The news

- Nigerian fintech, PiggyVest could go public in a few years.

- This was revealed by the CEO, Somtochukwu Ifueze, on Thursday, April 4, 2024, at an event organised by Kora, another fintech.

- While the specifics of the IPO haven’t been ironed out yet, Ifezue shared that an IPO was a more feasible alternative to a sale.

Two days after celebrating its eighth anniversary, Somtochukwu Ifezue, CEO of PiggyVest, has hinted at plans to go public “in a few years.”

Inspired by a tweet, Ifezue and three other co-founders started PiggyVest in 2016 with the goal of digitising savings for Nigeria’s youthful population. Since then, the company has grown quickly, with nearly 5 million customers and paying out over ₦1 trillion to its users.

Its parent company, Piggytech, completed the acquisition of Abeg, now known as Pocket, in 2022 as it made an entrance into the social commerce scene. Pocket now has over a million customers.

After a couple of years during which funding for African startups grew steadily, investors have begun angling for exits to prove the ecosystem’s maturation and justify the hype that has surrounded it so far. However, that has proven difficult to come by with undisclosed acquisitions littering the landscape.

While there have been the sales of Instadeep for $680 million and, more recently, Deel, most conversations around exits point back to Paystack, an exit that occurred nearly four years ago.

PiggyVest is not the only African startup with IPO ambitions. Flutterwave has been vocal about its plans to IPO in the last two years. While Flutterwave’s last funding round put it’s valuation at over $3 billion, PiggyVest’s valuation is unclear.

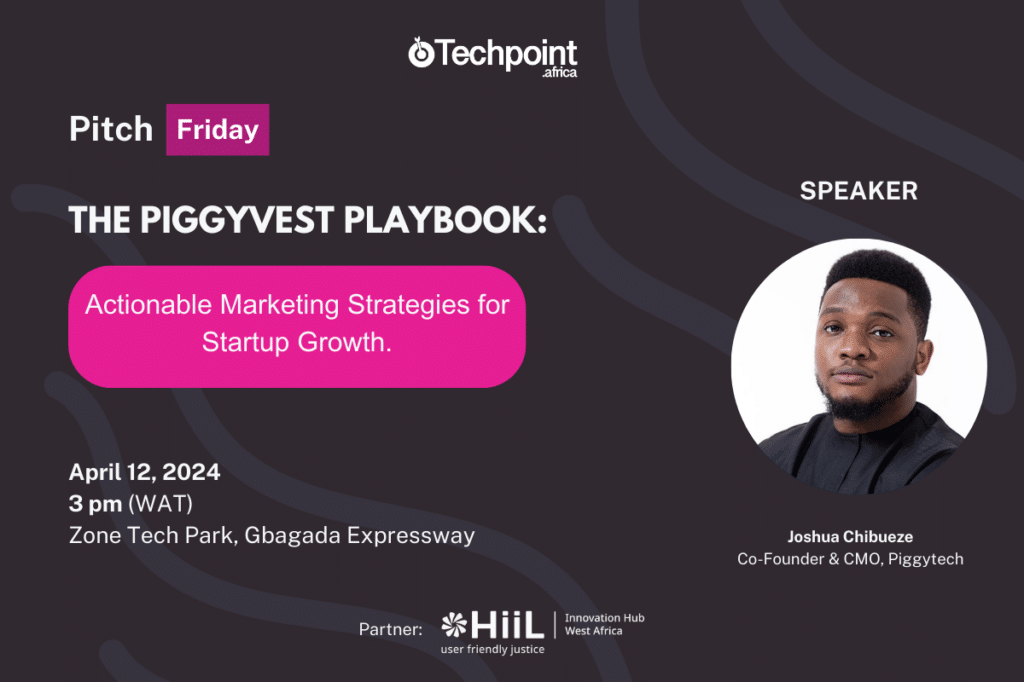

The startup has also been capital-efficient, raising far less money than many fintechs in the country. CMO Odun Eweniyi alluded to this while speaking to founders at Techpoint Africa‘s Lagos Startup Expo.

“On a tight budget, you don’t have the leeway for experiments. If you release your product into the market for free, the amount of work it takes to reorient users to pay for that product is simply not worth it.” Eweniyi said.

Where will PiggyVest IPO?

Although Ifezue gave minimal information on where the IPO will take place, the Nigerian Stock Exchange has been pushing for Nigerian tech companies to list locally.

VFD Group and Chams Holdings are already listed on the exchange and have had impressive showings in the last year, but there are still doubts over the merits for Nigerian startups that are raising from largely foreign investors.

Interestingly, VFD Group invested in Piggytech, PiggyVest’s parent company. This investment is part of the $35.6 million investments VFD Group made in 2021.

With primarily local investors, an IPO could potentially have a bigger impact on the Nigerian tech ecosystem than the Paystack sale did.

For one, it would reinforce the notion that startups can win without huge injections of cash and a prudent approach to growth, something both Paystack and PiggyVest embody. It could also drive renewed interest in venture capital from local investors.

This is a developing story.