Platnova, one of Nigeria’s fastest-growing fintech platforms, is proudly celebrating its second anniversary — marking two years of innovation, customer-centric growth, and global impact.

Since its launch in 2023, Platnova has remained committed to its mission of providing Africans, both on the continent and in the diaspora, with access to global financial services. Since its launch in 2023, Platnova has remained committed to its mission of providing Africans In just two years, the platform has evolved into a dynamic lifestyle finance ecosystem, serving users in over 13 countries and evolved into a dynamic lifestyle finance ecosystem, helping them transact, connect, and thrive.

“From day one, we wanted to create more than just a money transfer app. We wanted to build a financial lifestyle brand — one that bridges the gap to global financial services and provides these services with the utmost ease and seamlessness,” said Benjamin Oyemolan, CEO of Platnova.

Recognized as the Fastest fastest-growing fintech startup in Nigeria, Platnova has proven its ability to scale quickly while staying deeply connected to user needs, especially in a region where infrastructure, regulation, and currency volatility present ongoing challenges.

Redefining Financial Access with Everyday Solutions

At the heart of Platnova’s success is its powerful multi-currency capability, which allows users to send and receive money in over 13 different currencies across 50+ countries. This feature has empowered individuals, freelancers, families, and business owners to break down financial borders, transact in real-time, and access global opportunities from anywhere.

A standout product in Platnova’s offering is Vault — an innovative savings feature that allows users to grow their funds in four major currencies: Dollars, Euros, Pounds, and Naira. Vault is the first of its kind in the market to offer a unified multi-currency savings experience with an exceptional 15.5% ROI across all currencies.

This has given users the ability to build wealth intentionally while hedging against local currency volatility.

Platnova also provides virtual cards for smooth and secure global payments, enabling users to shop internationally, pay for subscriptions, and manage recurring expenses with ease. For users who prefer physical payment tools, Platnova’s physical debit cards are more than just for spending — they support budgeting and savings, helping users track expenses and control spending while still offering global access.

But Platnova didn’t stop at payments. It also delivers lifestyle convenience through a wide range of in-app services, including flight bookings, hotel reservations, restaurant deals, and international experiences, making it a one-stop platform for both financial management and lifestyle planning. Users now rely on Platnova not just for transactions, but for travel, relaxation, and everyday convenience.

Most recently, the company launched its highly anticipated USD Account, allowing users in Africa to receive, hold, and send USD instantly. With this feature, Platnova has introduced one of the fastest and most seamless dollar payment solutions available in the market today. It has already transformed how individuals, freelancers, remote workers, and digital entrepreneurs across the continent manage cross-border income.

Celebrating Recognition and Global Accolades

Over the last year, Platnova’s bold innovations and user-focused strategy have been recognized across the tech and fintech industry. The company was awarded the Most Innovative Fintech of the Year and won the regional finals at the Tech Unite Africa Startup World Cup, going on to emerge as second runner-up globally at the Startup World Cup Grand Finale in San Francisco.

These honors reflect not just the platform’s impact but also the growing global relevance of African-led financial innovation.

Platnova’s user base and platform activity have grown exponentially over the past months. The app has surpassed 100,000 downloads, with over 90,000 verified users actively transacting across its suite of features. In 2024 alone, Platnova participated in over 10 prominent fintech and tech events and sponsored high-impact innovation initiatives, further cementing its place as one of the fastest-growing fintech startups in Nigeria and Africa.

A New Space for a New Chapter

Another significant milestone for Platnova is its new corporate office— a dynamic, future-ready space designed to inspire innovation, collaboration, and community. The office launch was held in tandem with the 2nd anniversary campaign, symbolizing the brand’s growth and its readiness for the next phase of expansion.

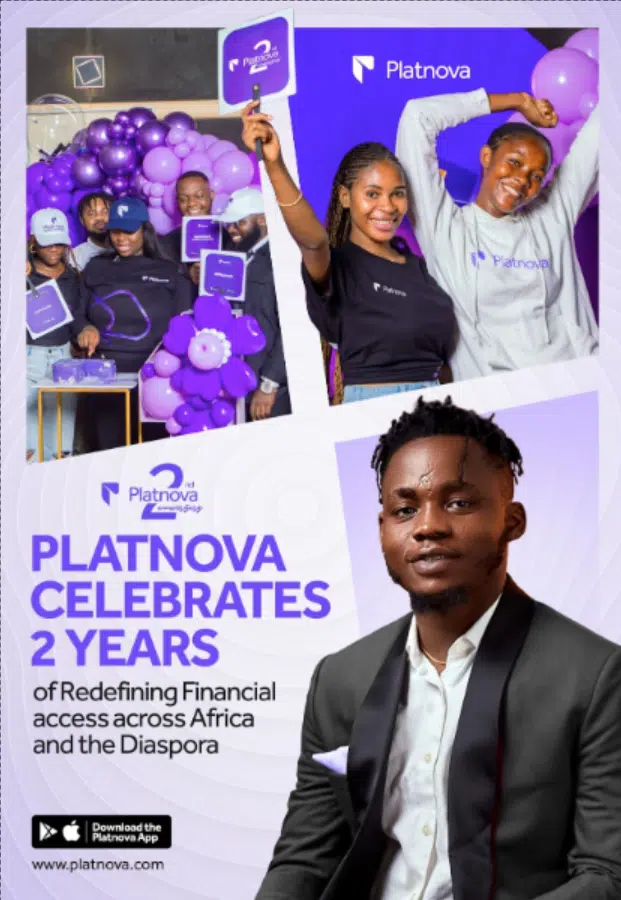

To mark the occasion, Platnova hosted a lively in-house celebration at its new office with its team, stakeholders, and community members, including its most active users, top referrers, loyal customers, and a few notable celebrities and influencers who have supported the brand’s journey. The event was not just a party but a heartfelt thank-you to those who helped shape the Platnova story.

To commemorate the anniversary, Platnova launched a 10-day campaign from April 21 to May 1, designed to celebrate its community and reward users through fun, impactful activities. The campaign’s highlight was the 10-day Zero Transfer offer, where all users could send money for free — a symbolic gesture of appreciation from the brand to its growing community.

What’s Next for Platnova?

Platnova’s third year will focus on expanding globally, deepening lifestyle partnerships, and launching new features based on user feedback. The platform plans to integrate even more global services, improve user onboarding and transaction speed, and strengthen security across all digital touchpoints.

Above all, Platnova’s team remains deeply grateful to its users — the students, freelancers, families, creators, and small businesses that have made this journey worthwhile. Every transaction, referral, story, and review has helped Platnova evolve into what it is today.

“We built Platnova for the people — and it’s the people who made it work. Thank you for trusting us, growing with us, and choosing us every day,” said Benjamin Oyemolan, Platnova’s CEO.

About Platnova

Platnova is a global financial lifestyle platform built to help Africans at home and in the diaspora move money, manage finances, and access global services with ease. With support for 13+ currencies and operations in over 50 countries, Platnova offers multi-currency wallets, virtual cards, lifestyle bookings, crypto tools, bill payments, and more — all from one simple and secure app.