Key takeaways:

- The PiggyVest Savings Report 2023, The Nigerian Financial Service Market reports, and the Lagos State Household Survey are three reports that show how much Nigerians make monthly.

- Although there are some differences, the reports show that the majority of Nigerians do not earn above ₦100,000 ($126.90) a month.

- These stats are a reflection of the economic realities of the majority of Nigerians.

For some middle to high-income-earning Nigerians who live within and outside the country, it is possible to lose touch with the economic realities of many Nigerians as they interact mostly with people from the same social standing.

However, some reports help us put things in perspective.

The World Bank’s poverty assessment report, for example, revealed that 83 million Nigerians live in extreme poverty.

In another 2022 survey by the Nigerian Bureau of Statistics (NBS), 63% of Nigerians are poor.

These figures show that the country needs urgent economic reforms to improve the living conditions of many Nigerians. Per the World Bank, some of the leading causes of poverty in the country include low economic growth, weak labour market opportunities, and exposure to shocks such as conflict.

These issues beg the question: how much do Nigerians earn?

How much do Nigerians earn?

The PiggyVest Savings Report 2023, The Nigerian Financial Service Market reports, and the Lagos State Household Survey are three reports that give an idea of what Nigerians earn monthly.

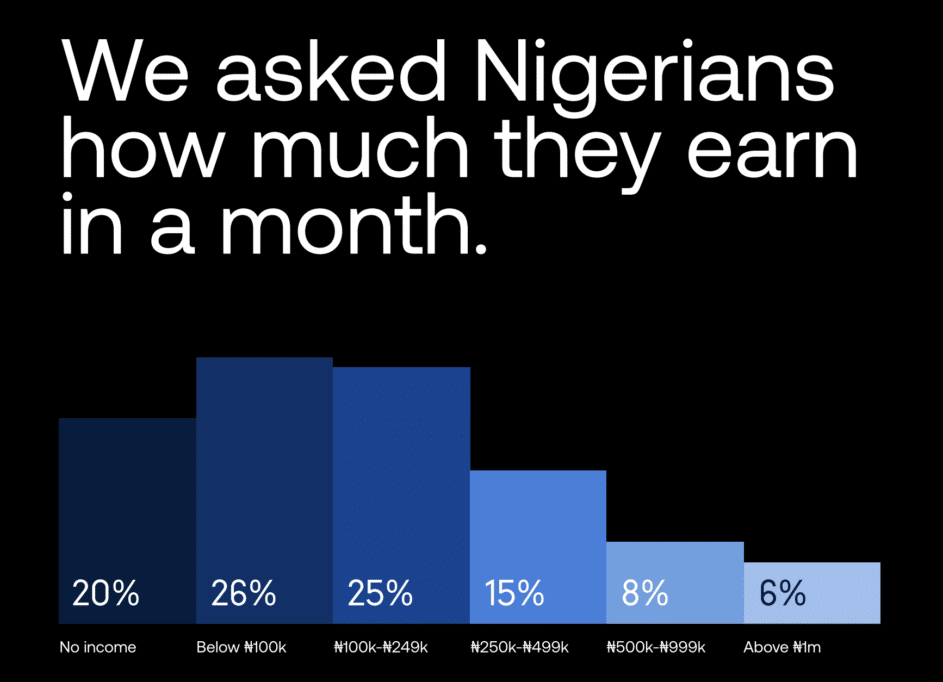

PiggyVest Savings Report 2023

PiggyVest surveyed over a thousand Nigerians and 26% — the highest percentage — earn below ₦100,000 ($126) monthly. 20% had no income, 25% earned between ₦100,000 and ₦249,000 ($126 – $315), and 15% earn between ₦250,000 and ₦499,000 ($317 – $633).

However, only 6% earn above the global average monthly salary of $1,020 to ₦795,600 ($1,269) in a month.

Nigerian Financial Services Market Report 2022

The Nigerian Financial Services Market Report (NFSM) by Intelpoint (Techpoint Africa’s data arm), surveyed 4,698 people and the difference in income levels for Nigerians was similar to the PiggyVest savings report.

According to the report, 27% of the people surveyed earn less than ₦35,000 a month, while only 2% earn above ₦200,000 a month. 17% were unemployed, 21% earn between ₦35,000 and ₦50,000, 19% earn between ₦51,000 and ₦100,00, and 8% earn between ₦100,000 and ₦150,000.

As expected, more low-income earners did not have a bank account. This is because a large percentage of them do not have proximity to banks and cannot afford financial services.

Lagos State Household Survey Report 2020

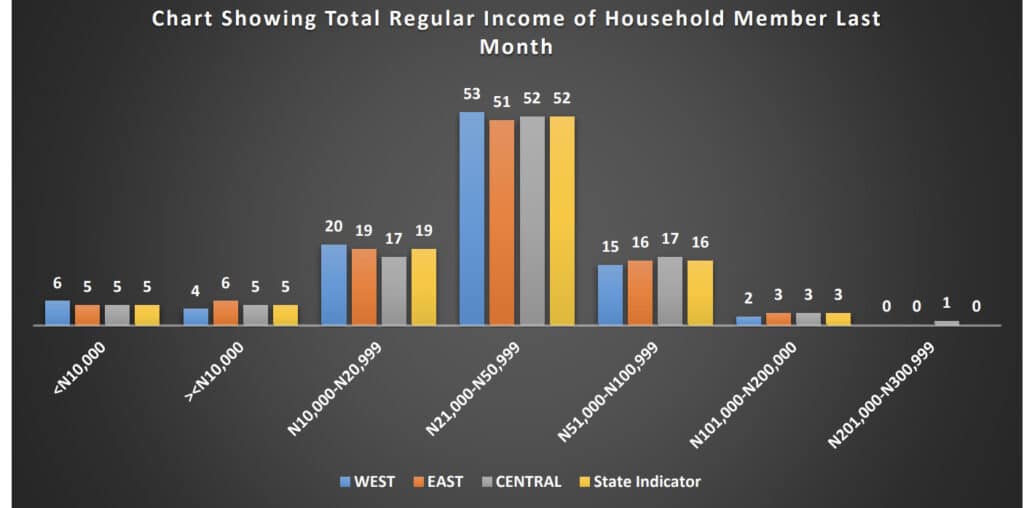

While this survey was taken three years ago, its results still bear some similarity to the NFSM 2022 and PiggyVest Savings Report 2023. However, the percentage of low-income earners was higher than in the other two reports.

The report surveyed 10,000 households and revealed that 52% of household members earn between ₦21,000 and ₦50,000, 19% earn between ₦10,000 and ₦20,999, 5% earn more than and less than ₦10,000.

For people who earn between ₦101,000 and ₦200,000, the percentage is just 3%.

Although these three reports give us an idea of how much Nigerians earn, they do not tell us what these levels of income mean in terms of access to the primary and secondary needs of a human being or simply what someone who earns ₦50,000 can afford.

Unfortunately, there’s a dearth of data when it comes to the cost of living in Nigeria. However, given that 83 million Nigerians live in extreme poverty, there’s an urgent need for change.