OhentPay, a remittance platform serving Nigerians abroad, has released its 2025 UK–Nigeria Remittance Report, revealing how family support obligations — often called ‘Black tax’ — influence financial planning among Nigerians in the diaspora.

The report surveys 655 Nigerians across the UK to examine the weight of black tax. The findings reveal not only how much people send, but who receives it, what it costs the sender, and how a new generation is beginning to challenge traditional expectations.

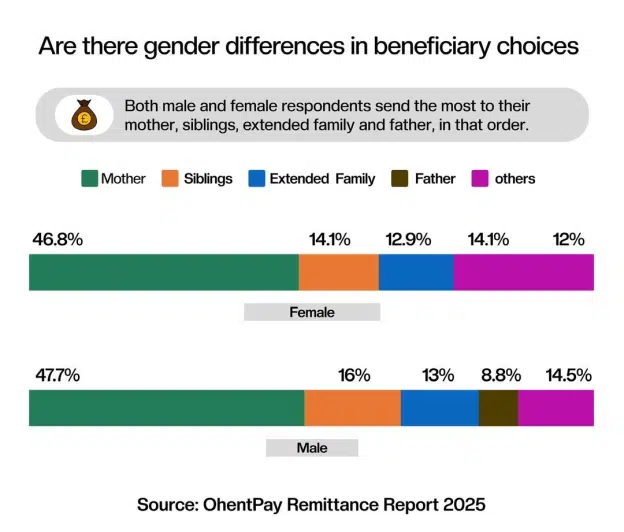

According to the report, 51.4 percent of all large transfers go to mothers. Siblings follow at 12.9 percent, with fathers and extended family members receiving smaller shares.

Even for smaller amounts below £100, mothers and siblings remain the primary recipients. Extended family members receive a modestly higher share at this level.

This reflects deep-rooted family patterns in Nigerian culture, where adult children often prioritise their mothers’ wellbeing. However, “comfortable” is a relative term: ongoing household expenses such as generator repairs, medical bills, or school fees frequently increase the need for continued support.

The report also shows that women are slightly more likely than men to support extended family members, including aunts, uncles, and cousins. The gender dynamics of caregiving back home often mirror those seen in diaspora communities, with women assuming a larger share of both emotional and financial responsibility.

The study also found that 28% of respondents said that supporting family in Nigeria directly affects how much they can save or invest, while 15 percent have postponed major life decisions such as buying a home, getting married, or starting a business because family obligations take precedence.

Higher earners report the greatest strain. Among Nigerians earning above £125,000 annually, the proportion sending over £1,000 per month is significantly higher than in other income groups. This creates a paradox: the more people earn, the greater the expectation to send, with no clear end point to these commitments.

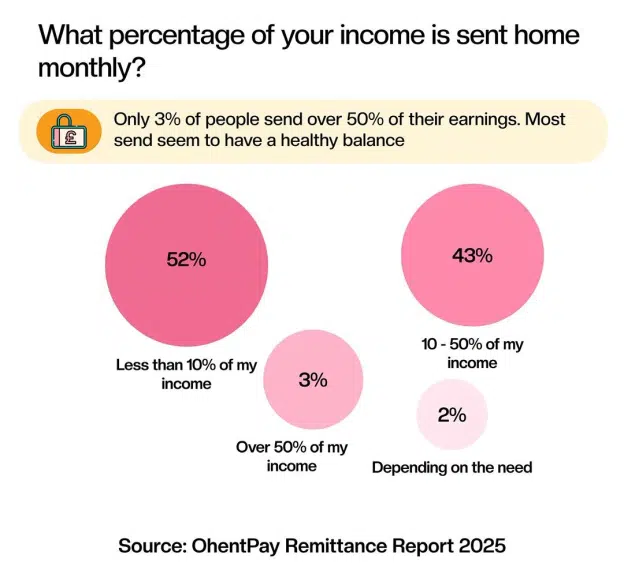

The report also reveal that among Nigerians surveyed, aged 18 to 28, 54 percent send between 10 and 50 percent of their income home — the highest proportion of any age group. Many are recent graduates in entry-level jobs, living in shared accommodation and managing tight budgets, yet still supporting dependents in Nigeria.

By contrast, most respondents aged 29 to 60 now send less than 10 percent of their income home. This group often balances responsibilities in the UK — mortgages, childcare, education — with continuing family support in Nigeria. Among respondents aged 61 to 79, 11 percent send more than half of their income, often from pensions or savings, either as family support or as part of retirement planning back home.

Get the report

The OhentPay UK–Nigeria Remittance Report 2025 offers a data-driven view of how Nigerians abroad earn, send, and spend — revealing an evolving relationship between culture, income, and obligation.

For the full report, visit ohentpay.com/report2025.