In a major step toward strengthening Nigeria’s digital payment ecosystem, Strowallet Digital Services Limited has unveiled its card issuing infrastructure designed for fintech startups, microfinance institutions, and microfinance banks. The new solution enables partners to issue both physical and virtual cards in record time, dramatically reducing launch periods from several months to just days.

With the new platform, partners can issue Physical Naira ATM Cards for everyday cash withdrawals and in-store payments, create Virtual Naira Cards for secure local online transactions, and generate Virtual Dollar Cards for international payments, subscriptions, and e-commerce.

The service is accessible in two ways via API for seamless integration into existing banking systems or through Strowallet’s intuitive dashboard, tailored for non-technical institutions that need a straightforward way to issue cards.

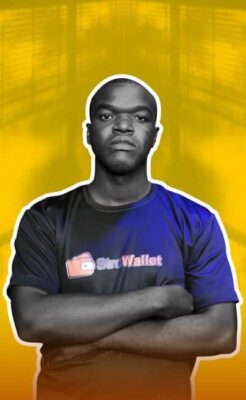

According to Oseni Jamiu, CEO of Strowallet Digital Services Limited, the company’s focus is on enabling financial institutions to serve their customers better without worrying about the complexities of card issuance.

“We built this to empower other fintechs and microfinance banks to focus on their customers, while we handle the heavy lifting of card issuing,” Jamiu said. “Our goal is to make world-class payment solutions accessible to every institution, big or small.”

Strowallet’s infrastructure is already making an impact, with early adopters reporting significant efficiency gains in their product rollout timelines. This positions the company as a key player in Nigeria’s evolving fintech landscape, where speed, compliance, and reliability are crucial to staying competitive.

About Strowallet

Strowallet Digital Services Limited is a Nigerian fintech company offering virtual bank accounts, card issuing services, and API-based payment solutions. By partnering with licensed banks, the company ensures that its services meet strict compliance requirements while offering nationwide coverage. Strowallet’s mission is to make advanced financial services accessible to individuals, SMEs, and financial institutions across Africa.

For more information you can visit their official website.