Back in 2021, Octavia Securities wasn’t building a fintech product. Its focus was security, specifically the headaches of managing the constant flow of residents, workers, and visitors across Lagos’s growing gated estates. The DNI Security App was designed to bring order to estate check-ins and check-outs at a time when urban migration and remote work fueled demand for safer communities.

It worked. But another problem was hiding in plain sight: payments. Every subscription fee from residents was processed through third-party gateways, with charges that steadily eroded margins. As transaction volumes rose, the costs became impossible to ignore.

“At first, the goal wasn’t to become a fintech company, it was simply to stop depending on someone else’s rails.” recalls Kenechukwu Uche, Co-founder and CMO at DNI Pay.

Discovering the Bigger Opportunity

Through the leadership of CTO Israel Omotayo, the team rebuilt its backend to process payments independently. That move not only cut costs but also proved something bigger: if their infrastructure could reliably settle estate dues, it could just as easily handle everyday payments at scale.

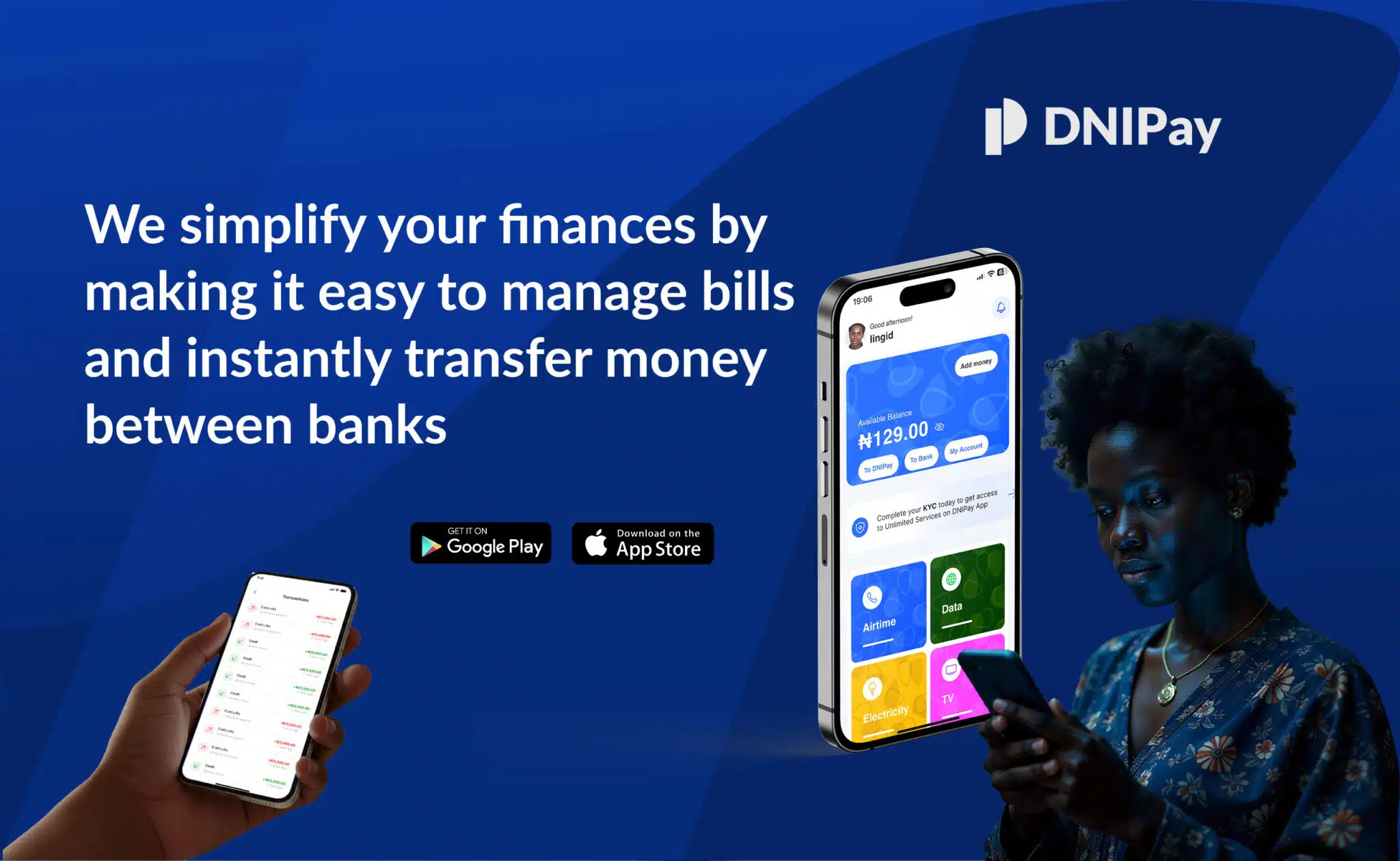

By early 2024, the company took the leap launching DNI Pay, a payment app built to make local transfers instant, reliable, and stress-free.

Betting on Everyday Transactions

While many Nigerian fintechs chase the billions flowing in from international remittances, DNI Pay is doubling down on the country’s overlooked backbone: small, frequent local payments.

“Every week, millions of Nigerians send ₦2,000 here, ₦5,000 there for food, transport, school fees, or daily allowances,” Kene explains. “These are the transactions people depend on most, yet they’re still plagued by delays, failed confirmations, and hidden fees.”

Nigeria’s domestic payments market processed ₦100 trillion ($220B) in 2023, yet friction remains a daily pain. DNI Pay’s bet is that fixing these small, everyday moments could unlock more value than any flashy add-on.

Stripping Down to What Matters

Instead of chasing dozens of features, DNI Pay delivers just four:

Send money

Receive money

Top up a wallet

Withdraw funds

No complex dashboards. No confusing extras. Just fast, low-cost transfers that work when users need them.

“In 2025, nobody should be waiting for a simple ₦2,500 transfer to reflect,” Kene says. “We want to set the standard where local transfers are instant and eventually free.”

Building Through Trust and Community

DNI Pay isn’t starting from zero. Its first adopters are the very estate residents already familiar with its security platform. That trust gives the team a ready-made launchpad and a powerful feedback loop.

“We’re not guessing what users want, we’re asking them directly,” says Kene. Through estate meetings and town hall sessions, users share frustrations and shape the roadmap. “Until they request it, we won’t add it.”

Scaling With Caution

Rather than racing for venture capital, DNI Pay is moving deliberately. The next 12 months are focused on fine-tuning operations and proving the model works sustainably before chasing scale.

CEO Olayinka Olaoye puts it plainly: “We want DNI Pay to be remembered as Zelle for Africa.”

The strategy is to keep expanding estate by estate, community by community, until seamless peer-to-peer transfers become the default.

The Bigger Picture

Nigeria’s fintech space is crowded, but gaps remain. For millions, the most basic act of moving small sums still feels broken. DNI Pay’s journey shows that innovation doesn’t always start with global ambition; it often begins by solving the problems at your own doorstep.

If the team succeeds, it won’t just be estate residents who benefit. It could be anyone trying to move money across Nigeria quickly, reliably, and without the usual stress.

As CEO Olayinka puts it, the ambition is clear: “We want people to recall this product as Zelle for Africa.”

DNI Pay is available on the Apple App Store and Google Play Store.