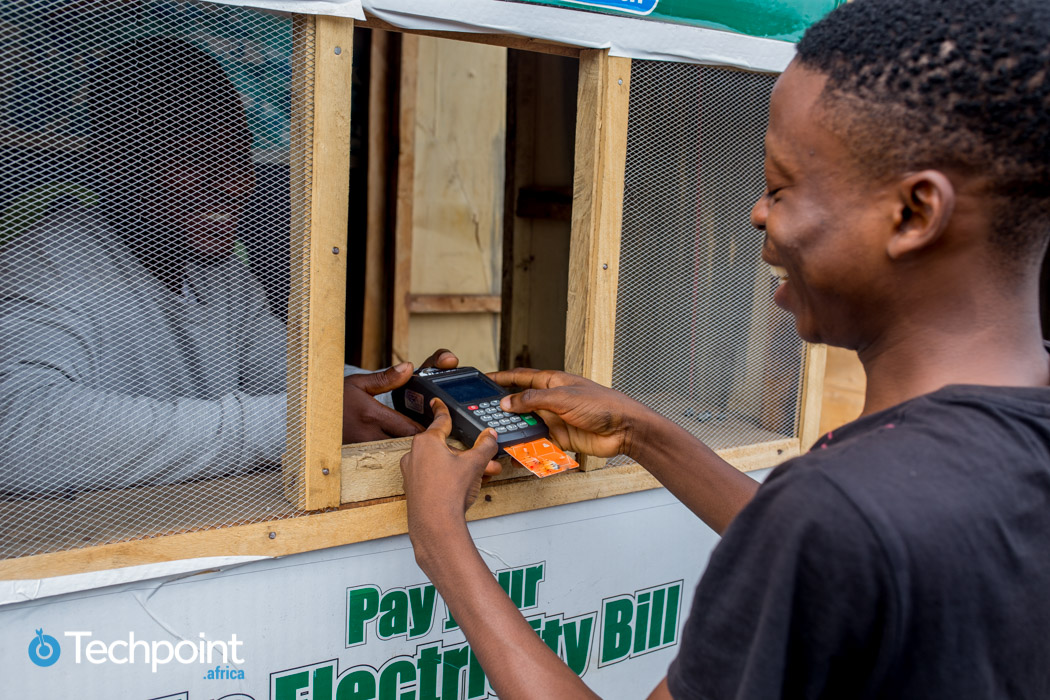

Every other minute, someone in Nigeria is making a payment with either cash or card. . Four years ago, the notion that “cash is king” in Nigeria was correct but the narrative is rapidly changing because of the high acceptance and integration of card payments as a means of payment in Nigeria.

In 2022, the Nigerian cards and payments market was valued at $22 billion. That same year, 1.5 billion transactions took place on ATMs, with 3.5 billion transactions facilitated at PoS terminals. According to Statista, in 2023, card payment was the most popular online retail payment method accounting for over 37% of online payments; closely following were bank visits (29%) and cash transfers (16%).

Data from Moniepoint also shows that 8 out of 10 times, Nigerians choose cards over transfers when making payment. Card transactions are now so widely accepted that in 2023, Verve International, Africa’s first and largest domestic card payment company, announced that it had issued over 50 million payment cards in Nigeria. This was a remarkable feat because Nigeria is generally a low-trust society and physical cash is held in the highest esteem.

The Nigerian fintech space is home to over 200 startups and stakeholders such as the government, the Central Bank of Nigeria (CBN), and the Nigerian Inter-Bank Settlement System (NIBSS).

What was once a payment-based industry has now expanded to include blockchain, credit, and regulatory compliance. The introduction of digital and card payment services has greatly contributed to the industry’s growth.

The latest trend is embedding fintech into other sectors of Nigeria’s economy so that technology strengthens those sectors while also offering financial services in the product.

Table of Contents

Card payments and Nigeria’s fintech space

The traditional banks were the foundation of Nigeria’s modern-day fintech landscape. Their early adoption of technology paved the way for the evolution of banks and other financial institutions, including the present-day neobanks.

A major problem the earliest financial institutions faced was that they were elitist in their operations, and did little to cater to the banking needs of the masses. Account opening processes were time-consuming and the required initial deposits were huge and beyond the reach of most Nigerians.

For Deji Olowe, Lendsqr founder and early banking innovator, the massive rollout of payment cards was instrumental in solving the problems the traditional banks faced. Banks and other fintech companies can now open instant accounts for their customers with no initial deposits and also issue debit cards.

Upon issuance, the customers can use the cards for payments, deposits, or withdrawals without going to the bank. This has also helped reduce banks’ overhead costs as they do not necessarily need to open branches in every nook and cranny of Nigeria.

This singular move has de-elitised the banking system, making the idea of financial inclusion a more realistic phenomenon in the Nigerian economy. Nigeria’s fintech space evolved from the traditional brick-and-mortar banks. This grew out of the need for the financial industry to meet its growing customer needs through the efficient methods that technology promised.

Key landmarks in Nigeria’s card payments revolution

You could divide Nigeria’s card revolution into some key moments – ATMs, Interswitch, Neobanks, and the ris rise

The introduction of ATMs in Nigeria

The very first companies to fuse financial services and technology were the already existing banks. The first Automated Teller Machine (ATM) installed in Nigeria was done by the Societe Generale Bank of Nigeria in 1989. You probably know them as Heritage Bank today. This marked the introduction of digital and card payments in Nigeria.

From this point, card transactions began to take place in Nigeria. But it was still an elitist way of banking because, at that time, banks were regarded as an elite institution.

Then came Interswitch

In 2002, Interswitch was founded by Mitchell Elegbe, an electrical engineer. Interswitch was founded to tackle the lack of local infrastructure to carry out payments through cards. It was the brain company that enabled card owners to withdraw cash from ATMs other than those of the issuing bank. At the time, other companies such as Paga and Remita by SystemSpecs were also in the arena, facilitating payment systems and improving the country’s financial inclusion.

According to Olowe, at the early stages of the rollout of debit and virtual cards in Nigeria, the cards used magnetic stripe technology, which was heavily prone to card cloning and fraud. The CBN in a directive in 2012 mandated all payment service providers to ensure that their cards used chip and pin technology to prevent the prevalent card fraud and cloning.

In 2012 Interswitch founded Verve International, the first Nigerian domestic card scheme, and presented a cost-effective way of producing cards in Nigeria. This sped up the rise in the number of payment cards available in Nigeria because the cards produced were paid for in naira.

Next came the neobanks

From 2016, the card payments industry began to witness another round of changes. This time, because of the operations of neobanks that offered card payment services just like the traditional banks, but without physical branches. The first neobank in Nigeria was ALAT founded by WEMA Bank in 2017. With these banks, customers began to have access to all banking services, including payment cards just like the traditional banks.

Among other things, the rise of neobanks facilitated financial inclusion and a rise in the use of card payments since they also issued payment cards. Companies like OPay, Kuda, Moniepoint, and PalmPay are currently the leading neobanks in Nigeria.

Don’t forget the payment service providers

Apart from neobanks, other fintech companies offering payment services to small businesses have also joined in the train of card issuance, thus contributing to the rise of card payments in Nigeria. Companies like Korapay and Nomba are taking the lead in offering payment services and issuing payment cards to such businesses.

Who are the architects of Nigeria’s card payments revolution?

The disruption in the payment landscape was heralded by major card giants who are still playing in the Nigerian card payments space today. Fintech companies partner with these card payments companies to issue their cards to their customers.

Verve Card

Verve Card was founded in 2009 by Interswitch Group as the first Nigerian and Africa-focused payment card. Verve was founded to address the inefficiencies of card payments and make available ease of payment in Nigeria. Currently, it is accepted in over 180 countries across the world.

In 2023, Verve was the most popular card in Nigeria, and it accounted for 35% and 65% of the cards used for PoS and e-commerce transactions in Nigeria, respectively. Currently, it has partnered with over 250 financial institutions both within and outside Nigeria.

Verve card is most popular for its stance in protecting the security of its users. It was the first pan-African chip and pin payment card, ensuring a two-factor security for its customers. This greatly reduced the risk of fraudulent activities on customers’ cards.

The fact that Verve is a homegrown card made it more cost-effective and readily available for Nigerians while aiding seamless transactions.

Mastercard

Mastercard is the second largest card payments company in Nigeria with a share of about 30% of Nigeria’s card users. Guaranty Trust Holding Company PLC (GTCO) — then Guaranty Trust Bank (GTB) — partnered with Interswitch to begin the issuance of Mastercard in Nigeria.

In Mastercard’s bid to contribute to the Nigerian fintech space, it takes an interestingly different approach. Mastercard seems to have a keen interest in the fintech companies of Nigerian telcos. In 2021, it invested $100m in Airtel Money for the development of its (Airtel Money) virtual card. This was to promote the use of virtual cards in Africa where its use is still at the infancy stage.

In 2023, Mastercard also announced that it had acquired a $500m minority stake in MTN Nigeria’s fintech, MoMo. This acquisition was to strengthen the fintech’s cybersecurity.

Apart from being a payment service provider, Mastercard is also famous for its Mastercard Foundation which sponsors young Nigerians in their quest to further their education.

Visa Card

Visa card was introduced into the Nigerian market by Unified Payments Nigeria in 2006 after it became a Principal Member of Visa International in 2004. According to Statista, 18% of Nigerian cardholders use the Visa card. Access Bank, UBA, and Diamond Bank were among the first issuers of the Visa electronic cards.

Visa Card has made a tremendous impact in Nigerian fintech companies, investing in Flutterwave, Paystack, and Interswitch — all giants in Nigeria’s card payment space. Although seemingly the least card player on the scene, the Visa Card has been very instrumental in Nigeria’s quest of banking the unbanked as a result of Nigeria’s large population living in rural areas.

In 2023, the CBN announced that it would be introducing its card payment scheme, AfriGo, to displace Mastercard and Visa in Nigeria. However, this move was highly criticised by stakeholders in the fintech industry as the proposed card scheme did not offer any innovations to the card payment space in Nigeria.

What drove the massive adoption of card payments in Nigeria?

Cash used to reign supreme in Nigeria and even banks with electronic transfer options could not topple it. The tides began to turn in favour of cards as different events unfolded.

Favourable government policies

As acceptance of cards began to rise and the government saw the potential of card payments in Nigeria’s economy, it began to roll out favourable policies for the penetration of cards.

In 2018, the CBN introduced a policy that mandated Payment Service Banks (PSBs) to operate in rural areas to reach its banking the unbanked goal. This policy saw the penetration of some neobanks such as OPay in rural areas. One of the necessary effects of the policy is that the PSBs issued their payment cards to their customers. This move further deepened the reach of cards to the unbanked and illiterates.

Technological advancement

Technological advancements also made card payment penetration in Nigeria smooth. The instant card issuance and activation process currently available for card users has made ownership of and payment with cards more convenient and desirable. Within minutes, you are a cardholder with banking services embedded in your card.

Payment providers’ promises to secure holders’ data have also increased the allure of card payments in Nigeria. The security of cards has developed over time, with the requirement of PIN and OTPs before payments can be processed for online and POS payments.

Changing Consumer behaviours

Cash has remained king because none of the alternative methods have been compelling enough to dethrone it in Nigeria. However, with the COVID-19 pandemic in 2020 and the CBN’s proposed change in Nigeria’s currency in 2022 that led to a scarcity of cash, Nigerians became more receptive to non-cash payment methods, including card and bank transfers.

Card payment was the preferred choice of payment since it is in many ways similar to cash. It is almost instant and the business owner is sure that the money paid for the goods or services is in their bank account. As cards became more popular, everyone started getting cards.

The challenge of card payments in Nigeria

If we drill down too much, you’ll find several challenges in the card payment space, but two that standout are the issues of fraud and regulations.

Chargeback fraud is a menace

Perhaps, one of the biggest challenges to card payments in Nigeria is chargeback fraud. In 2023, Interswitch reportedly lost $30 million to chargeback fraud that year. On the global scale, Mastercard reported a loss of $117 billion.

In simple terms, chargeback fraud occurs when a customer makes a payment online with their card and gets the item. Then they report to their bank that they didn’t make the transaction, forcing the bank to refund the money. This results in a loss for the business involved and the card issuing company.

Although legal actions can be taken against the fraudsters, that is a rather expensive path considering how slow and technicality-prone our Nigerian legal system is.

Some promising solutions so far

One-Time-Passwords: The Nigerian card payment space has made considerable improvements in tackling chargeback fraud. Perhaps the best is the use of a new One-Time Password (OTP) for every transaction coupled with a card PIN for online card payments. Since most chargebacks are mostly about unauthorised transactions, having the OTP provides an extra layer for the customer to confirm and reduce the risk of reversal.

However, not all online transactions completed with card payments require an OTP. Some payment service providers have not implemented the use of OTPs to verify payment transactions instituted using their cards. This poses serious risks of chargeback fraud as fraudsters in possession of a card and its PIN can successfully steal goods from businesses and facilitate chargeback fraud.

Facial recognition: For physical card payments, most PoS machines do not have features to capture the identity of the cardholders making transactions. PoS machines should have software installed to facilitate video surveillance of everything happening in front of them just like in ATMs.

Fingerprint: ATMs should have fingerprint verification options for cardholders which businesses and payment service providers can rely on when such a holder requests a chargeback for goods or services not received.

The regulator-innovator dance

Another major challenge faced by card payment companies — and other fintech companies — is the issue of regulation. Over the years, Nigeria’s fintech space has been dogged by continuously volatile and unpredictable regulations. For startups that like to move fast-paced, this could be an issue.

The first issue payment service providers have with regulators is that of multiple regulatory agencies. There are different agencies in charge of the registration of companies, submitting reports, obtaining licences and approvals, and the security of customers’ data.

The multiplicity of regulatory agencies often slows down the operation pace of service providers. Failure to get the required licence from a regulator can prove very devastating for the service provider. This was the case when the CBN momentarily restricted the licences of some neobanks in 2023.

Another challenge payment service providers have with regulators is that the former want to innovate while expecting the latter to play catch up. On the other hand, regulators who do not understand the potential of these innovations are often quick to restrict and ban them so that they can buy more time to understand the innovation. This played out in the SEC and Chaka debacle in 2021.

The constant bickering between regulators and payment service providers has not improved the Nigerian payment service industry. A good way to foster a harmonious relationship between both parties is to find a meeting point and forge ahead from there.

Regulators and the payment industry have one interest at heart — the customers. While the innovators want to meet customers’ needs, the regulators are there to protect the customers from any infractions the industry poses. This is a viable starting point for both parties to come to an agreement and work out less fractious pathways to achieving their goals of peaceful co-existence.

The future is filled with diverse options

Some leading voices in the Nigerian card payment space have noted that the end of the age of card payments is quickly closing in on us. For Olowe, card payments may be dead in the next five years. According to him, interbank transfers with mobile devices have been (and continue to be) a major challenger to card payments. USSD payment options are available for even the cheapest basic feature phones and are easily accessible by illiterate bank customers.

Mobile money

The basic pain point of Nigeria’s economy is its 64 million unbanked citizens. Nigeria is one of seven countries with half of the world’s unbanked. The others being Bangladesh, China, India, Indonesia, Mexico, and Pakistan. The country’s illiteracy rate is high and a vast number of them fall under the unbanked bracket.

To address this problem, the CBN has taken a positive posture towards less formal banking institutions that can meet the needs of its illiterate and unbanked citizens. This is where mobile money comes in.

Mobile money removes the need for a bank account and allows customers to store, send, and receive money on their mobile phones. It works on smartphones and basic feature phones, promising convenience and safety. Fintech companies like PAGA and MTN’s MoMo are Nigeria’s leading mobile money companies.

With mobile money, the need for cards is essentially non-existent. It also has the feature of instantaneous transfers like card payments, making it a great choice for Nigeria’s unbanked.

QR codes

Another major limiter to card payments is the QR code payment option. With this, all a customer needs to do is scan the QR code for the payment to be made and the money is transferred immediately just like card payment. However, this option isn’t a major contender to card payments as it should be because of CBN’s inability to enforce the OR standards appropriately across banks.

Once this is fixed, payment with smartphones will get better and faster, and displace card payment options.

Contactless payments

A fast-rising alternative payment means is contactless payment. There are many types of contactless payments but the most popular is the Tap-to-Pay service. Essentially, the customer only has to tap their smart devices on an enabled payment terminal to make payment. The payment terminal isn’t limited to regular POS machines. The technology can also be installed in stickers, wearables, and mobile devices.

In 2023, the CBN released a guideline introducing a daily limit for contactless payment transactions for individuals and businesses to ₦15,000 and ₦50,000, respectively. Since contactless payments work so fast, the CBN introduced these limits should fraud, theft, impersonation, or misappropriation occur. Above these amounts, the user would have to authenticate with a PIN or biometrics.

In 2022, NowNow, a Nigerian fintech company raised $13m in seed for its contactless payment solution. In April 2023, Verve International entered the contactless payment market by enabling financial institutions that issue Verve cards to offer contactless payments. In May of the same year, FCMB partnered with Mastercard to launch its contactless payment system, EasyPay. The Lagos Blue Rail has a contactless payment option for train users.

Direct debit

In November 2023, Paystack announced that it had partnered with NIBSS to introduce its direct payment service to customers. With this, their customers can receive recurring payments directly from their customers and users’ bank accounts without any need for payment terminals or cards.

The direct debit service is very similar to a bank order and it provides a more seamless and safe way for Paystack users to get payments from their customers.

Although card payment options are still the lead payment option in Nigeria, other payment methods are rising faster than cards. This raises the question of whether there is a future for card payments in Nigeria.

If fintech payment innovations continue at this rate, cards may become a relic of the past and card payments a distant memory.

To drive things home

The card payments landscape in Nigeria has undergone several stages of transformation and development. Technological advancements have also improved card issuance, its use, and the security concerns relating to card payments.

However, card payment companies and payment service providers generally have to be conscious in striving for improvement in the areas of tackling fraud and relating with regulators. Service providers must be aware of the contending competition for dominance in the payment market, particularly the competition posed by instant cash transfers.

Fintechs should always remember that their product is the backbone of Nigeria’s economy. Their strides in reaching out to the unbanked and ensuring financial inclusion are key to improving the country’s economic outlook.