Nigeria’s eNaira is Africa’s first central bank digital currency (CBDC) and one of the 11 active CBDCs in the world.

The eNaira is Nigeria’s way of enabling the use of blockchain — a technology popularised by cryptocurrencies — in mainstream finance. It is also another way to rival cryptocurrencies, which have become increasingly popular among young Nigerians.

It was touted to aid financial inclusion in Nigeria, cross-border transactions, and direct payments from the government to citizens.

However, for citizens to take advantage of the eNaira’s benefits, it is important to understand what they are. This article will be a guide to everything you need to know about the eNaira.

What are central bank digital currencies (CBDCs)?

Central bank digital currencies are digital versions of a country’s currency. To understand them better, you need to know what digital currencies are.

Digital currencies, as the name implies, are currencies that exist only digitally.

An example of a digital currency is bitcoin or ethereum. They use complex encryption techniques to secure transactions and control the creation of new currencies.

They also operate on the blockchain, a digital ledger that stores the transaction history of digital currencies.

When a central bank like the CBN decides to create something like bitcoin, it is called a CBDC.

What is the benefit of creating CBDCs?

Central banks want to create digital versions of their currencies to enjoy some of the perks that come with the likes of bitcoin and ethereum. One advantage of digital currencies is their low transaction cost because there are no intermediaries involved.

For example, when you’re using fiat currencies (the opposite of digital currencies) like the naira or dollar for transactions, they go through many people, which increases transaction costs. Depending on the type of transaction, the intermediaries are usually banks, a card scheme like Visa or Mastercard, or even the Nigerian Inter-Bank Settlement System (NIBSS).

But with digital currencies, a secure and direct link is created between the two parties to the transaction, reducing cost, making cross-border transactions seamless, and reducing transaction time.

Why the eNaira was created

One of the reasons why the eNaira was created was because of the FOMO around CBDCs. According to a 2021 study by the Bank of International Settlements (BIS), 90% of the central banks in the world were considering creating CBDCs. However, CBDCs do have features that can help a country’s financial system.

Goals and objectives of the eNaira

- Aid financial inclusion

- Improve payment efficiency

- Improve revenue and tax collection

- Direct payments to citizens by the government

How does the eNaira work?

The eNaira operates on a blockchain like Bitcoin. Transactions are carried out on a blockchain network, allowing you and another eNaira user to send the currency peer-to-peer (P2P) without any intermediaries.

How eNaira is different from Bitcoin

While eNaira and Bitcoin transactions are carried out on the blockchain, they operate very differently.

Bitcoin is a decentralised digital currency. This is because it operates on a public blockchain (the Bitcoin network), while the eNaira is a centralised digital currency that operates on a centralised or private blockchain.

Public blockchains are accessible to anyone. For example, you can check Bicoin’s transaction history on blockchain.com.

Public blockchains also allow anyone anywhere with an Internet connection to create a wallet without any KYC. You can create a wallet and initiate transactions within seconds.

The eNaira, however, operates on a private blockchainhttps://techpoint.africa/2021/08/03/experts-enaira-cbdc/. Unlike Bitcoin, where you have access to transaction records and create wallets instantly, the CBN keeps the eNaira closed off.

Why the eNaira runs on a private blockchain

The eNaira runs on a private blockchain because the CBN wants to control onboarding, KYC, and the creation of eNaira.

This is why the CBN used the Hyperledger Fabric, a system that allows private organisations to create their private blockchain.

What is the value of the eNaira?

The eNaira has the same value as the naira. Essentially, one eNaira is equal to one naira.

How does the CBN maintain the value of the eNaira?

The CBN maintains a 1:1 naira to eNaira value by backing the available eNaira with a naira reserve.

How the CBN issues and manages the eNaira

The eNaira uses a platform model in which the CBN is the provider of the core ledger, the platform that will enable and record transactions. It will grant other financial players in the country access to build on the platform via APIs.

eNaira: the role of banks

Banks and other financial institutions are tasked with the distribution of the eNaira. They do this by creating additional payment functionality for the eNaira, thereby creating a payment ecosystem for it.

How to use the eNaira

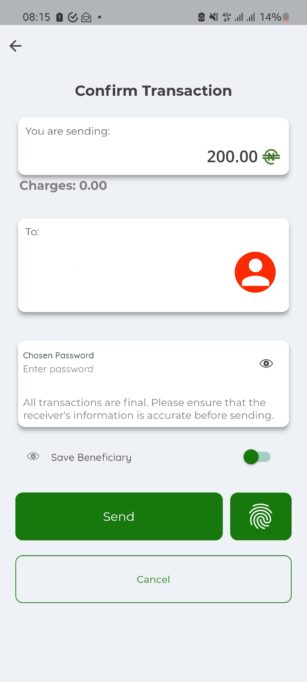

To use the eNaira, you need to download the eNaira Speed Wallet app on your smartphone or dial the USSD code *997*50# if you have a feature phone.

Types of eNaira wallets

There are two types of eNaira wallets

- eNaira Speed Wallet (Combo)

- eNaira Speed App Lite

Both wallets are similar with minor differences.

The eNaira Speed Wallet (Combo) is a two-in-one app that can be used by individuals and merchants. The Speed App Lite, however, requires you to specify if you’ll be using it as a merchant, business, or individual.

What you need to open an eNaira wallet

To open an eNaira wallet, you’ll need your National Identification Number (NIN), phone number, and Bank Verification Number (BVN).

However, not all tiers of the eNaira wallet require all these means of identification.

The different tiers of eNaira wallet and their requirement

| Tiers | Requirements | Daily transaction limit |

| Tier 1 | NIN and phone number | ₦20,000 |

| Tier 2 | BVN and phone number | ₦ 200,000 |

| Tier 3 | BVN, phone number, and public utility receipt. | ₦500,000 |

How to fund your eNaira wallet

Once you have created an eNaira wallet, you get a 10-digit wallet ID — a bank account equivalent. You can send money from your bank to your wallet using your wallet ID.

Whether you’re sending with your bank app, USSD code, or Internet banking platform, simply enter the wallet ID and choose eNaira as the bank you want to send to.

Advantages of using the eNaira wallet

- Free transfers

- Fast transactions

- Quick setup time for people without bank accounts

Disadvantages of using the eNaira

- Privacy: Unlike public blockchains like Bitcoin that can be used anonymously, the eNaira requires KYC protocols.

The eNaira is a pioneer when it comes to CBDCs. While adoption has not caught on, it bodes well for the financial future of many Nigerians.