The origins of prop trading predate remote evaluation systems and Discord-based trading communities. The business operated through physical spaces where traders worked under firm capital, while phones rang continuously and risk managers monitored from behind their chairs.

The combination of technological progress, regulatory changes, and market infrastructure development forced trading rooms to transition to server-based systems with dashboard interfaces and a challenge dashboard platform, transforming capital access for traders.

The development of prop firms exists as a parallel narrative to the evolution of financial markets. The transition from floor pits to screens occurred while market spreads decreased and trading speed emerged as a new competitive advantage.

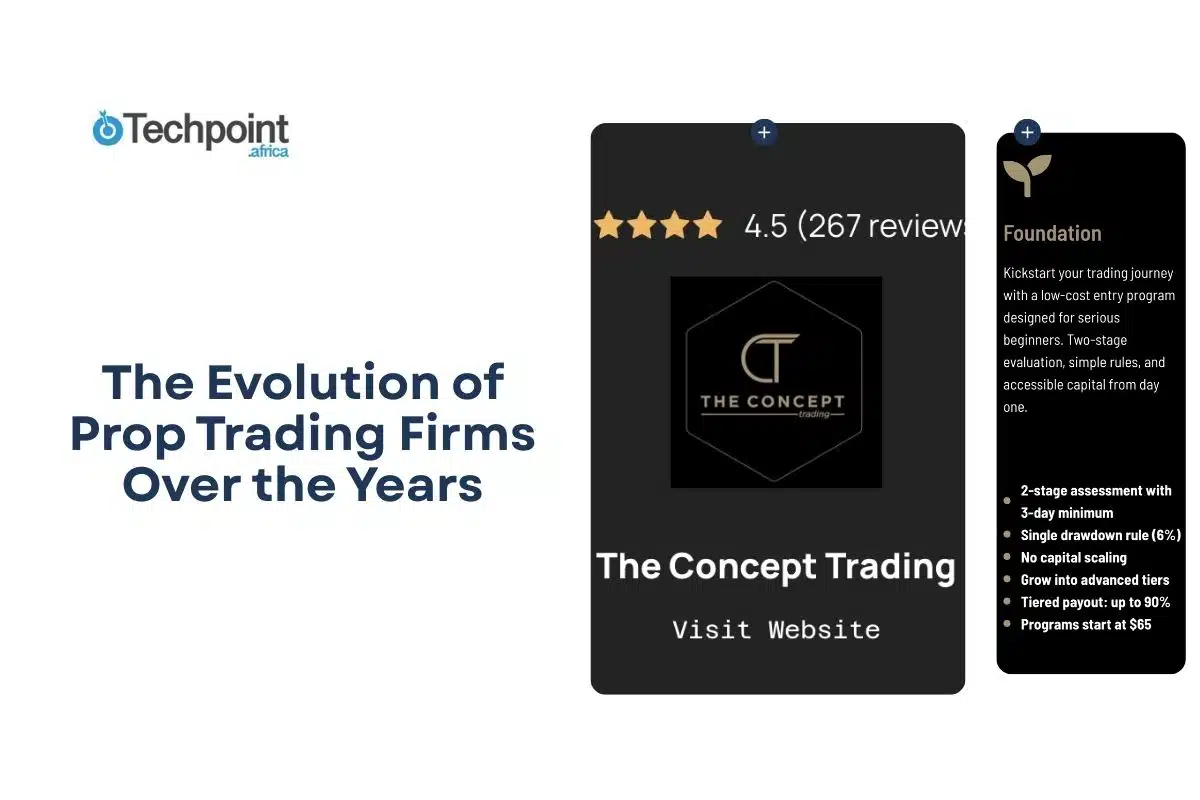

The current trading environment operates through distinct operational frameworks—traders now access remote prop firms that enable them to trade from home, subject to established rules. The Concept Trading, along with other modern trading firms, operates as a financial partners that provide traders with defined operational frameworks and technological infrastructure to maintain their trading autonomy.

The early days: local edges and in-house capital

Old-school prop shops operated as family-run trading organizations rather than modern-day platforms. The ownership of capital and trading edge remained restricted to specific individuals who gained access through direct recommendations or by first working as bank traders.

Early prop firms displayed the following characteristics:

• Physical presence: Traders needed to watch market tapes while shouting their price predictions. The combination of local market understanding and fast execution speed made these firms successful.

• In-house training: Senior traders mentored juniors, often informally. You learned by sitting next to someone and absorbing their process.

• Loose but personal risk control: Limits existed, but they were managed face-to-face. Blow-ups were rare because the firm knew every trader well.

• Simple products: Focus on a few futures contracts, index products, or specific options markets. Specialization was the norm, not the exception.

Newcomers needed to establish strong professional relationships and work from a specific location while demonstrating their trading experience to access prop firm resources.

The electronic shift: speed, screens, and new models

The transition to electronic markets brought two essential changes, which reduced trading spreads while speeding up market information delivery. The prop trading industry needed to adapt its operational methods.

Key shifts during this phase:

• From pits to platforms: Traders replaced hand signals with DOM ladders and multi-screen setups, focusing on order flow and chart structure.

• Rise of quant and systematic approaches: Using data as a fundamental element in trading operations became widespread. The combination of backtesting with statistical methods and strict execution rules produced trading advantages.

• Remote possibilities: Some traders started working off-site, but infrastructure was still largely centralized.

The period laid the groundwork for contemporary retail-access prop trading, which uses screen-based, rules-based systems to connect traders worldwide beyond traditional financial centers.

Modern prop firms: rules, evaluations, and global access

The previous decade saw the rise of remote prop firms, which established themselves as modern trading companies. The system operates through a straightforward process that requires clients to pay for assessments before they demonstrate compliance with the rules and achieve their targets to obtain funded trading capital.

Modern firms provide their clients with:

• Challenge-based onboarding: One or two phases with clear profit targets and risk rules (daily loss, overall drawdown, news windows).

• Transparent payouts and scaling: Regular payout cycles with defined scaling milestones as you show consistency.

• Flexible access: Trade from anywhere with a stable connection, often on multiple platforms and asset classes.

The system enables traders to evaluate their trading performance at substantial levels without requiring substantial personal funds. Traders need to stay within established boundaries that define their trading activities.

Final thoughts

Prop trading firms now operate as worldwide distributed networks that use dashboard systems and established rules to replace their previous small phone-based rooms. The core agreement between traders and firms remains unchanged because the company offers financial backing and operational structure, while traders need to generate steady market gains through controlled trading. The modernization of trading systems made it easier for traders to join, but it also raised the standards for their performance. Your trading success depends on selecting a firm that uses systems that match your trading approach in this complex trading environment. The trading environment now requires professionals to prioritize consistency and clarity, and professional conduct above all else.