National ID frauds, at 27%, were the highest identity document cases recorded on the continent in 2024, according to a new report by SMILE ID, a leading provider of identity solutions in Africa.

The rise of fraud cases involving National IDs is linked to their widespread use as a primary form of identification.

Driver’s licenses followed at 24%, driven by their frequent use across formal and informal settings, while passports, often perceived as more secure due to stricter issuance protocols, showed a fraud rate of 20%

“Work Permits and Alien Cards accounted for 19%, while Voter’s Identification cards had the lowest fraud rate at 14%,” the report stated.

These findings, the report notes, “highlight the diverse vulnerabilities across ID types, with National IDs remaining the most at risk due to their popularity.”

While passports and other specialised documents like work permits have lower fraud rates, their misuse often involves high-stakes activities, such as international travel or employment fraud, with significant financial and reputational risks.

In response to rising fraud rates, several African countries are adopting digital ID systems to enhance security and strengthen identity verification.

South Africa, for example, is working to replace its outdated Green ID Books, which is considered vulnerable to fraud, with more secure Smart ID cards.

Similarly, Ethiopia has made significant progress with its National Identification Programme (NIDP), known as Fayda. Launched in 2022, the program uses biometric technology to provide secure digital identities, aiming to reduce fraud while also improving access to essential services for millions of citizens.

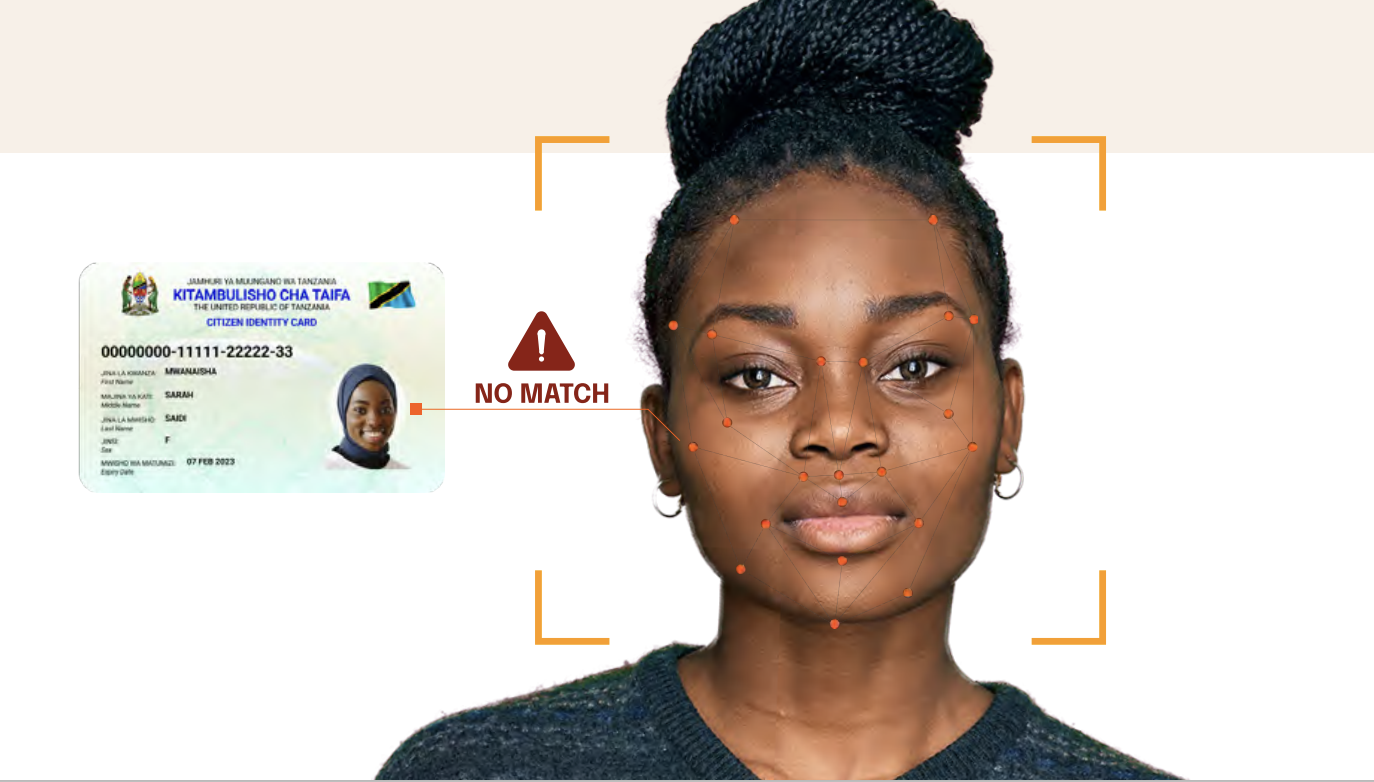

Despite these commendable efforts, fraud cases involving generative AI are surging, allowing criminals to bypass traditional verification systems. Fraudsters are now using AI to generate hyper-realistic fake documents, voices, and images, enabling them to impersonate individuals and commit financial crimes.

According to SMILE ID, deepfake-related fraud incidents in Africa soared sevenfold from Q2 to Q4 of 2024, as easily accessible AI tools lowered the barriers to creating fake identities and manipulating biometric data. Similarly, selfie anomalies, a key indicator of biometric fraud, accounted for 34% of emerging fraud cases.

Commenting on the development, Mark Straub, CEO of SMILE ID, noted that while AI has empowered fraudsters with sophisticated new tools, it can also be leveraged by security gatekeepers to harness global intelligence and strengthen fraud detection systems.

He, however, warned that “fintech platforms with weak KYC protocols remain the most vulnerable, as these bad actors use identity farming to create fraudulent accounts that conceal the origins of illicit funds. Tackling these vulnerabilities requires collaboration between industries, governments, and technology providers to create a safer digital ecosystem.”

The report also revealed significant regional variations in fraud methods across Africa in 2024.

East Africa topped the list in document fraud cases, reporting the highest combined rejection rate at 27% in 2024, driven by the region’s reliance on documents. West Africa emerged as the epicentre of biometric fraud, accounting for the highest incidents of spoofing and face-match inconsistencies, with notable vulnerability to AI-powered fraud attempts.

Central Africa saw a rejection rate of 22% up by 3% in 2023, while Southern Africa recorded a significant increase in fraud cases from 9% to 21%, primarily attributed to fraud attempts involving the retiring green book