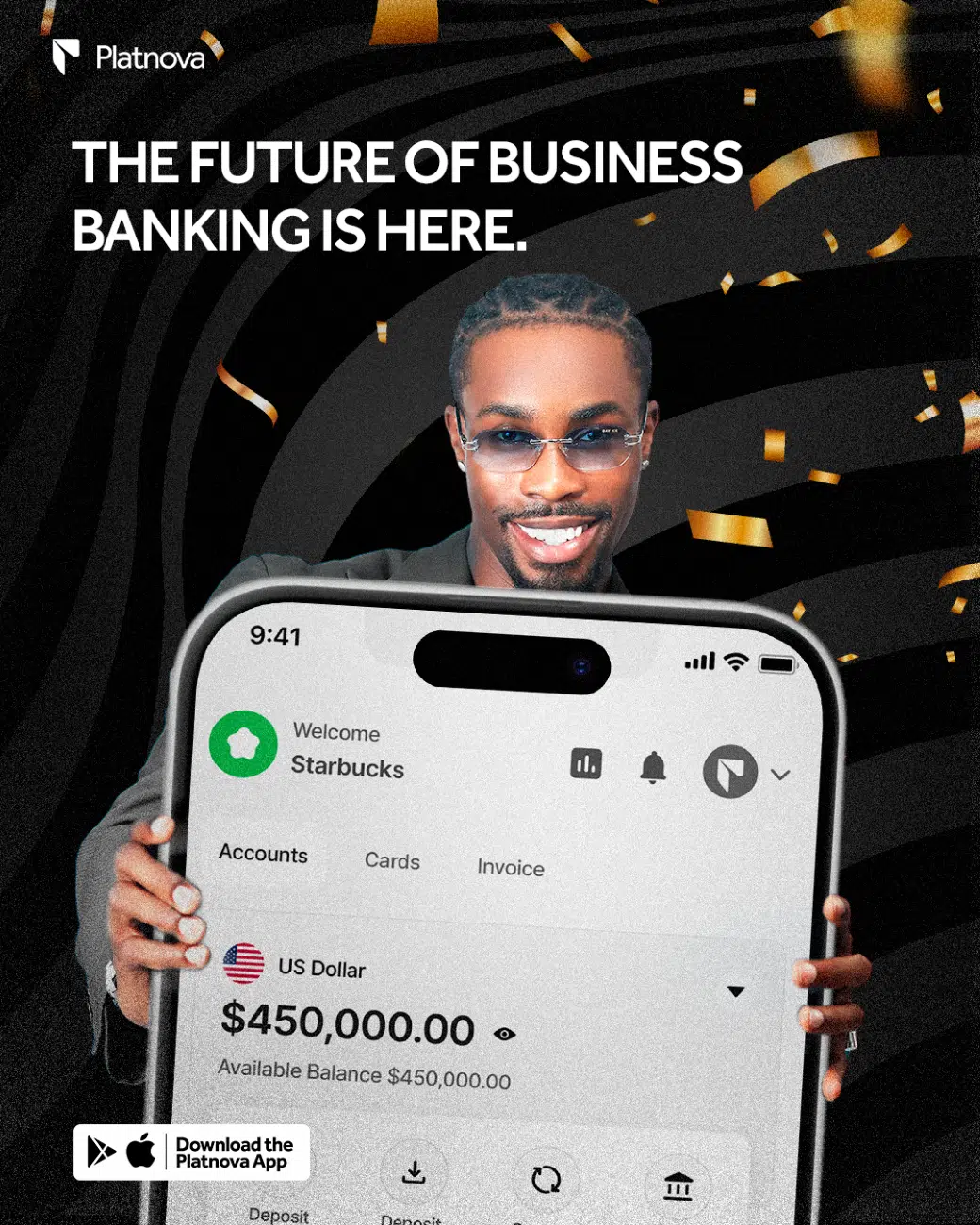

Platnova, one of Africa’s fastest-growing fintech disruptors, has launched Platnova Business, a game-changing financial suite built to fuel startups, scale-ups, and enterprises with the global banking tools they need to thrive.

From instant USD accounts and 30+ multi-currency wallets to API integrations, branded invoices, payment links, and expense management, Platnova Business condenses what used to require multiple providers into one sleek, borderless platform.

“We didn’t just build another business banking tool; we built infrastructure for Africa’s next wave of unicorns,” said Benjamin Oyemonlan, CEO of Platnova. “With Platnova Business, African founders, creators, and global merchants can plug directly into the world’s financial system, without borders or bottlenecks.”

With Platnova Business, businesses can:

- Open global accounts in your business name (USD, YUAN, GBP, EUR & NGN)

- API integration for technical businesses: Plug into ready-to-scale fintech infrastructure with developer-friendly APIs and webhooks.

- Get Paid Globally, Instantly: Open a USD account in seconds and receive payments via ACH, SWIFT, RTP, or wire without intermediaries.

- Manage your team all from one dashboard and run lean teams: Manage staff cards, set budgets, and monitor real-time expenses from a single dashboard.

- Scale Without Borders: Convert and move funds across 30+ currencies with instant settlement.

- Create payment links in one click

- Send invoices & get paid across the world

- Create virtual and physical cards for team expenses

- Automate payment workflows

For Africa’s fast-growing digital economy, Platnova Business is more than a fintech tool; it’s the bridge between local ambition and global opportunity.

Platnova Business is live now via the Platnova app and web platform.