In response to the surge in online fraud across Africa, fintech company Igbigi has introduced a powerful solution designed to restore trust in digital transactions and protect users from financial scams.

Every day, thousands of Nigerians and Africans lose their hard-earned money to fraudulent vendors, unverified marketplaces, and risky peer-to-peer deals. Igbigi was created to end this cycle by offering a secure and reliable payment system that shields users from online deceit.

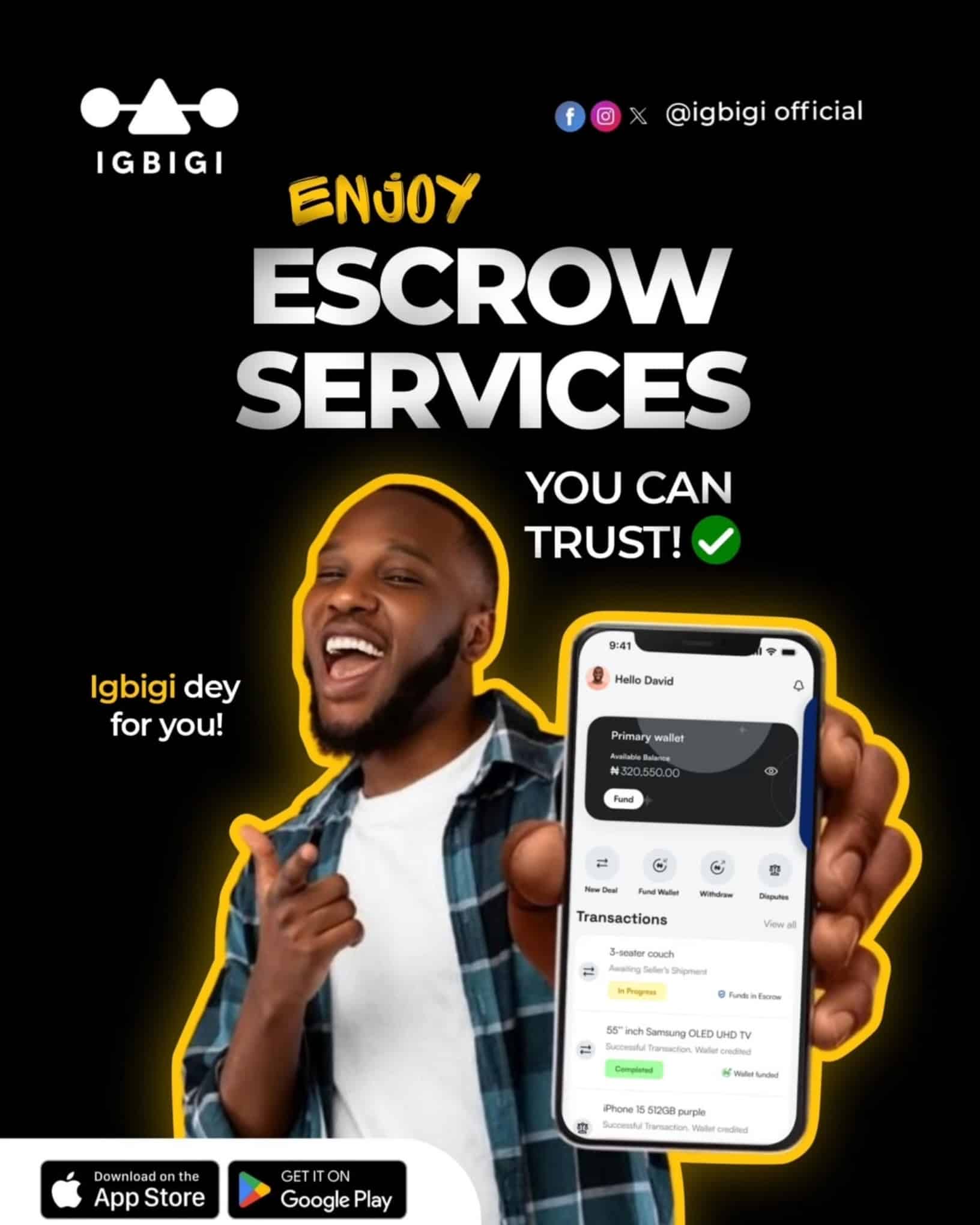

At the heart of the platform is a state-of-the-art escrow system that ensures no funds are released until both parties in a transaction are fully satisfied. Whether paying a freelancer, shopping from an online vendor, or exchanging digital assets, Igbigi holds the money in trust and guarantees that users get exactly what they paid for.

“This platform was born out of a deep frustration with the constant fear and uncertainty surrounding online transactions in Africa,” said Tonye Tariah, CEO of Igbigi. “We built Igbigi to empower people with a safer way to trade, pay, and trust again.”

Igbigi also functions as a comprehensive financial security suite tailored to the realities of Africa’s digital economy. Key features include:

- Virtual USD cards for international shopping and subscriptions, removing the barrier of domiciliary accounts.

- A secure crypto wallet with escrow-backed peer-to-peer crypto transactions.

- Instant bill payments for services like airtime and electricity, all handled within the app.

- Quick crypto swaps for converting between naira and cryptocurrencies, securely and effortlessly.

- Full regulatory compliance and enterprise-grade encryption that ensure user data and funds remain protected.

Now, in May 2025, Igbigi remains not only relevant but critically necessary. As Africa’s digital economy grows, so does the need for secure, trusted infrastructure to support it.

“Online fraud is not just stealing money, it’s eroding trust across the continent,” Tariah noted. “At Igbigi, we’re not just protecting payments, we’re rebuilding the foundation of digital trust in Africa.”

The platform is currently available for download. With their innovative escrow-powered payment system and additional financial tools, Igbigi, which also offers guides and resources to help users stay safe online at www.igbigi.com continues to lead the fight against online fraud in Africa, providing users with peace of mind in every transaction.