Grüezi,

Victoria from Techpoint here,

Here’s what I’ve got for you today:

- Shoprite exits Ghana and Malawi, focuses on SA

- Africa’s exit boom has a transparency problem

- Airtel challenges MTN with 38MW data centre

Shoprite exits Ghana and Malawi, focuses on South Africa

Shoprite Holdings is calling it quits in Ghana and Malawi, marking its seventh exit from African markets outside its home base. The South African retail giant is now doubling down on what it knows best — its core operations back home. After years of trying to crack markets across the continent, the company is shifting focus to where it sees better profitability and control.

Shoprite had previously pulled out of Nigeria, Kenya, Uganda, the DRC, and Madagascar. Now, it’s wrapping up operations in Malawi, pending regulatory approval, and has a serious buyer lined up for its stores and warehouse in Ghana. The company cited tough trading conditions, continuous losses, and rising operational costs for these moves.

It’s not just Shoprite. Other South African players have been quietly making their way out too. Massmart (owned by Walmart) shut down Game stores in Kenya, Uganda, Tanzania, Ghana and Nigeria. Builders Warehouse also closed its Nairobi outlet. Even Pick n Pay pulled out of Nigeria in late 2024, while Tiger Brands backed out of Kenya’s Haco Industries. The dream of pan-African retail empires is clearly losing steam.

What’s behind this retreat? A mix of steep inflation, currency volatility, dollar-based leases, costly import duties, and the struggle to localise effectively. These pressures have made it hard to run profitable operations in many African countries, especially where regulations are tricky and logistics are unpredictable.

Back home, however, Shoprite is doing just fine. In July 2024, the company launched a new online wholesale platform under its Cash & Carry brand in South Africa. The service targets spaza shops and small businesses, offering bulk delivery within a 50km radius.

What’s more, the company expects group sales to climb nearly 9% compared to the previous year, rising from around R231 billion in 2024 to over R252 billion (about $14 billion) in 2025. That’s a strong incentive to stick to familiar turf where the numbers continue to add up.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Africa’s exit boom has a transparency problem

Everyone in African tech keeps talking about exits, but no one’s saying what they’re really worth.

Sure, we’ve had headline-making deals like Paystack, InstaDeep and Expensya. But in between these big splashes are dozens of smaller acquisitions that quietly change hands with zero numbers shared. Take CreditChek buying CreditCliq, or C-One Ventures scooping up Bankly. Cool moves, but try asking how much? You’ll likely get a polite “We’d rather not say” or silence.

Now, to be fair, no law says private companies have to disclose their exit numbers. And focusing on the strategic value of a deal rather than just the cash involved? That’s not a bad thing. But the silence can backfire. No numbers means no data. And no data means it’s harder for investors, founders, and even journalists to track what’s working — or not — in Africa’s startup scene.

Christophe Viarnaud, founder of AfricArena, says this secrecy isn’t just an African thing. But because Africa has fewer exits to begin with, every undisclosed deal hits harder. Worse still, the hush-hush approach usually starts with the buyer. “Most times, the acquirer doesn’t want the numbers out,” he explains. “It’s not up to the startup.”

Tolu Adedayo, whose company Vella Finance got acquired by Carbon earlier this year, says the same. “If the person buying you wants to keep it quiet and makes you sign an NDA, that’s it. You can’t say anything.”

So why does this culture of secrecy persist, even when no NDA is involved? Sometimes it’s fear. Sometimes it’s humility. Other times, it’s just not wanting to draw unnecessary attention. But whatever the reason, it leaves a gap that’s hard to fill.

Want to understand what this lack of transparency really means for Africa’s startup ecosystem? Read Chimgozirim’s full piece here.

Airtel challenges MTN with 38MW data centre

Airtel Nigeria is coming for MTN’s cloud crown, and it’s not playing small. The telco just announced plans to build what it’s calling Nigeria’s largest data centre, taking direct aim at MTN’s new $235 million Sifiso Dabengwa Data Centre in Lagos.

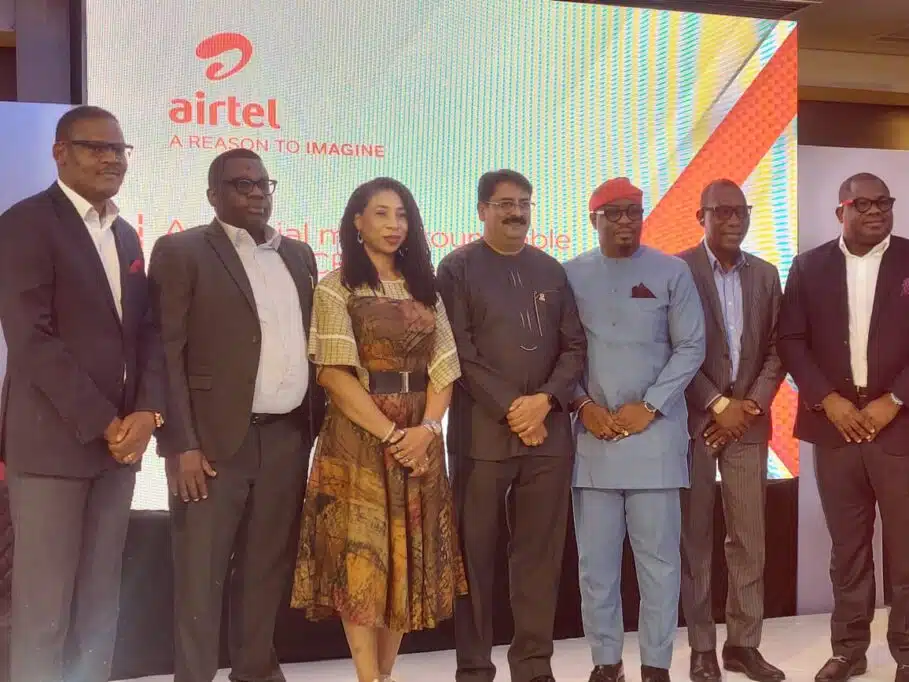

Speaking at a recent media briefing, Airtel’s CEO Dinesh Balsingh and Director of Airtel Business, Ogo Ofomata, said the new hyperscale facility will have an IT load of 38 megawatts. That’s more than eight times the current capacity of MTN’s 4.5 MW setup, which only plans to scale up to 9 MW in future phases.

“We don’t want to start small,” Ofomata said. “We’re building for the kind of server loads modern infrastructure demands.” The data centre, located in Eko Atlantic, is being positioned not just to rival MTN, but to compete with global giants like AWS, Azure, and Google Cloud.

But unlike MTN, whose data centre is geared more towards local cloud hosting, Airtel says its focus is squarely on artificial intelligence. “Data centres are actually for AI,” Balsingh explained, adding that they’ve already started installing GPU servers, which pack 100x more computing power than regular ones.

The Eko Atlantic location was also a deliberate move, citing stronger security and reliable power supply. And with plans to start rack power at 6 kilowatts (way above the typical 1.5), Airtel seems to be betting on heavier, more advanced use cases from day one.

MTN may have gotten the early spotlight, but with Airtel stepping in, Nigeria’s data centre wars are heating up fast. If anything, customers, from startups to enterprises, may just end up the real winners.

In case you missed it

- Airtel to work with smartphone manufacturers to make 5G devices affordable for Nigerians

What I’m watching

- Alain de Botton on Sex

- The revolutionary power of diverse thought | Elif Shafak

Opportunities

- Techpoint Africa is live in Kigali, Rwanda! Join us on August 13 at Norrsken House Kigali from 4:30 p.m. to 6:30 p.m. for an electrifying evening of bold conversations, powerful insights, and fresh ideas on what it truly takes to build borderless technology across Africa. To attend, register here.

- Pitch Friday is happening tomorrow, Friday, August 8, 2025. To attend, register here.

- Want to attend an evening of connection, conversation, and insight on how data is shaping East Africa’s creative economy? Join Communiqué on Thursday, August 21 at 6pm at Alliance Française, Nairobi, featuring Brian Kimanzi, Mars Maasai (HEVA Fund), Ezy Onyango (PAIPEC-CCI), Wangui Njoroge and more. Register here.

- Moniepoint is hiring for several positions. Apply here.

- Lagos Business School is looking for an Instructional Designer. Apply here.

- Max Drive is hiring a Facility/ Administrative officer. Apply here.

- Moove is looking for a Maintenance Executive. Apply here.

- Glovo is looking to fill several roles. Apply here.

- Businessfront, the parent company of Techpoint Africa, is looking for a Researcher and Scriptwriter Intern for Businessfront TV. Apply here.

- TetradPay is looking for a Content and Communications Specialist. Apply here.

- TetradPay is looking for a Marketing and Growth lead. Apply here.

- TetradPay is looking for a Creative and Design Executive. Apply here.

- Building a startup can feel isolating, but with Equity Merchants CommunityConnect, you can network with fellow founders, experts, and investors, gaining valuable insights and exclusive resources to help you grow your business. Click here to join.

- Help us make Techpoint better for you! Your feedback shapes what comes next (your responses may potentially save my job. A bit dramatic, but still). It will only take 30 seconds to tell us what works and what doesn’t. Fill it here.

- To pitch your startup or product to a live audience, check out this link.

- Have any fresh products you’d like us to start selling? Check out this link here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a superb Thursday!

Victoria Fakiya for Techpoint Africa.