OneDosh today announced the launch of its cross-border payments platform in the United States and Nigeria, activating its first major payment corridor and marking a significant step toward a truly borderless global financial system. The service is now live across 49 U.S. states, with New York coming soon.

For decades, cross-border payments have remained slow, expensive, and misaligned with how people live and work today. While commerce, careers, and communities have become global, financial systems have largely remained local. OneDosh was built to close this gap by providing modern financial infrastructure designed for speed, transparency, and global use from day one.

Powered by asset-backed stablecoin technology, OneDosh enables individuals and businesses to send, receive, spend, and convert money across borders in seconds, delivering real-time exchange rates and eliminating many of the frictions associated with traditional banking systems. The platform combines modern digital architecture with enterprise-grade compliance, robust KYC processes, and transparent security standards.

“Financial access should not be limited by geography,” said Jackson Ukuevo, Co-founder of OneDosh. “People already live global lives. OneDosh is built to ensure their money can move as freely as they do, supporting global work, global families, and global commerce.”

Designed for the realities of the modern global economy, OneDoshsupports freelancers working across borders, professionals sending money between continents, and businesses operating in multiple markets. These use cases are no longer exceptions but increasingly represent the global norm, and OneDoshis built to serve them at scale.

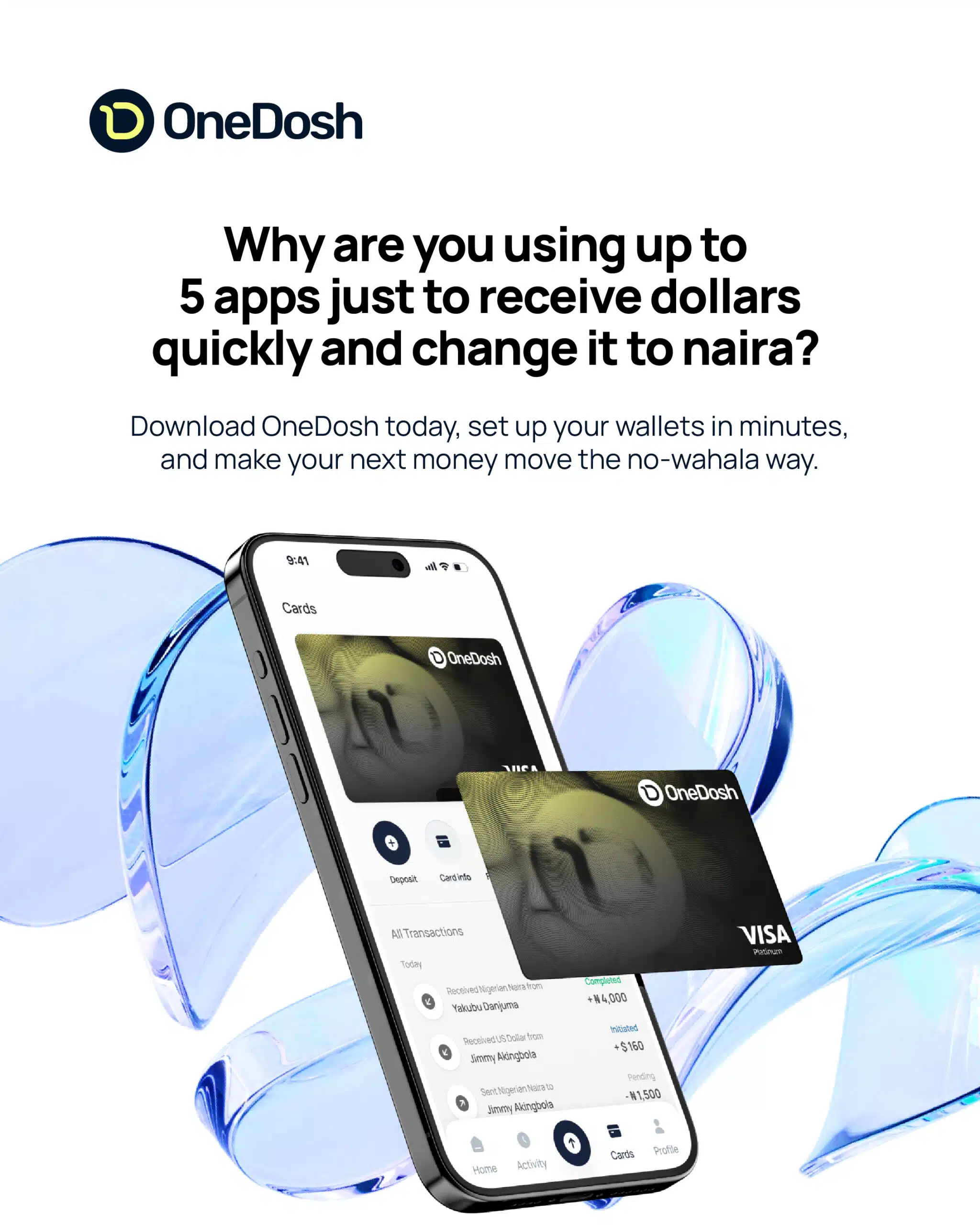

The OneDosh mobile app is available on iOS and Android, offering instant transfers, real-time foreign exchange, a global USD card compatible with Apple Pay and Google Pay, and 24/7 AI-powered customer support. With regulatory clarity and bank-grade compliance at its core, the company is positioned to scale responsibly while expanding access to efficient cross-border financial services.

Today’s launch marks the beginning of OneDosh’s global expansion. The company plans to extend its network across Sub-Saharan Africa, North America, the United Kingdom, Latin America, the UAE, Europe, and Asia, with the goal of making international money movement as simple and seamless as sending a message.

OneDosh is a financial technology company building modern infrastructure for instant, transparent, and borderless payments. Headquartered in New York City with its first African corridor in Nigeria, the company uses stablecoin technology to help individuals and businesses move money globally with speed, clarity, and trust.