Y Combinator a year after Paystack, has been using AI for lending since 2017.

Amazon CTO Werner Vogels even described what Aella was doing at the time as the future of banking.

During a call with Techpoint Africa, Aella’s former CTO, Wale Akanbi, recalled how the startup reduced the time it took to make lending decisions to just four minutes.

“To do this, we built machine learning tools. This was long before AI became what it is today. It was quite fascinating.”

Akanbi is bringing this same fascination with technology to his new startup, Bleyt, which solves cross-border transactions and remittances by allowing Nigerians to export their transaction and credit histories to countries they are immigrating to or simply visiting.

On the surface, Bleyt sounds like just another fintech, but for emigrants and frequent travellers — its target market — it is solving a problem in dire need of attention.

Foreign banks don’t trust Nigerians

Akanbi’s decision to build Bleyt was borne out of personal experience. “In 2021, I travelled to the UK with my family, and we could not spend money while we were there. I had to send naira to a friend who had been living there, and we used his card for payments throughout our stay.”

He tried to open a bank account in the UK, but was denied simply because of his country of origin. “They didn’t check my profile; that didn’t really matter. It was just about where I was coming from.

Victoria Fakiya – Senior Writer

Techpoint Digest

Make your startup impossible to overlook

Discover the proven system to pitch your startup to the media, and finally get noticed.

“I was even able to open a Wise account, but after some time, my account got flagged. I had to provide proof for a lot of things, and this took weeks.”

Akanbi had been observing these issues even before leaving Aella in 2021. As far back as 2019, purchasing items from foreign eCommerce platforms was a hassle. “We had to give our password to friends outside the country to buy things for us.”

He had always hoped someone would solve these problems, but when he realised that friends who had moved to the UK were still experiencing the same frustrations in 2024, he stopped waiting.

Other solutions have been built, and Akanbi admits this. “Yes, you can argue that there’s LemFi, MonieWorld, and Taptap Send, but they’re not solving the problem. You still need a first-party deposit.

“The money coming into my LemFi account, for example, must come from a bank account that holds my name, but I can’t even open an account in the first place.”

How Bleyt works

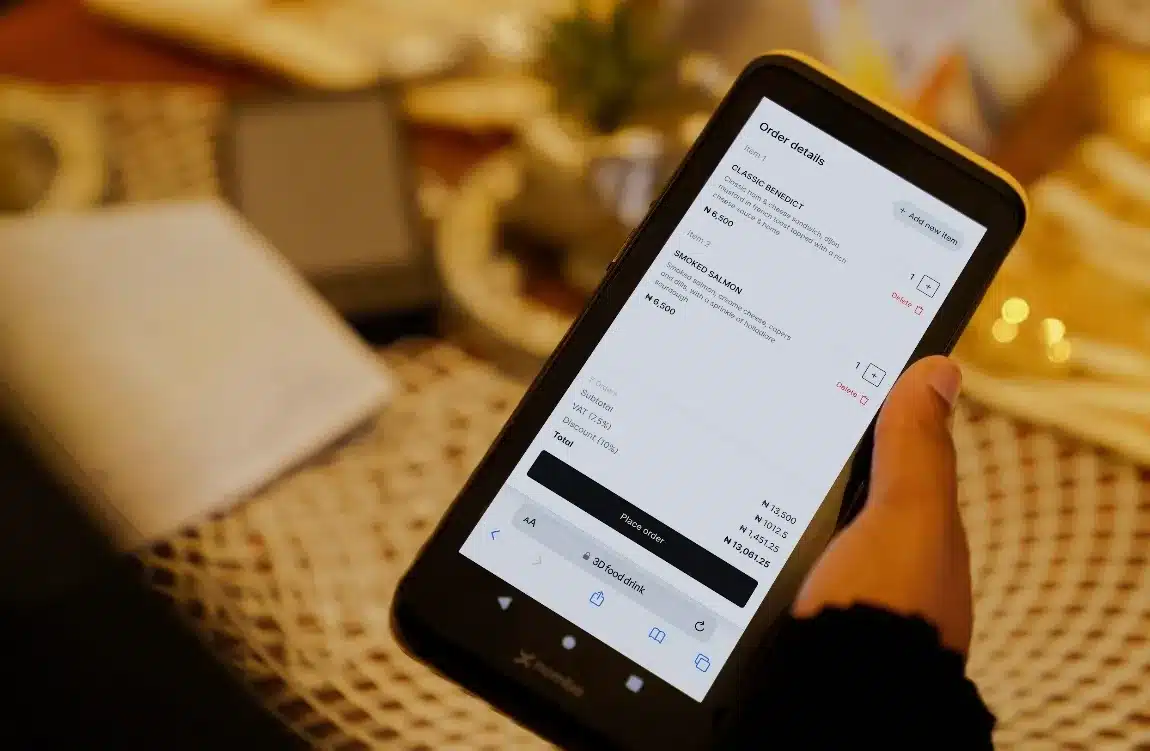

When users sign up on Bleyt, they gain access to multiple accounts that support various currencies, including the naira, dollar, and pound. Unlike other platforms, Bleyt users can spend naira in Nigeria, and when they travel abroad, the platform automatically detects the location change, allowing them to continue spending as though they had never left.

“You get all these currencies and a virtual card instantly, which means you can shop online from Nigeria, and when you travel, you can tap to pay.”

This seamless experience is possible because Bleyt requests users’ financial data after sign-up. Once consent is given, the platform can analyse spending patterns and financial habits.

“Once we have your consent, we’re able to create a credit profile for you.”

This credit profile is crucial. For a Nigerian moving to the US, for example, it means they don’t have to build a credit history from scratch. Instead, they pick up where they left off in Nigeria, making it much easier to access credit upon arrival.

“Instead of waiting six months to prove your creditworthiness in that country, you get access instantly because we’re able to port your credit and transaction history to that new country.”

Of course, making this possible is no easy task. Bleyt must form partnerships with lenders in different countries while navigating regulations in those markets, a challenge Akanbi admits has been one of the toughest parts of building the platform. But it is also what sets Bleyt apart from its competitors.

Stablecoins and AI in the background

Having successfully built an AI-powered lending product in 2017, Akanbi is deploying the same technology in 2025. “We’re using AI to create the underwriting part of the credit.” Just as with Aella, AI can sift through a person’s financial records and quickly create a credit profile.

However, while AI drives underwriting, it is stablecoins that make cross-border transactions possible for Bleyt. In 2025, stablecoins have become one of the hottest topics in global finance.

From Circle onboarding fintechs like Flutterwave and Onafriq into its Circle Payment Network to Nigeria’s Securities and Exchange Commission (SEC) formally recognising their importance, stablecoins are moving rapidly into the mainstream.

“While people batch money together or use SWIFT (Society for Worldwide Interbank Financial Telecommunication), we move money in real time using stablecoins.

“The customer does not interact with stablecoins, but we’re able to on-ramp and off-ramp across different countries.”

Stablecoins don’t just make cross-border payments possible — they also make them cheaper, giving Bleyt another competitive advantage. Akanbi argues that many fintech platforms bake extra fees into their transactions.

“They have a lot of middlemen and banking partners in between them.”

He explained that these fintechs often make money by hiking exchange rates. “It is lower with stablecoins. We don’t have as many middlemen, so we can give users more money.”

A product needed by 54,000 people

Bleyt is still in beta, but Akanbi plans a full launch in October 2025. The waitlist alone has shown the scale of demand: 54,000 people signed up within three months to join the beta test. “It was overwhelming,” Akanbi said.

So far, Bleyt has been fully bootstrapped, though a pre-seed funding round is now underway. The team is also integrating with new partners that can support a larger user base after launch, and has secured a Money Service Business (MSB) licence in Canada.

For now, Bleyt’s revenue will come from transaction fees. But Akanbi has bigger plans. Long term, lending will become a core feature of the platform, enabling Nigerian immigrants to do much more than send money — including buying homes abroad with the credit history and financial footprint they build through Bleyt.