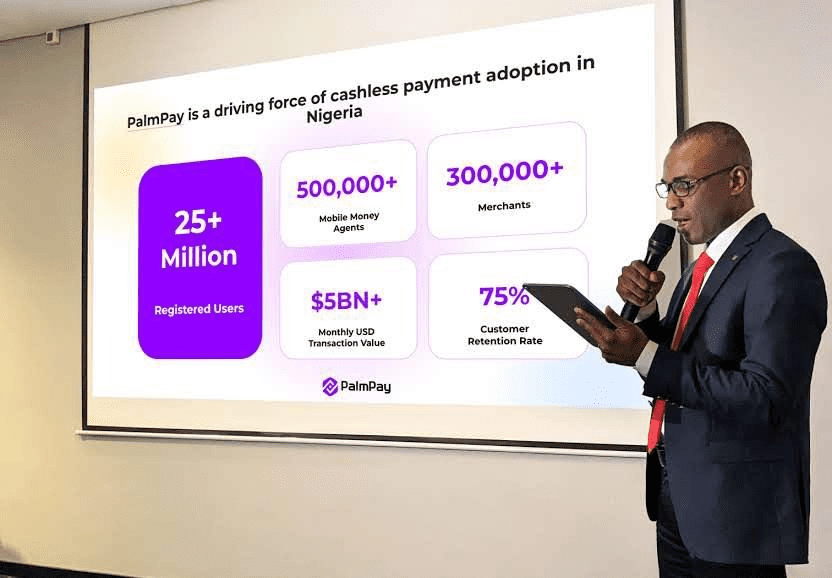

Africa-focused fintech platform, PalmPay, has announced that its payments ecosystem includes 25 million users, 500,000 mobile money agents, and 300,000 merchants.

The company also says it processes over five billion dollars monthly.

In 2019, PalmPay launched in Nigeria to become Africa’s largest financial services platform after securing a $40 million seed round.

After four years, Sofia Zab, the Chief Marketing Officer (CMO) of PalmPay Global, credits the company’s expansion to its strategy.

It also highlights the growing demand for innovative fintech solutions that address the specific needs of the underserved population in Africa.

She goes on to say that the company’s user-friendly app streamlines digital transactions, makes them quick and convenient, and encourages customers to stop using cash and start using digital wallets.

PalmPay, which provides banking services for businesses, equipping them with apps, web portals, and POS, has launched its savings service, which includes a 20% annual interest savings plan for all users.

What’s more, the company’s proprietary payment infrastructure, which supposedly provides unmatched dependability in a market that has long struggled with unstable financial systems, has been instrumental in the company’s success in Nigeria.

PalmPay: Growing from the ashes of Nigeria’s financial turbulence

PalmPay, like Moniepoint and OPay, is an example of the rapid growth caused by rethinking fintech distribution in Nigeria.

In August 2022, Palmpay celebrated 10 million users and 200,000 agents. That means it increased its user base and agent network by a whopping 150% in less than one year.

These fintechs are taking advantage of limitations with traditional banking, regulatory challenges and the trust issues that follow.

Recall that in January 2023, the CBN instituted a naira redesign that led to the scarcity of cash and a slowdown in traditional banking networks. In this period, the three companies mentioned above emerged as standout cases for reliability.

PalmPay’s Managing Director, Chika Nwosu, said the company was prepared for the cash crunch of January 2023. It was at this time the company launched the nearby agent services, a move that allowed customers to swap naira notes.

Nwosu told Technext that the company’s cash-back and rewards system was a game-changer that further separated it from regular banking providers. Nigerian fintech, ThankUCash, already employs a similar service to serve regular retail businesses, and PalmPay’s implementation is quite telling.

But there’s an elephant in the room – a 20% annual interest savings plan begs the question of sustainability, given the current economic climate in Nigeria. Similar platforms, including a savings and investment platform built into the OPay App, OWealth, give 15% annual interest. Nigerian digital banks, Kuda, and Carbon also do the same.

But in this rapidly shifting landscape, staying nimble is key. We’re betting PalmPay will adjust this figure in response to the current economic climate, shortly. But fingers crossed.

So, let’s keep the conversation going. What do you think lies ahead for PalmPay and Nigeria’s fintech scene?