Non-fungible token (NFT) was one of the most popular buzzwords in the crypto community in 2021, with many news headlines talking about NFT artists and traders making a killing with NFTs.

However, the much-praised blockchain is fast becoming the subject of some bad press in 2022 because of scams, which are not uncommon in investment-related activities.

According to the Federal Trade Commission (FTC) in the US, investment fraud — involving stocks, bonds, and cryptocurrencies — accounted for $285 million of all social media scams in 2021.

Going by the trend of investment style fraud so far in 2022, NFT scams should be added to the list.

According to Chainalysis’ 2022 Crypto Crime Report, a significant amount of criminal activity was associated with NFTs in 2021. The two illicit activities related to NFTs include wsh trading — artificially increasing the value of an NFT — and money laundering through the purchase of NFTs.

What is NFT wash trading?

Wash trading, also known as round-tripping, is a form of market manipulation done when an investor buys a financial instrument and sells it back to himself many times. This increases the instrument’s trade volume, creating the illusion that the asset is worth more than it actually is. Consequently, unsuspecting investors buy such assets only to realise they are not worth as much as they thought.

While wash trading is done by an individual, round-tripping can be done by one person buying and selling the same security within the same trading day or by two companies selling securities to themselves and agreeing to repurchase them at about the same price.

Is wash trading illegal with NFTs?

In traditional finance, wash trading is illegal. The US was the first country to declare it unlawful in the 1936 Commodity Exchange Act, and now, the practice is against the law in almost every part of the world.

However, in the decentralised world of NFTs, the legality of wash trading is yet to be clearly spelt out. While it is deceptive, there’s no legislation anywhere in the world detailing what is right and what isn’t in NFT trading as its asset class hasn’t been identified.

Despite this marked absence of NFT regulation and class determination, some countries have taken a stand on the practice. For example, Bithumb, a South Korean crypto exchange, was accused of allowing wash trading worth over $250 million in fake volume in 2018.

Although cryptocurrency wash trading might be illegal in some countries, it is still hard to identify the perpetrators because of the decentralised nature of cryptocurrencies. Unlike traditional financial instruments — stocks and securities — with verifiable know-your-customer (KYC) protocols, blockchain-powered assets can be exchanged without revealing identities.

How to spot NFT wash trading

Knowing how blockchain works is required to spot or track NFT wash trading. However, the simplest way to avoid buying NFTs with an artificial value is to purchase them from a reputable person.

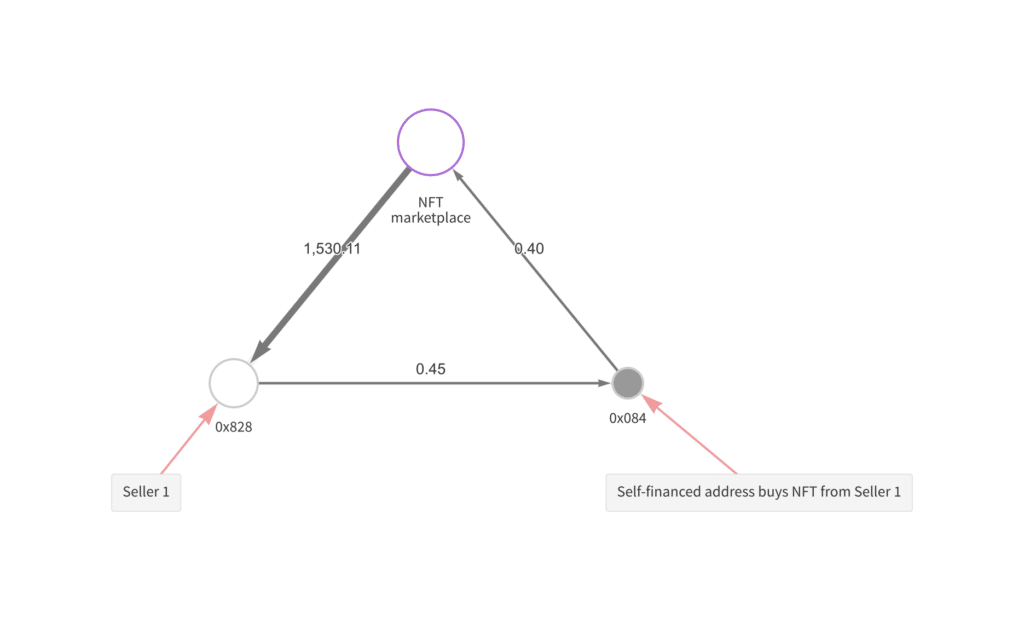

Interestingly, Chainalysis tracked wash trading activities with blockchain analysis, which revealed how sellers go about their wash trading activities.

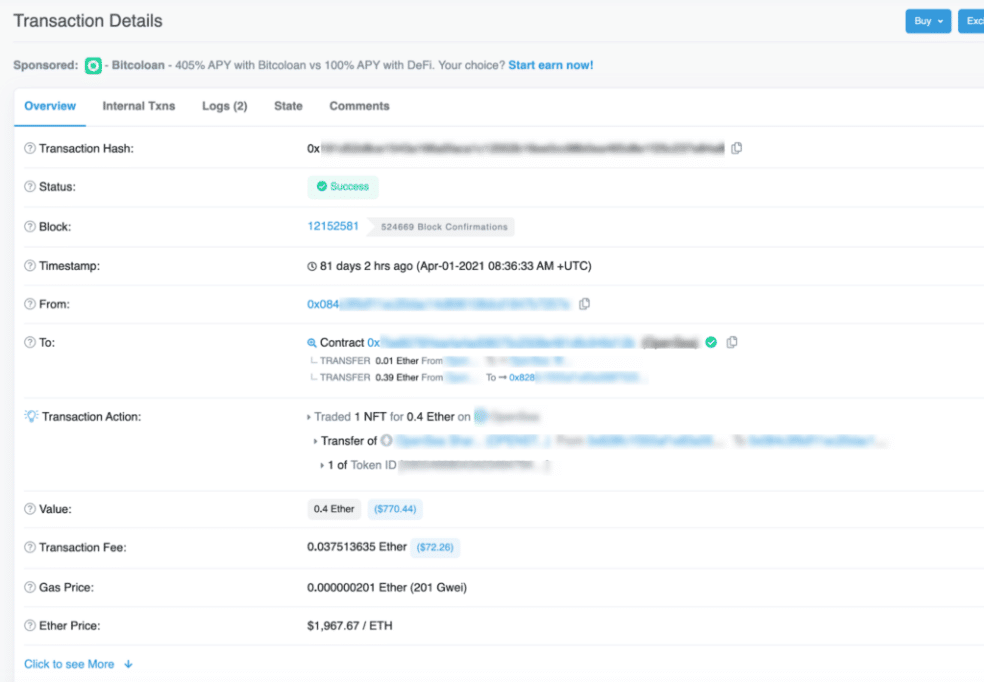

The blockchain transactions on Etherscan showed NFTs successfully sold from one Ethereum address to another. While the transaction appeared normal, a closer look revealed that wash trading had occurred. The address that sold the NFT also sent the ETH to the buyer’s address shortly before the sale. The seller financed the address used to purchase the NFT before the sale.

NFT wash trading is sort of like a WhatsApp vendor sending you money to buy their products to make it seem like they’re making sales. In the case of NFTs, however, one person can easily finance multiple wallets they own to purchase their listed NFTs.

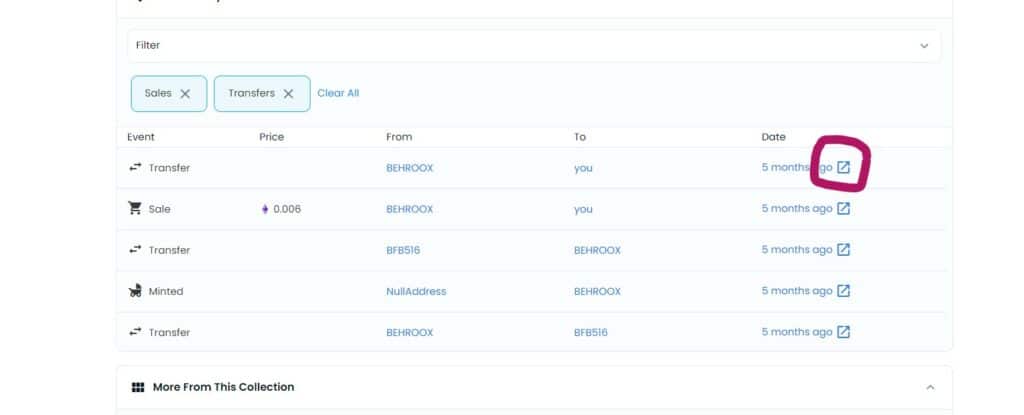

To check the transactions an NFT has gone through on a marketplace like OpenSea, go to the item activity tab below the NFT, and you’ll see the details of how the NFT has been bought and sold from several addresses. For more information on the NFT, click the diagonal arrow under the date column, and it takes you directly to the blockchain on which that NFT exists. You can go further by looking into the individual activity of each address associated with the NFT.

This is like checking the account history of someone who has sent you money; you see where their money goes and where it comes from. However, going through all these transactions is a gruelling task that should be left to experts.

The best way to avoid wash trading is to buy NFTs created by a known artist.

For example, you can decide to buy the works of an artist you’ve seen, read about, or follow on social media. That way, you are sure of the value of the NFT you’ve purchased based on the owner and not on trading volume.

What does wash trading mean for the NFT market?

Wash trading with NFTs doesn’t seem to have affected the NFT market so far. If anything, the market is doing better than ever.

OpenSea, the largest NFT marketplace in the world, surpassed $3.5 billion monthly trading volume in January 2022. While NFT trade volumes continue to grow despite the scams, Chainalysis’ report reveals that most wash trades didn’t yield as much as the work that went into them.

Most NFT wash trades have been unprofitable

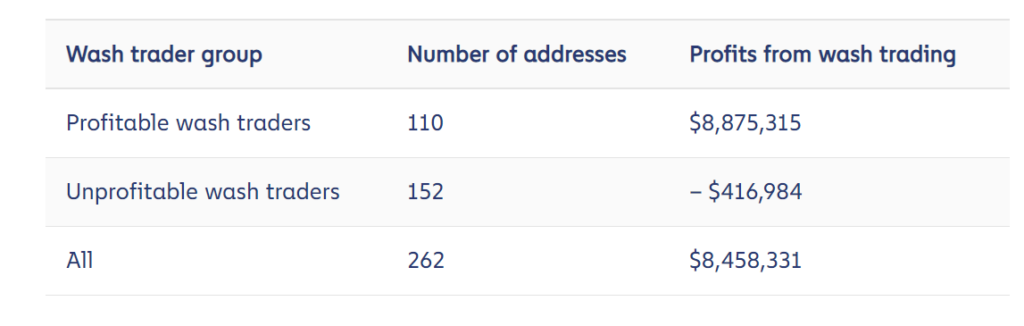

According to Chainalysis, selling an NFT to a self-financed account does not make it a wash trade; however, if it happens more than 25 times, the probability that it falls into that category is high. The research firm arrived at this conclusion after analysing the transactions of 262 sellers who sold NFTs to a self-financed account at least 25 times.

Interestingly, while only 110 of the 262 sellers made more than $8 million from their wash trades, 152 incurred losses of over $400,000 from the deceptive trade. It is important to note that only NFTs bought and sold on the Ethereum network were analysed by Chainalysis; the story could very well be different on other chains such as Solana.

According to the analysis, wash trading isn’t a dominant phenomenon yet. However, if it becomes more prominent, it could encourage regulators to define NFT’s asset class.

Wash trading isn’t the only crime-related activity that can attract the attention of regulators. NFTs are gradually becoming a suitable option for money laundering. The Chainalysis Report also identified an increase in the value of NFTs purchased by illicit addresses totalling $1.4 million in Q4 2021.

NFTs are not the only cryptocurrency used to carry out crimes. And according to Chainalysis, $8.6 billion worth of cryptocurrencies have so far been used in money laundering schemes in 2022.

Every form of economic value transfer can be a tool for committing crimes, and NFTs are no different. The fact that NFTs are being used for criminal activities does not impede its potential to become a tool for creators to get appreciation for their works or solve other economic problems.