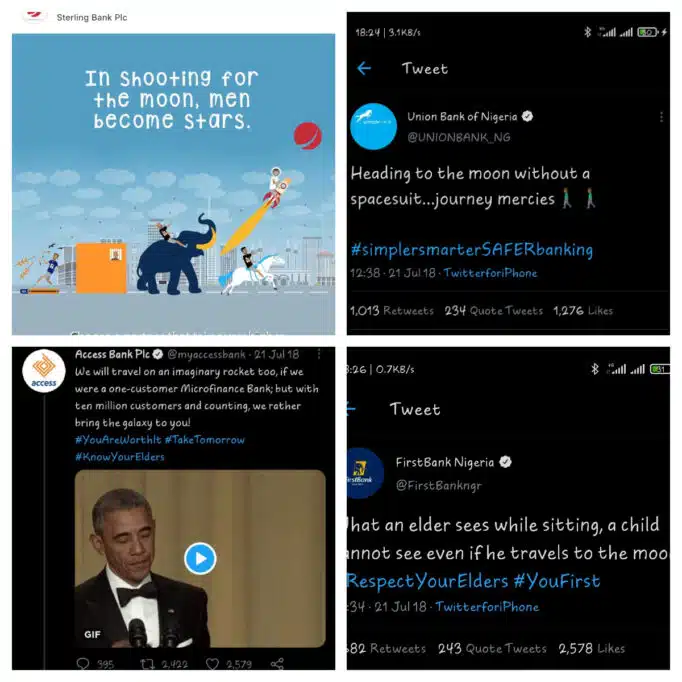

In 2018, an exchange among several Nigerian banks on X (formerly Twitter), dubbed #BankWars, highlighted how financial institutions use social media to make light-hearted jabs at competitors.

The exchanges began when Sterling Bank posted a tweet depicting itself as a rocket-bound moon traveller while rival banks remained on the ground, prompting witty responses from Union Bank, Access Bank, and FirstBank. The exchanges, which mixed humour with subtle competitive messaging, quickly went viral.

On Thursday, November 27, 2025, the Central Bank of Nigeria (CBN) issued a circular prohibiting financial institutions from advertising in this manner.

In the circular, the CBN instructed banks, Payment Service Banks (PSBs), and Other Financial Institutions (OFIs) to immediately withdraw all advertisements that are in contravention of Consumer Protection Regulations (2019) and the Guidelines on Advertisements by Deposit-Taking Financial Institutions (2000).

Among other things, the circular instructs that direct or indirect statements comparing or de-marketing competitors, as well as advertisements for lotteries, prize draws, and other chance-based incentives, are now prohibited.

The new regulations put renewed scrutiny on financial institutions’ advertising practices, some of which have relied on subtle jabs at competitors.

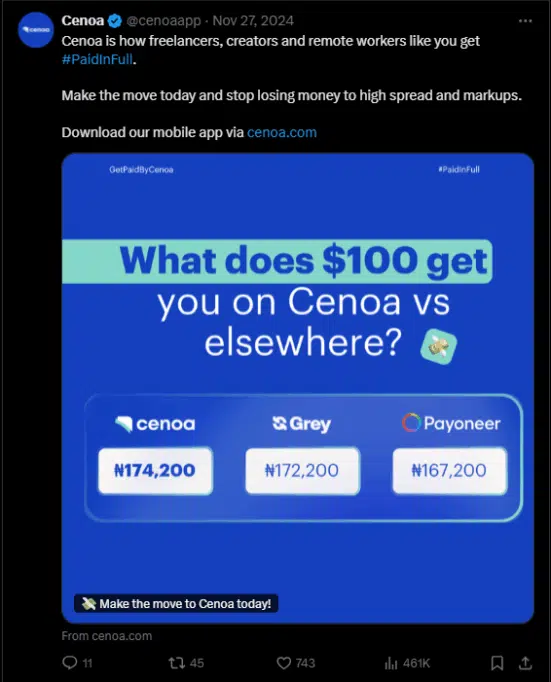

In addition to the earlier-stated bank wars example, a 2024 campaign by Cenoa showcases how ads with competitive and comparative undertones have helped financial institutions not only increase engagement but also attract customers.

In Cenoa’s case, the comparisons were not hidden behind clever words and metaphors. In two of its social media posts, the fintech explicitly compared its rates to those of competitors such as Grey, Chipper Cash, and Payoneer.

These marketing techniques, while engaging and often effective, now fall under the CBN’s regulations, which prohibit comparative, superlative, or de-marketing statements in advertisements.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

The new restrictions also raise questions about the future of incentive-based marketing, a strategy that has become increasingly popular among fintechs as they compete for customer attention in a crowded market.

Over the past few years, digital financial platforms have offered a range of incentives, from ‘spin to win’ challenges to occasional prize draws, to attract new users. These tactics are typically designed to boost engagement and drive sign-ups.

But with the CBN’s explicit ban on lotteries, prize draws, and similar “chance-based incentives,” these campaigns may no longer be permissible.

Much of the CBN’s stance is rooted in both the Consumer Protection Regulations (2019) and the Guidelines on Advertisements by Deposit-Taking Financial Institutions (2000). These documents, referenced in the circular, set the foundation for how financial institutions are meant to communicate with the public.

The 2000 Guidelines make it clear that advertisements by deposit-taking institutions must not be directly or indirectly misleading in any way or form, must not be offensive to the public or competitors, and must not use superlative and/or comparative words and/or phrases that will tend to falsely portray the advertising institution as better or safer than others.

The same guidelines also prohibit the use of words and phrases that depict lottery or gambling, including terms such as raffle, raffle draws, bonanza, and win.

The ban on prize-based or chance-based marketing in the new circular effectively restates what the 2000 Guidelines already required.

The Consumer Protection Regulations (2019) also reinforce this by requiring all financial institutions to present information that is accurate, clear, complete, and not misleading. Institutions must ensure that consumers are not misinformed about the features, risks, or limitations of a financial product.

This explains the circular’s emphasis on preventing statements that could create a false or exaggerated impression of superiority or benefit.

Why the CBN is tightening the rules

The circular targets two concerns: consumer protection and market integrity.

Due to the sensitivity of the financial sector, operators within it must be held to higher standards of transparency and accountability.

Comparative advertising can blur the line between creative marketing and misleading claims. Hence, while some of the marketing content might be largely harmless, the CBN appears concerned about the advertisements’ ability to influence consumers.

In an ecosystem where new products launch frequently, and customers are targeted through increasingly personalised ads, the CBN appears wary of scenarios in which consumers make financial decisions based on excitement, hype, or cleverly worded comparisons rather than reliable, balanced information.

The same logic applies to chance-based promotions. Lotteries and prize draws tap into behavioural impulses that can overshadow rational decision-making, a concern regulators in multiple countries have flagged when financial products are involved. By eliminating these tactics, the CBN is signalling that financial services should not rely on inducement or gamified incentives to drive adoption.

For instance, the UK’s Financial Conduct Authority (FCA) has repeatedly warned that gamified elements in financial apps, such as in-app points, badges, celebratory messages, and other game-like rewards, can encourage reckless trading or mislead users into believing the risks are lower than they are.

A shift in marketing strategy for banks and fintechs

The immediate implication is that marketing teams will have to rethink how they communicate value. Without the liberty to poke fun at rivals or run high-energy incentive campaigns, institutions must pivot to more factual, product-focused messaging.

This could usher in a more mature marketing landscape where brands must work harder to differentiate themselves without relying on tactics that once generated quick engagement.

Fintechs may have a harder time adapting to this shift because many of them rely on bold, youth-friendly, and social media-driven campaigns to differentiate themselves from traditional financial institutions.

Moreover, credit-based apps whose entire marketing strategies hinge on promises of ‘instant loans in five minutes will need to adjust quickly to these regulations.

Ultimately, the policy could prompt institutions to innovate not only in product development but also in their communication strategies. It may also protect customers from falling prey to flashy advertisements that exaggerate value.