- South Africa’s Standard Bank has launched a security feature on its mobile banking app designed to alert clients to potential vishing threats. Once activated and consented to by the client, the feature notifies users of suspicious calls.

- This move follows a warning about an increase in vishing fraud targeting older people who are approaching retirement or have recently received their cash payouts.

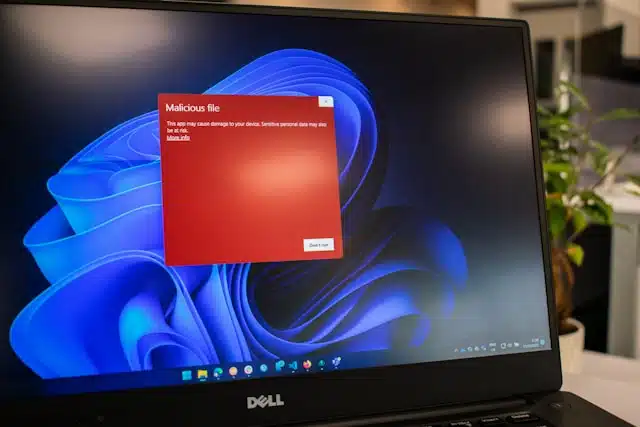

- The bank revealed in a statement on Tuesday that vishing — where scammers use phone calls and social engineering skills to manipulate victims into disclosing confidential information — has become the biggest contributor to application, digital banking and card-related fraud per a South African Banking Risk Information Centre data.

It confirmed that the fraudsters propose “high-return” investment opportunities and persuade victims to transfer funds into fictitious investment accounts with false promises.

The vishing calls trick people into sharing sensitive banking information or taking actions that compromise the security of their bank accounts compared to phishing scams where people are deceived into clicking on links in texts and e-mails.

Belinda Rathogwa, Standard Bank’s head of digital and e-commerce, stated that fraudsters ask victims to keep the fraudulent transactions secret from their banks and loved ones, complicating early detection. She pointed out that, due to banks’ effective risk controls preventing unauthorised access to accounts, fraudsters have resorted to social engineering to deceive clients in other ways.

Rathogwa highlighted that as more older clients use the bank’s app, additional security features can help protect them from fraud. She stressed that the bank will never request money transfers to unknown accounts via phone and advised verifying investment companies with the Financial Services Conduct Authority.

To avoid fraud, users should ignore unsolicited requests for personal information, not share their one-time PIN (OTP), and avoid using public Wi-Fi for banking. The bank also recommends using fingerprint or facial recognition for enhanced security on devices and banking apps.

The vishing warning issued by Standard Bank highlights the growing cyber threats in the South African banking industry. Recently, the country has faced significant issues with cyber fraud including phishing and smishing tactics to deceive bank users.

In July 2024, Dean Macpherson, the Minister of Public Works and Infrastructure in South Africa, revealed that cybercriminals had siphoned $16 million from the department over 10 years.

Recall that First National Bank (FNB) warned in June 2024 that cybercriminals are increasingly using advanced phishing and smishing tactics to target digital wallet users. These tactics trick users into sharing sensitive information, allowing criminals to obtain card details like the card number, expiry date, and CVV.