Despite all the progress made in Nigeria’s financial services sector over the last two decades,many of the transactions conducted within the country remain dependent on cash — from transportation to shopping.

For the Nigerian returning for the holidays, the expat relocating for work, or the digital nomad exploring Lagos, this presents some issues. The traditional options, such as attempting to get cash from bureau de change (BDC) operators or carrying bulky envelopes of cash, are a sharp contrast to the digital-first experience they are often used to.

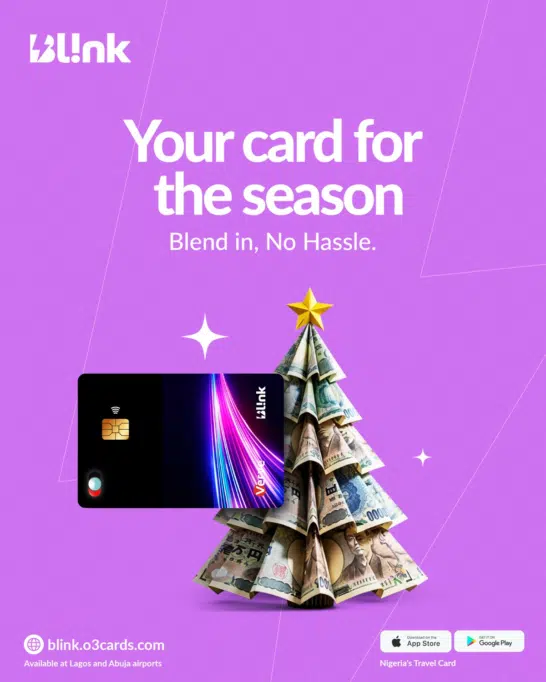

This is the gap that BL!NK is designed to bridge. Rather than navigating the uncertainty of the parallel market or waiting days for international bank transfers to clear, BL!NK provides visitors to the country with a travel card that offers instant access to naira the moment they touch down. No long queues, phone calls to relatives and friends, or haggling over parallel market rates.

Explaining the motivation behind the creation of the BL!NK Card, Abimbola Pinheiro, CEO of 03 Capital, noted that the 2024 Detty December period revealed that accessing naira after arriving in the country was a major challenge for foreign travellers hence the decision to create a card that catered to this group.

“BL!NK was created to remove the stress of foreign exchange, eliminate the difficulty of spending like a local, and ensure seamless merchant acceptance without concerns around chargebacks, disputes, or settlement,” he said.

Powered by world-class infrastructure

A product of O3 Capital, Nigeria’s first non-bank credit card issuer, the BL!NK card is powered by world-class financial infrastructure. As Nigeria’s first non-bank credit card issuer with over a decade of experience, O3 Capital provides the institutional muscle required to connect to local payment rails in real time.

A partnership with local card scheme Verve ensures users have access to a card that can be used at over 40 million merchants and ATMs nationwide, effectively removing the last-mile friction of domestic spending.

For the traveller, this means the BL!NK card isn’t just a temporary store of value. Depending on their needs, users are tapping into the same robust framework that supports O3’s diverse portfolio. This flexibility allows travellers to scale their spending from simple airport transfers to high-end hospitality and corporate expenses without the usual hurdles of traditional banking.

The infrastructure further expands through an alliance with American Express, offering a bridge for those who require international lifestyle benefits.

By leveraging the Amex Green, Gold, and Platinum frameworks, BL!NK users can combine Verve’s local ubiquity with American Express’s global prestige. So whether you are paying a local vendor in a Lagos market or booking a luxury suite, the transaction is backed by a secure, transparent, and highly regulated financial backbone.

Beyond seamless integration into the financial system, the 03 Capital team also focused on enhancing the overall visitor experience.

Recognising that many users are first-time visitors, the BL!NK Card is designed to help them settle in more easily by supporting lifestyle needs. Cardholders can discover scenic and iconic destinations, explore food recommendations, and stay informed about local events across the country.

“From the start, I was clear that BL!NK could not be just another fintech solution. Money only matters when it enables experiences — where you stay, how you move, where you eat, and how you connect. By embedding lifestyle into BL!NK, we’re building a product that fits naturally into how people actually experience Nigeria,” he noted.

Why this matters

In the past, the traveler’s checklist was simple: passport, ticket, and a thick envelope of cash. Today, that narrative is shifting toward a digital-first reality.

With the launch of the BL!NK card, the goal is to replace that physical friction with seamless access. BL!NK ensures that before a passenger even boards their flight, financial access is already secured.

From the Classic Verve card with its ₦100,000 entry limit to the Business and Corporate tiers reaching ₦5,000,000, O3 Capital’s ecosystem is built for scale and accessibility. The cards are available as either virtual cards used within the app or physical cards that can be picked up at any airport across Nigeria. Ultimately, this is about expanding economic participation. When travellers have unfettered access to local financial systems, the benefits trickle down directly to small businesses, allowing them to capture seasonal spending that was once deterred by the friction of legacy payments.