Editors note: This article has been updated to reflect that only financial institutions, telecommunications companies, and the Nigerian Stock Exchange will be required to pay the cybersecurity levy.

From Monday, May 20, 2024, telecommunications companies, financial institutions, and the Nigerian Stock exchange will be mandated to pay a cybersecurity levy for all electronic transactions, according to a directive from the Central Bank of Nigeria.

The levy, which will be equivalent to 0.5% of the transaction, will be remitted to the National Cybersecurity Fund.

Per the directive, mobile money operators, non-interest and payment service banks, commercial banks, and merchant banks have four weeks to complete system reconfigurations to enable remittance.

Meanwhile, other financial institutions, such as microfinance banks, primary mortgage banks, and development finance institutions, have eight weeks to ensure system reconfiguration.

Financial institutions that fail to remit the levy could face fines of at least 2% of their annual turnover.

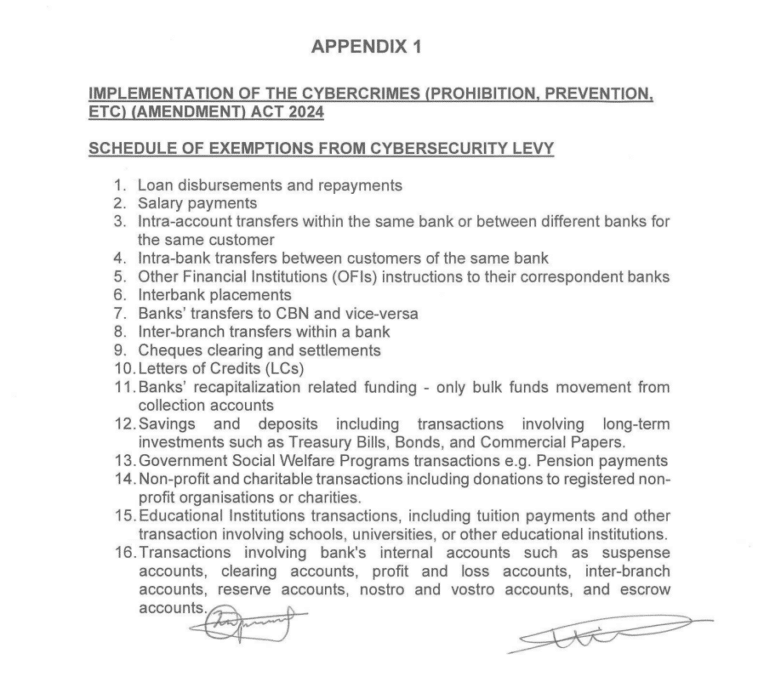

Not all financial transactions are subject to this levy. Salary payments, loan disbursements and repayments, intra-bank transfers between customers of the same bank, and intra-account transfers within the same bank or between different banks but for the same customer are exempt from the levy.

Other transactions include letters of credit, Treasury bills, bonds, commercial papers, government social welfare programmes, charitable donations, tuition payments, and transactions involving educational institutions.

The cybersecurity levy is the latest in a long line of puzzling policies by the CBN. In December 2023, the apex bank lifted a crypto ban that prohibited commercial banks from operating accounts for cryptocurrency service providers. However, recent reports have suggested that a ban on peer-to-peer transactions could be imminent.

Meanwhile, fintechs such as Paga, Moniepoint, and OPay have informed customers that accounts used to facilitate crypto transactions will be blocked. These announcements came shortly after the CBN had ordered these institutions to pause the onboarding of new customers.

Following the CBN’s announcements, users have argued that the cybersecurity levy could hurt the country’s financial inclusion efforts. EFInA’s Access to Financial Services in Nigeria survey revealed that financial inclusion in the country has grown from 56% in 2020 to 64% in 2023.