Bluesky was just “that other Twitter Jack Dorsey’s working on when it started.” Now, that version of the story is old news. What started as a decentralized social experiment has since grown into a full-on microblogging universe, complete with its own culture, inside jokes, and crowd of diehards who’d rather crash a server than go back to the bird app.

It’s no longer just a Twitter alternative. In 2025, Bluesky feels like its own Twitter. One where people are building communities from scratch, experimenting with federation (yes, that’s a thing now), and vibing to a refreshingly non-algorithmic rhythm.

But who, exactly, is on Bluesky these days?

Understanding Bluesky’s user demographics in 2025 is practical intel. Whether you’re a marketer chasing fresh eyeballs, a creator trying to grow a following, or a community builder aiming to connect with people, you need to know who you’re talking to. Otherwise, you’re just shouting into the void, and no one has time for that.

Plus, Bluesky isn’t operating in a vacuum. Its rise (and quirks) say a lot about where online communities are heading.

So in this piece, I’m breaking down what Bluesky’s user base looks like by age, gender, and geography, and how that’s changed over time. I’ll also unpack growth trends, engagement patterns, and how Bluesky stacks up against Twitter, Threads, and even Mastodon in 2025.

TLDR: Key takeaways from this article

- Bluesky is still a Gen Z and Millennial stronghold. Over 62% of users are under 34, with 18–24-year-olds making up the biggest slice.

- 62% of users are male, putting it right behind Reddit and Discord. It’s one of the most male-heavy platforms, but evolving.

- Bluesky grew from 10M to 33M users in just 6 months. At this pace, it could hit 53M by the end of 2025.

- Most users are lurkers, and that’s fine. About 55% scroll without posting, 25–30% engage lightly, and 15–20% are power users.

- Engagement metrics are surprisingly strong. Users spend 10 mins 35 secs per session on average and visit nearly 8 pages each time.

So, what is Bluesky?

| Platform | Bluesky |

| Released by | Bluesky Public Benefit Corporation |

| Initial backing | Twitter (Jack Dorsey, 2019) |

| Current owner | Jay Graber & the Bluesky PBC team |

| Total users | 33 million (as of March 2025) |

| User growth rate | 1 new user every second |

| Monthly site visits | 154.68 million |

| Unique monthly visitors | 41.3 million |

| Daily active users (DAU) | 3.2 million in the US and the UK |

| Average visit duration | 10 minutes, 35 seconds |

| Pages per visit | 7.91 |

| Top traffic sources | Direct, X (Twitter), Threads, Reddit, Mastodon |

| Primary user regions | North America, Western Europe, Japan |

At first glance, Bluesky looks a lot like Twitter: timelines, posts (called “skeets” by the community), likes, reposts, the whole familiar microblogging vibe. But under the hood, it’s trying to become something very different. And in 2025, that difference is starting to matter.

Bluesky was originally incubated inside Twitter back in 2019, back when Jack Dorsey was still calling the shots. The idea was simple but ambitious: build a decentralized protocol for public conversations, kind of like email or RSS, where no single company controls everything.

Since it went independent, Bluesky has grown into a Public Benefit Corporation. It’s no longer a Twitter side project; it’s its own thing, with its vision for how social media should work.

Built by many, owned by none

Bluesky likes to say it’s “social media as it should be.” And what they mean is: open, user-driven, and modular. You’re not stuck with one app or one company’s rules. Anyone can build their own app using the same social graph. You can host your server (if you’re into that), choose your content filters, and even customize how you experience moderation.

Which brings us to one of the wildest things about Bluesky: its approach to content moderation.

Open source moderation

Bluesky’s moderation isn’t just rules handed down from a mystery algorithm. It’s designed to be observable and composable. That means:

- Anyone can label content or accounts, whether it’s “spam,” “NSFW,” or something else. These labels don’t have to come from Bluesky itself; they can come from third-party tools, communities, or individuals.

- Those labels can be automated or manual, created by users, moderators, or algorithms.

- You get to decide what you see. Services and users can choose which labels they want to filter out or highlight. It’s like having your custom moderation toolkit.

In 2023 alone, Bluesky’s team reviewed over 358,000 moderation reports. But the goal isn’t to be the sole referee of online speech; it’s to give users more control over how their feeds look and feel.

Why does Bluesky demographics matter (more than you think)?

If you’re building anything, whether it’s a product, a campaign, or a conversation, knowing who’s on the other side of the screen is everything. And on a platform like Bluesky, where things still feel early and raw, user demographics aren’t just vanity stats; they’re signals.

Demographic data fuels smarter decisions. It shapes how products get designed, how content gets positioned, and how communities either flourish or quietly fade. On TikTok or Instagram, algorithms decide what blows up. On Bluesky, people do. This means that if you’re not tuned in to who those people actually are (age, gender, location, mindset), you’re flying blind.

Here’s why it matters:

- Early adopters are culture-setters. On niche platforms, the first wave of users often shapes the tone of everything that follows. If your audience overlaps with this crowd, you’re not late to the party. You’re early enough to help plan the menu.

- Bluesky isn’t algorithm-heavy. That’s great for authenticity, but it also means your content won’t be artificially boosted to the wrong crowd. Relevance matters more than ever. Demographic data tells you how to be relevant.

- Decentralized design attracts a distinct audience. Think privacy-first, tech-savvy, community-oriented. This isn’t a passive, scroll-all-day crowd. They’re active participants. They care about how platforms are built. You’re speaking to a more intentional user base, and that changes your whole approach.

- You can’t copy-paste your X (formerly Twitter) strategy. The vibes are different. The users are different. And the expectations are different. What worked on Twitter might fall flat if you don’t tailor it to this evolving community.

If you’re still treating Bluesky like a fringe platform, the 2025 user data might just change your mind. It’s a growing, evolving ecosystem with a real identity. And if you understand who’s here now, you’ll know how to show up before everyone else does.

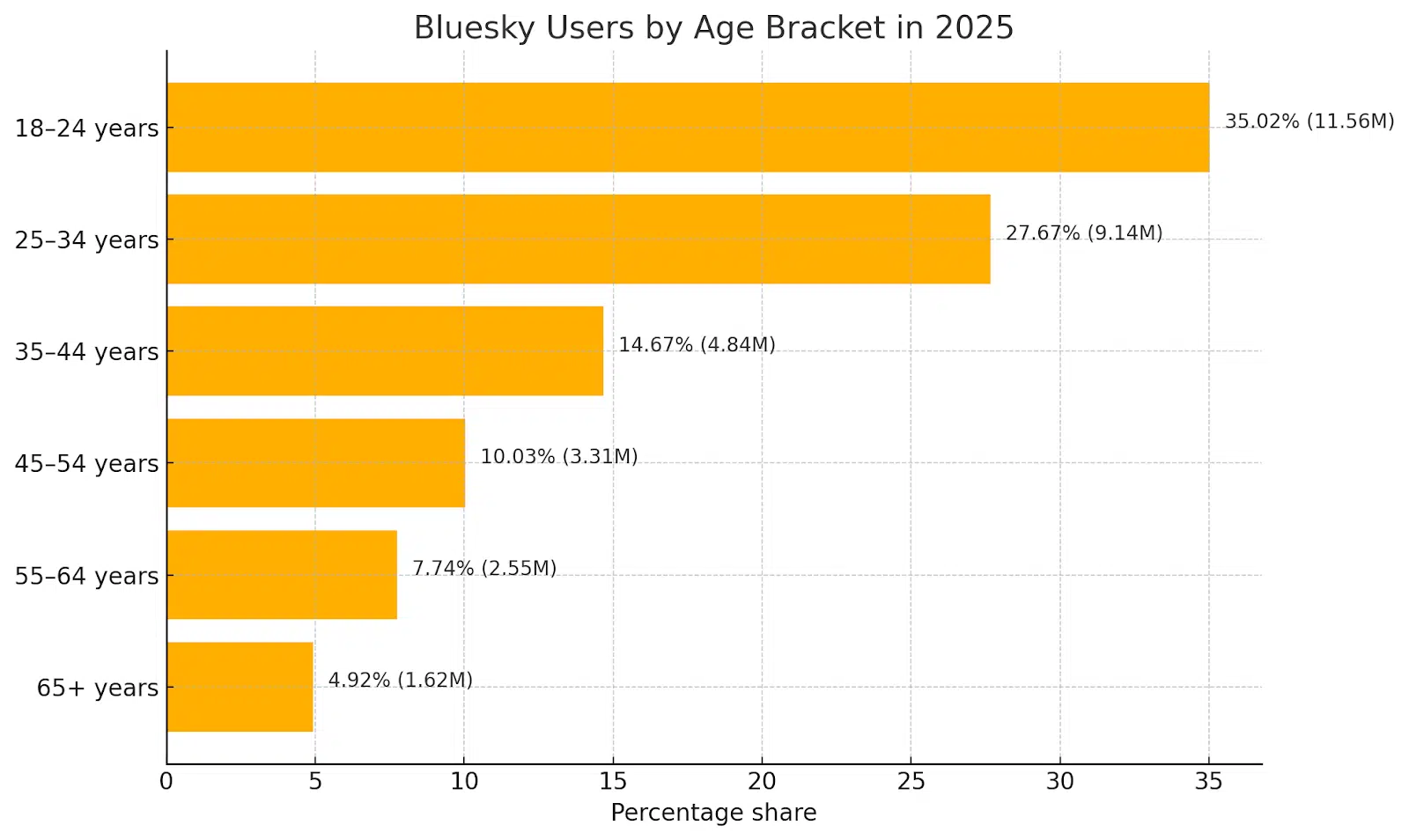

BlueSky’s age distribution in 2025

Who’s showing up on Bluesky in 2025, and who’s still watching from the sidelines?

| Age bracket | Percentage share | Numbers |

| 18–24 years | 35.02% | 11.56 million |

| 25–34 years | 27.67% | 9.14 million |

| 35–44 years | 14.67% | 4.84 million |

| 45–54 years | 10.03% | 3.31 million |

| 55–64 years | 7.74% | 2.55 million |

| 65+ years | 4.92% | 1.62 million |

Note: Bluesky’s age distribution is typical of emerging microblogging platforms, especially when they put open-source structure and user control forward.

These estimates, pulled from a blend of 2024–2025 public data, developer insights, and usage patterns, paint a clear picture:

1. Bluesky is still young at heart, but growing up

Bluesky was once the digital playground of the 18–24 crowd. In 2023, they were the loudest and most active. They still are, as around 1 in 3 Bluesky users fall within that age bracket, but in 2025, the tide’s shifting.

The 25–34 age group is closing the gap fast, and in some use cases, already overtaking younger users. Because Bluesky is starting to feel like a more stable, less chaotic Twitter. The app is drawing in users who want dialogue, not dopamine.

2. Over 62% of Bluesky users are under 34

That’s a key signal for creators, marketers, and community builders: If your content resonates with Gen Z or late-stage millennials, this is your stage. But if your focus is on Gen Alpha or boomers, Bluesky might still be outside their orbit, for now.

3. The grown-ups are here for the features

The 35–44 segment is growing steadily. This isn’t the crowd chasing memes, ad-riddled, algorithm-heavy platforms burn them out. They want control, transparency, and clean conversation threads, and Bluesky’s decentralized model fits the bill.

So, what does this mean for you?

If you’re:

- Building a brand for under-34s: You’re in the right place.

- Creating tools or products for early tech adopters, this crowd will test and evangelize for you.

- Trying to market to under-18s or late boomers, you might want to look elsewhere, for now.

Gender distribution on Bluesky

Let’s talk gender and what Bluesky’s user base tells us about who’s showing up, and more importantly, who feels welcome.

Estimated gender breakdown (2025)

More than half of Bluesky users are male.

While Bluesky doesn’t publish official gender stats, third-party platform scans and user profile analyses give us a working snapshot:

- Men: 62.04%.

- Women: 37.96%.

In short, Bluesky is still slightly male-dominated. That’s not shocking for a platform born from developer DNA, but it’s evolving.

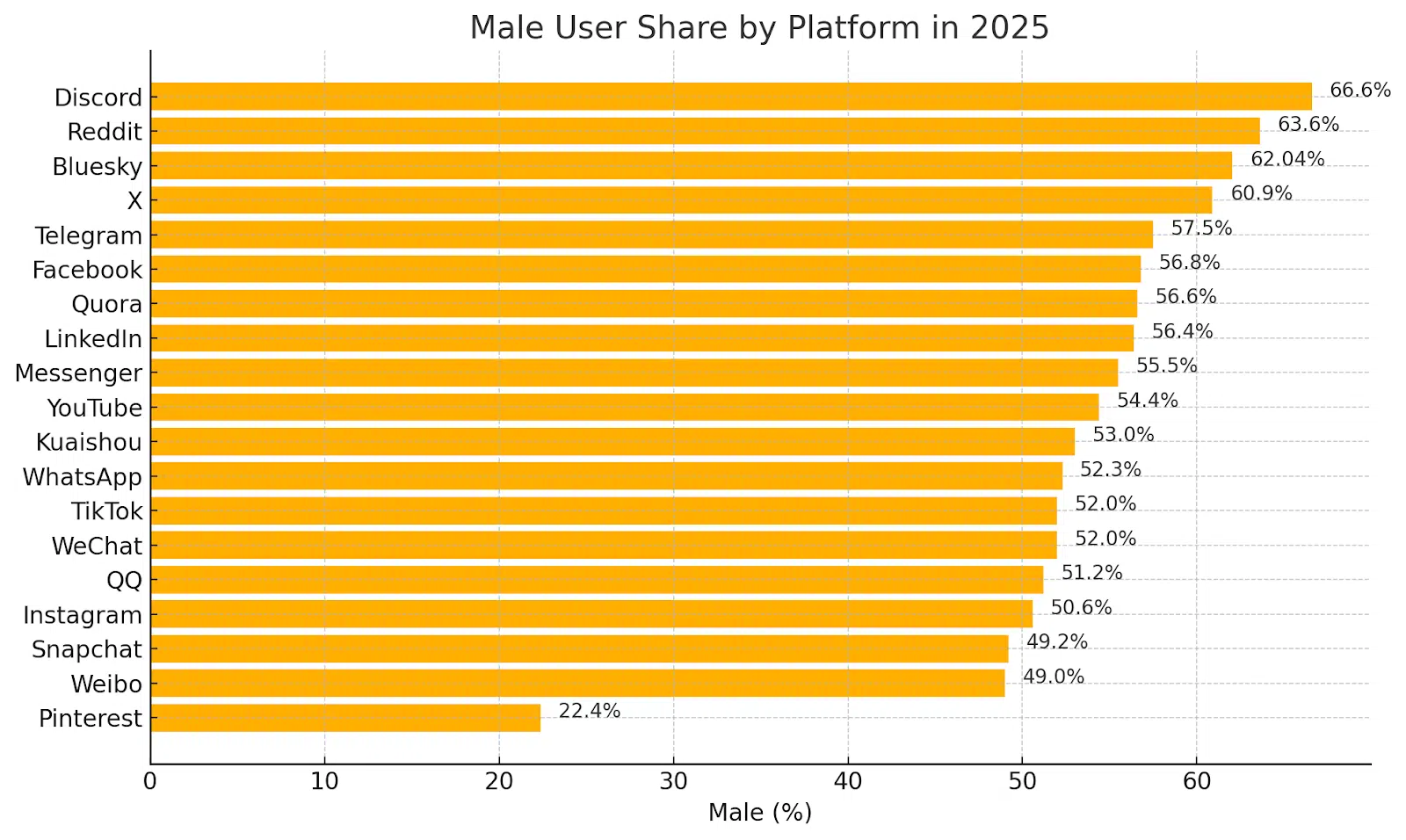

Where does Bluesky sit on the gender scale compared to other platforms

Here’s how Bluesky stacks up against other major platforms in terms of gender distribution:

| Social media platform | Male visitors | Female visitors |

| Discord | 66.6% | 32.2% |

| 63.6% | 35.1% | |

| Bluesky | 62.04 | 37.96% |

| X | 60.9% | 39.1% |

| Telegram | 57.5% | 42.4% |

| 56.8% | 43.2% | |

| Quora | 56.6% | 43% |

| 56.4% | 43.6% | |

| Messenger | 55.5% | 44.5% |

| YouTube | 54.4% | 45.6% |

| Kuaishou | 53% | 47% |

| 52.3% | 47.6% | |

| TikTok | 52% | 48% |

| 52% | 48% | |

| 51.2% | 48.8% | |

| 50.6% | 49.4% | |

| Snapchat | 49.2% | 49% |

| 49% | 51% | |

| 22.4% | 69.5% |

Sources: SimilarWeb, Data Reportal.

So yes, Bluesky sits comfortably among the more male-skewed platforms, right behind Reddit and Discord. But its lean is softening.

So, why does this matter?

This is a culture check. Platform demographics shape what gets posted, how people engage, and who feels safe speaking up. If you’re building anything, from a newsletter to a community, knowing the gender dynamics helps you adjust your tone, format, and message so it hits home.

And on Bluesky, where virality is replaced by conversation and decentralization is the main event, people want to be seen, but they also want to be respected. Gender visibility and inclusivity are part of the experience design, not bonus features.

Gender identity options

Unlike X or Threads, Bluesky lets users define their identities on their terms. There’s no forced dropdown, no binary lock-in. It’s a small thing, but it has resonated especially with trans, non-binary, and queer users who often feel erased or flattened by legacy platforms. The philosophy of “building social media like the early web” shows up in how Bluesky treats identity: open, flexible, and user-owned.

How things have shifted since 2023

In the early days, Bluesky was a hangout for indie developers, crypto-curious folks, OSS (open source software) champions, and male-dominated tech circles. But in 2025, we’ve seen a significant influx of women and gender-diverse voices, especially among writers, digital artists, mental health advocates, and community builders.

More importantly, this is a leadership shift. Some of the most influential and engaged communities on Bluesky are now led by women and non-binary users, especially in conversations around activism, mental health, decentralized culture, and collaborative art.

Yes, Bluesky still leans male, but it’s no longer a boys’ club. It’s an evolving space where inclusivity is quietly baked into the architecture, not just the marketing. If you’re paying attention to where gender dynamics are headed (not just where they’ve been), Bluesky is signaling a shift, and it’s one worth watching.

Where Bluesky users live: Top regions in 2025

Where Bluesky once was “just another Twitter clone,” it’s now officially a global movement. But the user map tells a more nuanced story.

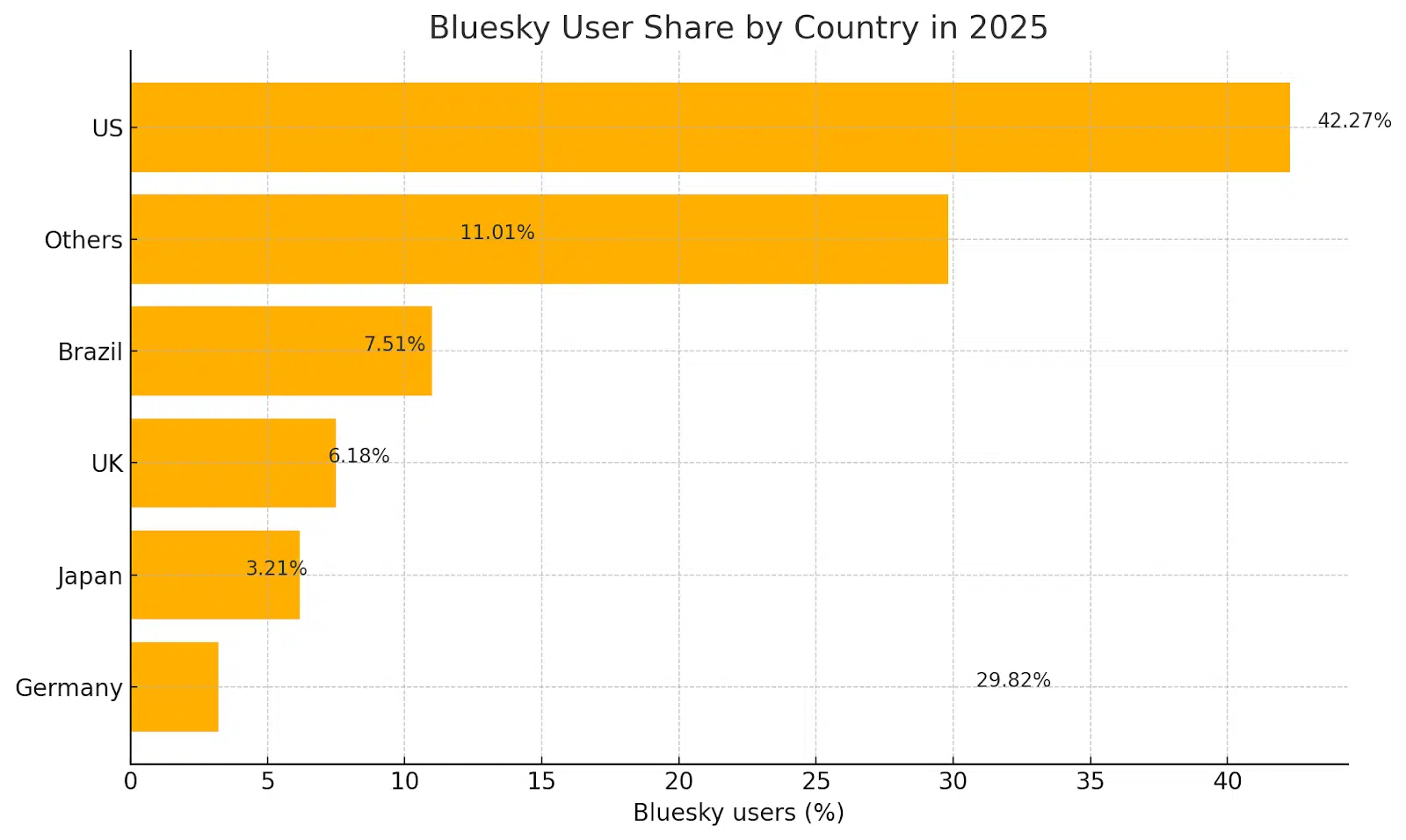

Top countries using Bluesky in 2025

Based on traffic data for Bluesky.com released by Semrush, the social media platform had 362,000 visitors in November 2024. Here are the top five countries by visitors:

| Rank | Country | Bluesky users | Visit duration | Pages per visit | Bounce rate |

| 1 | US | 42.27% | 12 mins 9 secs | 8.41 | 33.97% |

| 2 | Brazil | 11.01% | 11 mins 21 secs | 9.93 | 28.74% |

| 3 | UK | 7.51% | 13 mins 32 secs | 8.41 | 27.01% |

| 4 | Japan | 6.18% | 6 mins 26 secs | 5.16 | 52.53% |

| 5 | Germany | 3.21% | 10 mins 14 secs | 7.01 | 40.93% |

| 6 | Others | 29.82% | – | – | – |

Source: SimilarWeb.

Similar to TikTok, the United States has the largest proportion of Bluesky visitors, at 42.27%. If you look closely at the data, you’ll see that Bluesky gets more visitors from the US alone than the rest of the top five nations combined (27.91%).

The usage gap between urban vs. rural

Like most digital-first platforms, urban users dominate. Cities like Lagos, São Paulo, Berlin, Mumbai, and San Francisco are high-density zones for Bluesky activity. That said, the gap is narrowing, thanks to more mobile-friendly updates and community-led onboarding in smaller towns and college hubs. But it might take a while for the difference to cease being significant.

Language and local culture

One of Bluesky’s quiet superpowers is that it doesn’t force English as the default. Because of its decentralized nature and open protocol (AT Protocol), Bluesky supports local-language communities organically, from Portuguese-speaking techies in Brazil to Tamil meme accounts in India. This has helped non-Western growth feel more native, not bolted-on.

From the West to the world

Bluesky is no longer just a U.S.-centric playground. It’s building digital neighborhoods across the globe, and if you’re a brand, creator, or marketer, that opens up real opportunities for localized strategy.

Take Nigeria, for instance, Tech Twitter’s migration to Bluesky brought a strong wave of early adopters. Today, Bluesky is home to thriving African creator communities, discussing AI, startup life, music, and culture without the algorithmic noise.

Also, India isn’t left out. From IIT grads to Tamil writers, India’s user base exploded in late 2024 after several open-invite campaigns. Bluesky’s “no ads, no noise” approach appeals to young digital natives burnt out by Instagram’s performative culture.

Usage and growth trends: Who’s posting, watching, and building?

In 2025, Bluesky is a platform with serious staying power. But who’s using it day in, day out?

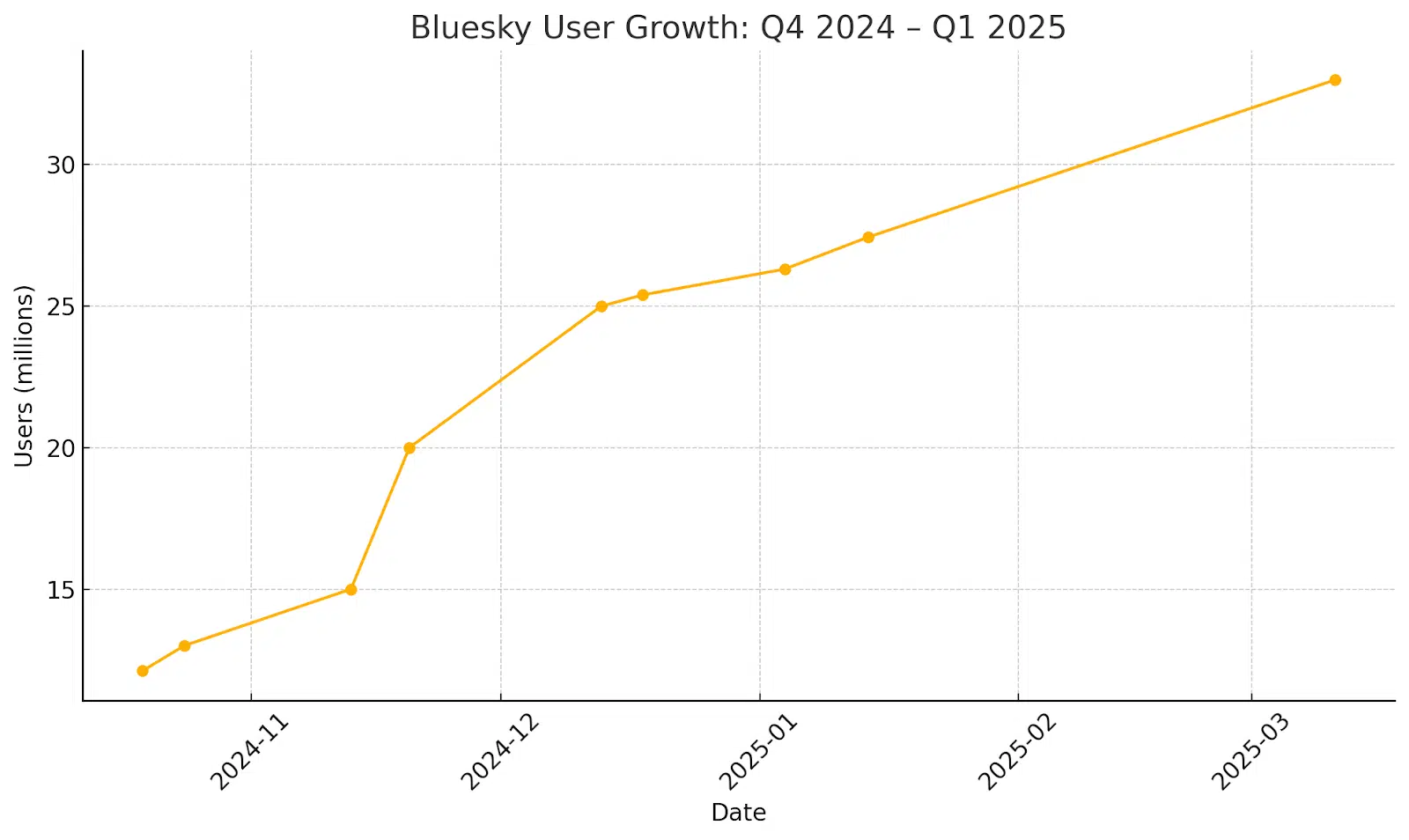

Active users

In Q4 2024, Bluesky’s user base exploded, growing from 10 million in September to over 27.4 million by mid-January 2025. That’s a +174.4% increase in just four months.

Here’s how the number of Bluesky users has increased in Q4 2024:

| Date | Number of Bluesky Users |

| October 19, 2024 | 12.11 million |

| October 24, 2024 | 13 million |

| November 13, 2024 | 15 million |

| November 20, 2024 | 20 million |

| December 13, 2024 | 25 million |

| December 18, 2024 | 25.4 million |

| January 4, 2024 | 26.31 million |

| January 14, 2024 | 27.44 million |

| March 11, 2025 | 33 million |

Sources: Exploding Topics.

If growth continues at even half this pace, Bluesky could reach 50–53 million users by December 2025, and potentially cross 80 million by the end of 2026.

What’s fueling the rise is a combination of:

- X chaos, especially moderation issues and government bans. Bluesky gained 3M users after X was suspended in Brazil, which explains the bump in the number of users from the South American nation on the app.

- Decentralized platform fatigue shifting into curiosity.

- And a strong pull from indie creators, writers, and niche communities looking for “less algorithm, more agency.”

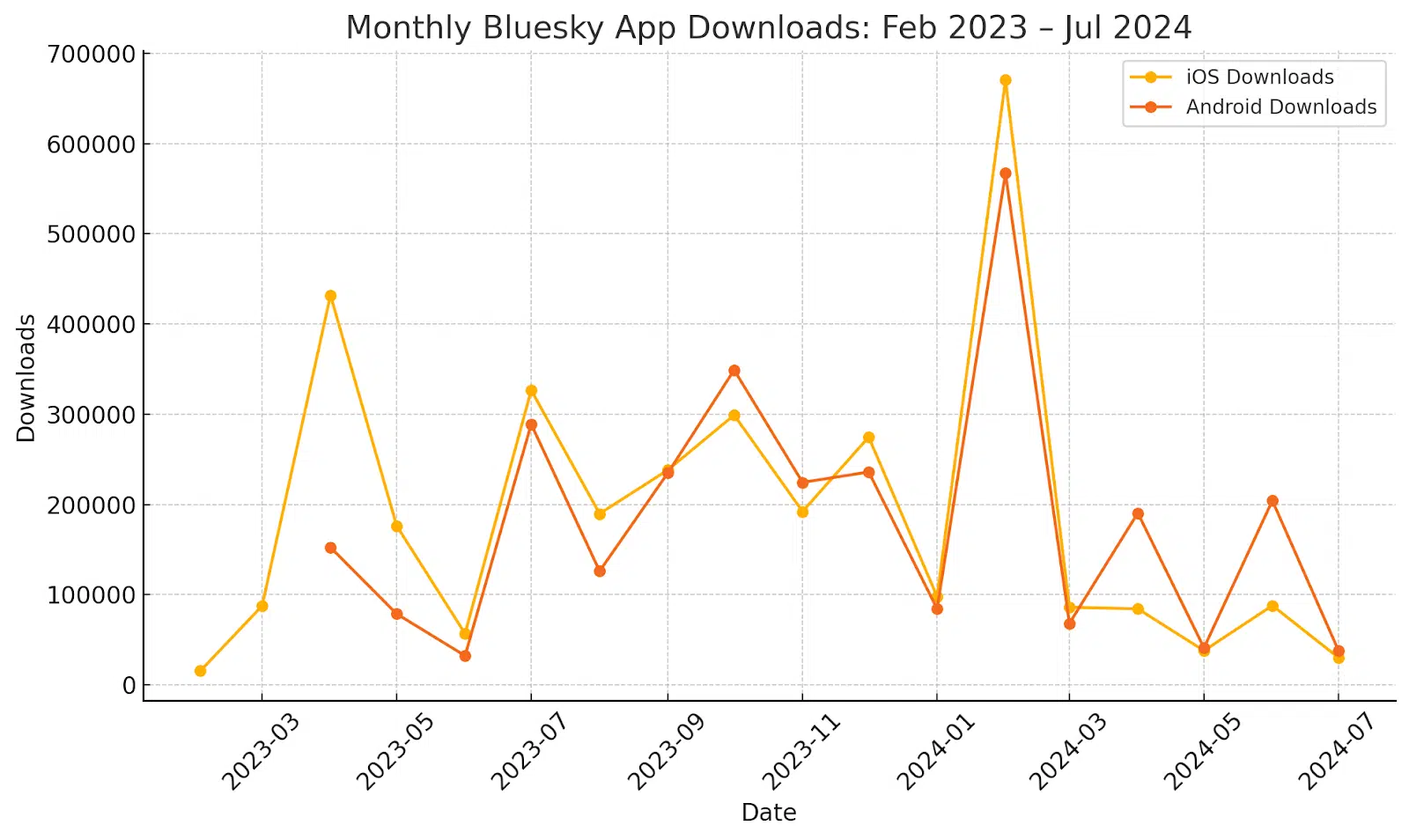

App download patterns: iOS vs Android

2024 saw 16.5 million total downloads worldwide for Bluesky across Google Play and the App Store.

February 2024 was easily its biggest plot point yet. That month, downloads peaked at 670,722 on iOS and 567,267 on Android. Both platforms went wild.

From February 2023 to March 2024, iOS was mostly in the lead, beating Android in 12 out of 14 months. For a while, it looked like iPhone users were more curious (or just quicker to grab invites).

But then came a shift. From May to July 2024, Android suddenly took the wheel. Not only did it outpace iOS downloads each month, but it nearly doubled iOS’s numbers over that period:

Android racked up 473,703 downloads compared to iOS’s 240,132.

Here’s how it all breaks down over time:

| Month, Year | iOS Downloads | Android Downloads |

| Feb, 2023 | 15,417 | – |

| Mar, 2023 | 87,516 | – |

| Apr 2023 | 431,999 | 152,375 |

| May 2023 | 176,288 | 78,688 |

| Jun 2023 | 56,846 | 32,292 |

| Jul 2023 | 326,608 | 288,936 |

| Aug 2023 | 189,795 | 126,068 |

| Sep 2023 | 238,318 | 235,117 |

| Oct 2023 | 299,109 | 349,052 |

| Nov 2023 | 192,199 | 224,450 |

| Dec 2023 | 274,685 | 235,960 |

| Jan 2024 | 97,826 | 84,220 |

| Feb 2024 | 670,722 | 567,267 |

| Mar 2024 | 85,949 | 68,147 |

| Apr 2024 | 84,289 | 190,522 |

| May 2024 | 37,866 | 41,076 |

| Jun 2024 | 87,899 | 204,271 |

| Jul 2024 | 30,078 | 37,834 |

Source: Statista,

Who’s using the platform?

Bluesky has become a layered, choose-your-own-adventure kind of place.

The power users (15–20%)

This group posts daily, runs custom feeds, and moderates communities. They’re the ones keeping Bluesky vibrant and weird (in the best way).

They include:

- Indie journalists and long-form writers who’re building followings.

- Developers who are customizing their experience via the AT Protocol.

- Moderators and community hosts who’re curating public feeds.

- Artists, zine-makers, and culture creators reclaiming the timeline.

This small but mighty group keeps the platform dynamic and deeply human.

The lurkers (55%)

Scroll, read, repeat. More than half of users fall into this category. They consume content but rarely engage. This isn’t a bad thing; it’s normal. Reddit, Tumblr, and even Twitter started the same way.

Don’t underestimate the scrollers. They are the majority on the platform and the ones who follow threads, check feeds, read posts, and ensure there’s an audience for anything on Bluesky.

The occasional (25–30%)

They drop in to reply, boost, or post now and then. They are not builders, but not ghosts either.

Altogether, these three groups make up the Bluesky platform. This ratio isn’t bad at all. In fact, it’s typical of healthy microblogging ecosystems.

Feature adoption by age

Here’s how different age groups are using the platform in 2025:

- 18–24: Deep into aesthetic feeds, visual posts, and layout tweaks. Think Tumblr vibes but decentralized.

- 25–34: Posting threads, sharing articles, curating timelines. They form the bulk of the newsletter crowd.

- 35–49: Building public feeds, moderating communities, and following niche discourse.

- 50+: More passive users, mostly following journalists, public figures, or close contacts.

The modular structure and decentralized nature of Bluesky, where you can build or follow custom feeds, make this segmentation feel organic. You get the platform you build.

Momentum vs. the drop-off

Yes, Bluesky had a “hype peak” in 2024, fueled by Twitter/X chaos and celebrity signups. But unlike Threads, it didn’t flame out. Why?

- It didn’t chase mass scale, it grew on a user-led culture.

- It kept things open-source and weird (in the best way).

- It focused on trust, moderation tools, and letting communities lead.

In 2025, Bluesky isn’t the biggest platform. But it is one of the most intentional, sticky, and creatively alive.

Bluesky had its hype moment in 2024, powered by celebrity signups, X drama, and everything in-between. But unlike Threads, it didn’t fade when the buzz cooled.

Here’s why:

- It didn’t chase mass scale too soon and too fast. Instead, it grew on a user-led culture.

- It kept things open-source and weird (in the best way).

- It focused on trust, moderation, and slow, steady community building.

Of course, Bluesky is not among the biggest social media platforms in 2025, but it might be one of the most intentional.

Bluesky vs. Twitter, Mastodon & Threads: Who’s using what?

When I started using Bluesky, I quickly realized it wasn’t trying to be another Twitter — it was something else entirely. But how does its user base stack up against its closest cousins: Twitter, Mastodon, and Threads?

Let’s break it down.

Comparison table: Platform vs. age group vs. gender balance

| Platform | Dominant age group | Gender balance | Audience Vibe |

| Bluesky | 18–34 | Has more males than females, almost 2:1 | Indie, privacy-aware, early adopters |

| Twitter (X) | 25–44 | More than 60% male | Broad, political, breaking news |

| Mastodon | 18–34 | Skews male, highly technical | FOSS crowd, decentralization purists |

| Threads | 18–34 | More male, Instagram-native | Polished, lifestyle-driven, brand-friendly |

Bluesky vs. X

X is still massive and messy. It’s where breaking news, drama, and global trends collide, but that scale comes at the cost of intimacy. The age range is broader (25–44), and the content is less curated.

Bluesky wins here because it has:

- Fewer trolls. I mean, have you seen Twitter these days?

- More control.

- Less doomscrolling, more community-building

Bluesky vs. Mastodon

Same tech roots, different energy. Both are built on decentralization, but Mastodon is the social media of tech-savvy users. It attracts older, tech-fluent users who care about Free and Open Source Software (FOSS) principles and tight moderation.

Compared to Mastodon, Bluesky is:

- More casual.

- A bit weirder (in a good way).

- Focused on custom feeds instead of instances.

- Easier to use for everyday users. You don’t need a PhD in federation to get around here.

Bluesky vs Threads

Threads may have more clout (thanks to Instagram), but Bluesky has more culture. Threads, backed by Meta, brought Instagram polish and millions of users, but the novelty wore off fast. The age demographics overlapped with Bluesky, but the entrance was brand-heavy and influencer-polished.

Bluesky stayed small but stuck:

- No ads.

- No algorithmic timeline.

- More zines and memes.

If Threads is an airport lounge, Bluesky is your favorite local café where people actually talk.

So, what makes Bluesky’s audience unique?

- Age: 18–34 core, but 35+ is growing fast.

- Gender: Male skew, but rising gender-diverse participation.

- Location: Still mostly U.S. and Western countries, but emerging pockets in Nigeria, India, and Brazil.

- Mindset: Community builders, privacy-first users, folks who miss old-school internet culture

This is a niche app. But it’s a micro-network with macro potential, and the people here are shaping what future internet culture could look like.

Bluesky user habits

So far, we’ve talked about who’s on Bluesky and how fast it’s growing. But what about how people use it?

Here’s what the numbers reveal about behavior, attention spans, and how Bluesky stacks up against the social media heavyweights.

Engagement at a glance

As of March 2025, Bluesky users have made around 1.18 million posts. With about 33 million users, that comes out to roughly 35 posts per user, a modest but meaningful indicator of platform engagement.

This isn’t a shout-every-hour platform; it’s more deliberate. Think threads, dispatches, curated feeds. Less noise, more signal.

Average session time: Bluesky vs other social media platforms

The average visit to Bluesky lasts 10 minutes and 35 seconds, just shy of X’s 12-minute average.

| Platform | Average visit duration |

| YouTube | 20 minutes, 19 seconds |

| X | 12 minutes, 1 second |

| 10 minutes, 57 seconds | |

| Bluesky | 10 minutes, 35 seconds |

| Snapchat | 8 minutes, 45 seconds |

| 8 minutes, 37 seconds | |

| 6 minutes, 3 seconds | |

| TikTok | 3 minutes, 54 seconds |

Pages per visit: Bluesky vs other social media platforms

Bluesky users visit 7.91 pages per session, which is smaller compared to platforms like X, where users visit around 50% more pages (12.26 per session).

Below is a breakdown of the average user’s number of social media pages per visit:

| Platform | Average pages per visit |

| X | 12.26 |

| 11.74 | |

| 11.52 | |

| YouTube | 10.91 |

| Bluesky | 7.91 |

| Snapchat | 6.31 |

| TikTok | 5.24 |

| 4.62 |

What does this mean for you?

Knowing who’s on Bluesky is a strategy fuel. Whether you’re a marketer, creator, brand, or building communities from the ground up, here’s how to work smarter with the data.

If you’re a marketer

You’re not blasting ads into a void here. You’re talking to:

- Young adult males (18–34) working in tech, media, and design.

- People who care about privacy, transparency, and not being tracked across five apps.

Some tactics to consider include:

- Geotarget urban tech hubs. Think Austin, Berlin, Lagos, Toronto.

- Use gender-aware messaging. With a growing gender-diverse base, inclusive language and design aren’t optional.

- Be subtle. Shouting “Buy now!” doesn’t work here. Spark conversation instead.

If you’re a creator

If you’re a content creator, Bluesky is early-stage gold. You’re not late to the party, you are the party. Some niche corners are already thriving:

- Booksky (book recommendations, literature snobs, and zine lovers).

- Techsky (developers, crypto skeptics, and open source nerds).

- Memesky (if you know, you know).

Pro tip: Use custom feeds to build and nurture micro-communities. Think of it like RSS meets Reddit, but with fewer trolls and more vibes.

If you’re a brand or advertiser

You’re not fighting for attention here, yet. That means:

- Less ad fatigue, more meaningful impressions.

- Room to test partnerships, sponsored content, even limited-edition drops.

But tread carefully because the audience is privacy-aware and anti-corporate by default. Do your homework, join conversations, and be human first.

If you’re a community builder

Building communities on Bluesky is about encouraging meaningful growth.

Here’s what to keep in mind:

- 18–34-year-olds crave expression but respect boundaries. Get your moderation tone right.

- Gender diversity is increasing, make your space feel welcoming without forcing it.

- Create onboarding pathways for new users so it doesn’t become an echo chamber of early adopters.

In summary, Bluesky is still early enough to matter and open enough to experiment, if you’re intentional about it. Know the people, speak their language, and you might just build something lasting.

Conclusion

So, who’s hanging out on Bluesky in 2025?

Mostly younger adults, mostly male, but it’s evolving. The platform’s core vibe attracts privacy-conscious, tech-forward users who are tired of algorithm-heavy noise. Its user base may not be massive yet, but it’s influential, intentional, and surprisingly global.

In a fractured social media scene where every platform feels like it’s chasing its tail, Bluesky is building slowly, with purpose. Understanding the age, gender, and regional DNA of its community gives marketers, creators, and founders a strategic edge, especially as decentralized social continues to grow.

FAQs about Bluesky user demographics in 2025

What age group uses Bluesky the most in 2025?

The dominant age group is 18–34, with the 25–34 bracket making up the largest single slice. Gen Z is here, but Millennials are the power users.

Is Bluesky more male or female in 2025?

As of 2025, Bluesky skews slightly male, especially in the tech and media niches, but it’s seeing a rise in gender-diverse and nonbinary users as the community diversifies.

Does Bluesky support business features or ads?

Bluesky is currently an ad-free platform. While it focuses on decentralized social networking and community-led growth, it has not yet introduced traditional advertising or monetization tools for brands.

Can brands benefit from using Bluesky today?

Absolutely. While Bluesky does not have paid advertising yet, early presence on the platform can help brands build organic visibility, community connections, and stay ahead of trends in a fast-evolving social media space.

Which countries have the most Bluesky users in 2025?

Top countries include the U.S., U.K., Germany, Japan, and Brazil, with notable growth in tech-forward cities like Lagos, Berlin, and São Paulo.

How fast is Bluesky growing in 2025?

Steadily. MAUs and DAUs have nearly doubled year-over-year since 2023, but growth is still organic and community-driven, not the kind of hyper-viral spikes seen on Threads.

How does Bluesky’s user base compare to Twitter or Mastodon?

Compared to Twitter, Bluesky is younger and more ideologically focused. Compared to Mastodon, Bluesky is more user-friendly and less rigid, attracting a wider slice of early adopters.

What makes Bluesky’s demographics unique compared to other social platforms?

Bluesky users tend to be privacy-conscious, values-driven, and highly engaged. It’s a space where early adopters shape the trends, and where niche communities thrive without drowning in noise.

Disclaimer!

This publication, review, or article (“Content”) is based on our independent evaluation and is subjective, reflecting our opinions, which may differ from others’ perspectives or experiences. We do not guarantee the accuracy or completeness of the Content and disclaim responsibility for any errors or omissions it may contain.

The information provided is not investment advice and should not be treated as such, as products or services may change after publication. By engaging with our Content, you acknowledge its subjective nature and agree not to hold us liable for any losses or damages arising from your reliance on the information provided.

Always conduct your research and consult professionals where necessary.