In 2015, African startups raised $185 million from venture capitalists. That number sounds minuscule for anyone following the African tech space over the past three years, but if you’re not familiar with it, African startups raised approximately $5 billion in 2021 alone. In addition to raising so little from VCs, only a handful of Africans at that time were investing in startups either as angel investors or VC firms.

Somewhere in Nairobi, Brian Odhiambo had just accepted a role as an Investment Associate at Novastar Ventures, an early-stage VC firm with offices in Nairobi, Lagos, and London. Seven years later, in October 2022, he became a partner at the firm. In this interview just a few weeks after his promotion, we look at how the venture capital landscape has changed since his debut.

Before joining the firm, Odhiambo had been an early employee at the company that would later become Jumia and founded two startups — Afrisolar and LivelyHoods — after he left. Having gained ample experience in these roles, he was weighing his options when a friend mentioned that Novastar Ventures was hiring, and the rest, as they say, is history.

The changing landscape of venture capital in Africa

In 2015 when Odhiambo joined Novastar, Africa’s tech ecosystem was still nascent, and only a handful of companies were getting funded. As he pointed out during our conversation, it was common to find European or American founders of startups based in Africa. A lot has changed since then, with more local entrepreneurs throwing their hats into the ring and spurring innovation on the continent.

Odhiambo stated that two significant changes have occurred since, the first being that more investors are willing to look at and fund African startups thanks to the successes of a few startups.

He also noted that there are more African founders, perhaps encouraged by the successes of the early founders in the space. He also pointed out that successes in other parts of the world have fueled the growth of the local VC landscape.

“There’s obviously now a lot of global attention on African assets, so being able to bring in global investors into some of our companies as well is something that wasn’t there a long time ago. There are also just a lot more founders now. People are willing to take the chance when in 2014, many people were not willing to take a leap and try to start something. Now, there’s a lot more of a track record that you can leave your day job and start a company, and there’s an infrastructure to support you.”

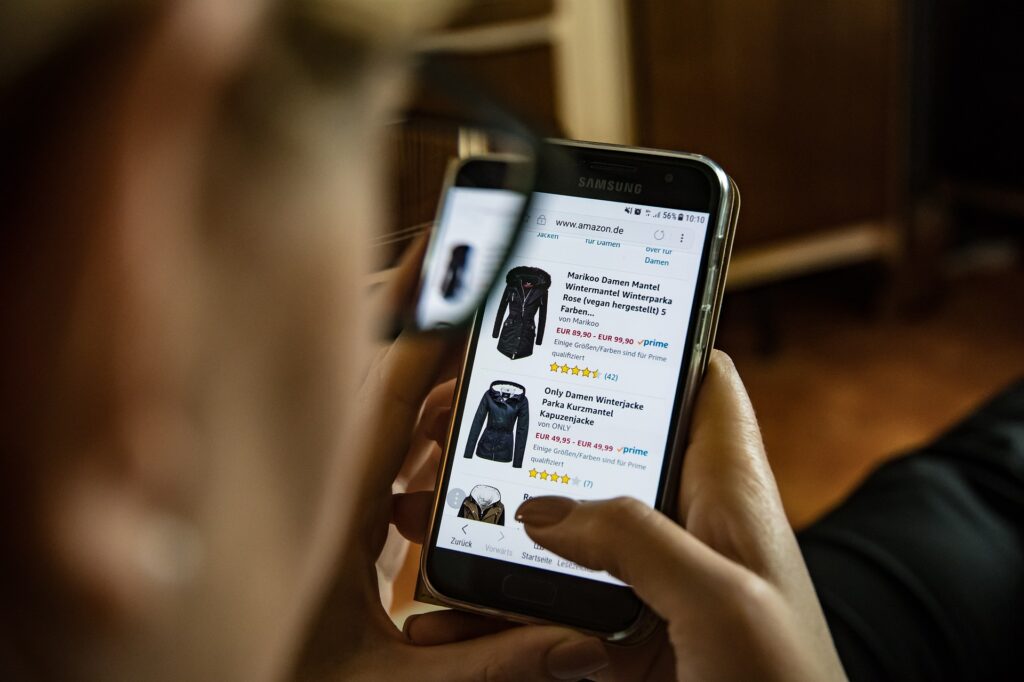

The problem with B2C eCommerce in Africa

On Monday, November 7, 2022, Jumia announced that Co-CEOs, Jeremy Hodara and Sacha Poignonnec would be stepping down, with Francis Dufay replacing them in an acting capacity. The eCommerce company also stated that it hoped to reduce its operating losses while looking for senior management staff closer to the people, perhaps hinting at a desire to hire leaders with local experience.

As one of the pioneers of eCommerce in Nigeria, Jumia’s struggles have been well documented, with the company struggling to turn a profit. Odhiambo argued that while B2C businesses in Africa are complex, it could get harder when behavioural changes are required for the businesses to succeed.

“B2C is difficult, and even more difficult if you’re trying to change behaviour. In some ways, there’s an element of behaviour change required in online shopping and an element of trust. I don’t think it’s that eCommerce will not work, or B2C doesn’t work. A lot of manufacturing companies and telcos have B2C businesses that thrive; it’s just that someone is paying for that acquisition cost or has paid for the behavioural change.”

According to the Nigeria Multidimensional Poverty Index (2022) released by the National Bureau of Statistics, 133 million Nigerians are poor. Consequently, these individuals are more likely to look for cheaper products, even if they are not better, making it harder for an eCommerce company to thrive.

“The reason B2C businesses thrive in other parts of the world like the US, Europe, and increasingly now Asia and India, is that the middle class is getting bigger. For convenience-type businesses where you’re paying for convenience, those customers are willing to pay for that because the opportunity cost is much higher. In contrast, the cost is still the biggest concern if you’re dealing with people earning less than $6 a day.”

To thrive in selling to Nigerians, Odhiambo maintains that such businesses must strive for efficiency in their operations to avoid additional costs, which would typically be passed on to customers.

How Brian Odhiambo’s entrepreneurial experience helps when working with founders

What goes into the making of a great investor? For many founders, an investor who has not founded a company in the past is not as valuable as one who has. Some argue that investors who are former founders can understand the experience and challenges a founder faces.

Using data from its annual list of the top 100 VCs in the United States, CB Insights discovered that previous entrepreneurial experience had no bearing on a VCs ranking. Surprisingly, there was also no relationship between VC’s years of experience and their rank on the list.

Odhiambo, however, has sufficient experience as a founder, having founded two companies, and he believes that experience helps him understand how entrepreneurs feel.

“The biggest thing, I think, is being able to have empathy, which is basically understanding what the entrepreneur is going through and putting yourself in their shoes. Many founders are super smart and need all the help they can get. Investors can give generic or industry-specific advice, but what ultimately wins is being able to relate to the founder and what they’re going through.”

What differentiates Novastar Ventures from other venture capital firms?

While explaining that Novastar Ventures invests in early-stage tech-enabled companies, Odhiambo added that the firm also looks for companies that add financial, social, and environmental value to the areas they operate in.

“We have this idea of the menu which you could interpret in various ways, but for us, we make sure that we are adding to the societies and environments that we’re operating in. We don’t just want to come in, extract commercial value and leave. We want to improve people’s lives through our investments, and that’s what motivates us.”

Through its first and second funds, Odhiambo estimates that its investments have impacted the lives of more than 20 million Africans.

Like other VC firms, Odhiambo acknowledges that its first value proposition to startups is financial, adding that its network of other investors, including development finance institutions like Proparco, British International Investment, and the Dutch Entrepreneurial Development Bank, means startups get additional funding quickly.

“For every dollar Novastar has put in a company, we get 4.5x of it as follow-on funding. That tells you that our assets are not just interesting to us but also to other people, including our investors.”

Furthermore, Novastar Ventures helps its portfolio companies set up robust corporate governance structures while assisting them in incorporating environmental, social, and governance factors into their decision-making.

With a portfolio of 26 startups across East and West Africa, Novastar Ventures helps its portfolio companies build synergistic relationships through quarterly meetups, while its presence across Lagos, Nairobi, and London provides it with expertise for startups looking to expand beyond their immediate environments.