Y Combinator-backed fintech extends enterprise finance management platform with mobile-first solution for field operations

Bujeti, the Y Combinator-backed financial operations platform serving over 5,000 finance professionals across Nigeria and Kenya, has launched its mobile application, enabling businesses to manage expenses, approvals, payments, and more directly from smartphones.

The launch extends the company’s web-based platform, operational since 2022, to address a critical gap for African businesses whose operations increasingly happen beyond traditional offices.

“Business operations don’t stop when people close their laptops,” explained Titilayo Akinjogunla, Head of Product Marketing at Bujeti. “Our clients told us their sales teams, logistics managers, and operations leaders needed the ability to execute financial transactions on the move, without creating reconciliation headaches for finance teams back at headquarters.”

Solving the multi-platform problem

The mobile app responds to specific feedback from Bujeti’s client base. While companies used Bujeti’s web dashboard for comprehensive financial management—budgeting, policy setup, detailed reporting—field teams resorted to separate banking apps for urgent payments, creating fragmented workflows.

“We use Bujeti for everything on the web, but when our sales reps are on the ground, they have to use a different app to make payments,” one client explained. “Then we spend hours reconciling everything back into Bujeti.”

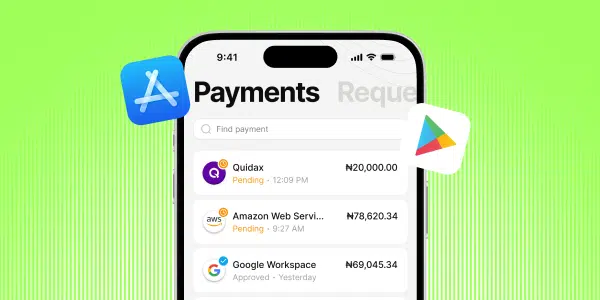

The new mobile application eliminates this fragmentation by enabling five core functions optimized for mobile use: fund requests, payment approvals, money transfers, receipt capture, and real-time transaction tracking. All actions sync instantly with Bujeti’s web platform, providing unified visibility across the organization.

A field representative paying a vendor at 2:47 PM triggers immediate visibility on the finance manager’s web dashboard, with receipt automatically attached, budget updated, and transaction categorized.

Strategic feature selection

Notably, Bujeti’s mobile app does not replicate every feature available on the web platform. Functions like budget creation, approval workflow configuration, detailed financial reporting, and team management remain web-exclusive.

This design choice reflects the company’s understanding of mobile use cases. “When you’re setting up budgets or building approval workflows, you need time and space to think,” Akinjogunla noted. “When you’re on the ground and a vendor needs payment now, you need speed.”

“I’m an operator and I’m always on the go—this helps me,” said Seyi William Ogunbiyi, Selar’s Chief Operating Officer, reflecting the target user profile: business leaders who need immediate financial control without laptop access.

The mobile app supports creation of virtual and physical corporate cards, receipt management with photo capture, and configurable approval workflows for employee expenses. These capabilities serve businesses across sectors including logistics, healthcare, agriculture, and construction, and technology—industries where significant business activity occurs in the field.

Africa’s mobile-first opportunity

The timing aligns with Africa’s digital economy trends. According to GSMA’s Mobile Economy Africa 2025 report, the mobile sector contributed $220 billion to Africa’s GDP in 2024, representing 7.7% of economic output. This is projected to reach $270 billion by 2030, driven by 5G deployment, AI integration, and smartphone adoption.

Mobile subscribers are expected to approach 915 million by 2030, up from 710 million in 2024. The trajectory indicates substantial growth potential for mobile-enabled business services.

Finance applications show particularly strong adoption in Sub-Saharan Africa, with sustained year-over-year growth in app installs reflecting appetite for mobile-delivered financial services.

Expanding Bujeti’s reach

The mobile launch extends Bujeti’s addressable market beyond finance teams to operational roles that rarely access web dashboards but handle daily financial transactions: procurement officers negotiating with suppliers, project managers tracking field expenses, regional directors approving vendor payments while traveling.

Bujeti has established significant traction since its founding. The company secured $2 million in seed funding from Y Combinator and recently formalized a strategic partnership with Nigeria’s Small and Medium Enterprises Development Agency (SMEDAN) to digitize thousands of Nigerian SMEs.

The platform’s all-in-one finance management capabilities include corporate card issuance with customizable spend limits, automated bulk vendor payments in multiple currencies, expense policy enforcement by team or project, tax management, and automated reconciliation with integrations to tools like QuickBooks, Google Sheets, and Slack.

Notably, Bujeti’s all inclusive suite of products largely outranks other financial management platforms in Africa in scope, capabilities, and reach. The company knows this well, and fittingly describes itself as the Finance Control Centre for African businesses.

Clients including Selar and Autogirl have adopted Bujeti’s spend control systems, with Autogirl’s CEO crediting the platform with transforming operational efficiency. The mobile app builds on this foundation by bringing the same level of control to distributed teams.

Addressing reconciliation fatigue

For African businesses navigating complex multi-currency operations and evolving tax compliance requirements, the mobile app promises to reduce a specific operational burden: end-of-month reconciliation of scattered payment data.

“Your team shouldn’t have to use one app for operations and another for finance management, then spend hours reconciling the two,” Bujeti’s product documentation states. “Everything happens in Bujeti, whether web or mobile.”

The instant synchronization between mobile and web platforms means finance teams maintain real-time visibility into company spending regardless of where transactions originate. This unified approach addresses a challenge that has constrained digital transformation efforts at many African SMEs and enterprises.

Getting started

The Bujeti mobile app is available on iOS App Store and Google Play Store. Existing users can log in with current credentials and access all budgets, accounts, transactions, and approvals immediately. New businesses can request product demonstrations at bujeti.com.

The mobile launch represents Bujeti’s evolution to a comprehensive, cross-platform solution designed for how African businesses actually operate—with teams distributed across cities and regions requiring different levels of financial control depending on context.

For more information, visit bujeti.com or contact marketing@bujeti.com